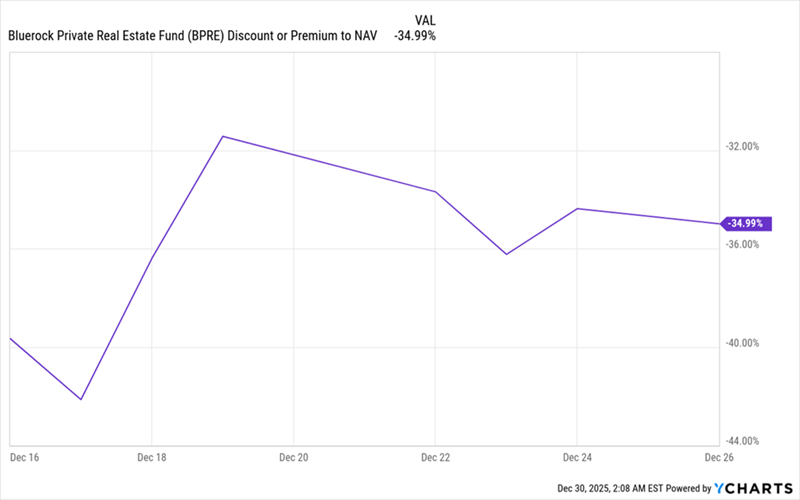

The two recently launched closed-end funds (CEFs), the FS Specialty Lending Fund (FSSL) and the Bluerock Private Real Estate Fund (BPRE), are facing significant market discounts following their IPOs in November and December 2025, respectively. BPRE’s shares are currently trading at a 35% discount to its net asset value (NAV), while FSSL’s shares are at a 23.6% discount. Both discounts arise from a disconnect between the perceived value of their assets by the market and the management’s valuations.

BPRE was initially a private fund focusing on illiquid real estate assets and moved to public trading due to investor demand for liquidity. Its market price fell dramatically after its IPO, placing it as the second-cheapest CEF. FSSL, which operates as a business development company making loans to small and mid-sized businesses, also experienced a decline in market price post-IPO, leading to concerns about potential dividend cuts due to undervalued assets.

Despite the attractive yields—12% for FSSL—investors are cautioned against jumping into these funds without assessing their long-term viability and risks associated with illiquid assets. Both funds highlight the risks of investing in new CEFs amidst substantial market discounts that may take time to recover, if at all.