Nvidia Sells AI Partners: What This Means for Investors

Wall Street observed recent Securities and Exchange Commission filings revealing that artificial intelligence (AI) chipmaker Nvidia (NASDAQ: NVDA) has made significant changes to its investments, exiting its stakes in Serve Robotics (NASDAQ: SERV) and SoundHound AI (NASDAQ: SOUN).

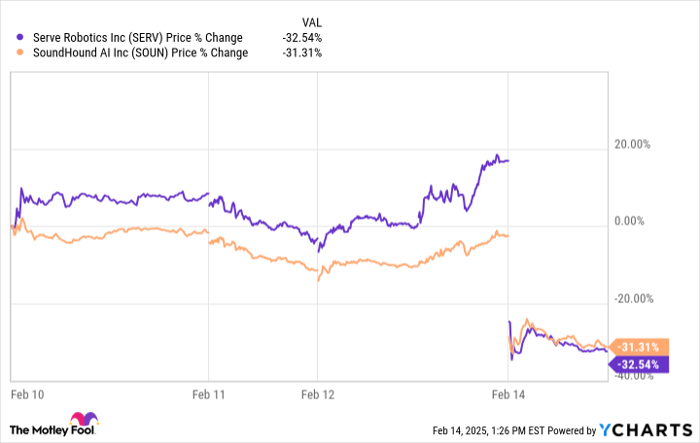

The moves of Nvidia, a leadership figure in AI hardware, often influence market trends. Unsurprisingly, both companies saw a decline in stock prices following the announcement:

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

SERV data by YCharts

Nvidia’s decision to sell raises important questions for investors. As a key player in the AI sector, Nvidia offers insight into technological advancements and market trends. However, I suspect this shift is more about realizing profits after both stocks experienced significant gains lately, rather than underlying issues with the companies. Caution over valuations has caused me to pause my own buying activities recently.

Image source: Getty Images.

Now, I’m using this market pullback to strengthen my positions in both companies, which are pursuing unique but substantial opportunities in the AI space.

SoundHound AI: A Major Business Opportunity on the Horizon

Established in 2005, SoundHound AI has taken the lead in voice AI technology, allowing for natural communication between humans and machines. The company’s platform supports interactions in various sectors, including automotive, food service, and finance, showcasing its adaptability.

The stock’s impressive 143% rise over the past three months indicates that Nvidia was likely cashing in on gains, a move that some investors may find concerning, but for me, it represents potential. At its core, SoundHound offers a unique position as an independent voice AI platform, built on proprietary technology, facilitating seamless communication across different industries.

The market potential is substantial. For 2024, SoundHound estimates its addressable market, which includes device royalties, subscriptions, and advertising, to be around $140 billion. Management anticipates revenues between $82 million and $85 million in 2024, rising to $155 million to $175 million in 2025. With subscriptions and total bookings surpassing $1 billion, these figures reinforce my optimism regarding this voice AI innovator’s stock.

Early collaborations highlight the company’s significant prospects. SoundHound AI has secured crucial automotive agreements with Stellantis, which oversees brands like Chrysler and Jeep, and is building relationships in quick-service restaurants and other industries.

Of course, I recognize the risks involved. As a developing company, SoundHound grapples with noteworthy operating losses, steep R&D expenses, and a fast cash burn rate, all while competing against larger tech firms. Successfully managing growth will be essential as it aims for profitability.

I’m keenly awaiting the fourth-quarter and full-year 2024 earnings, set for release on February 27, as they should provide further clarity on the company’s future. Despite the uncertainties stemming from Nvidia’s exit, I view the current pullback as an opportunity to invest in a company poised to play a pivotal role in the expanding voice AI market.

Serve Robotics: Innovating Last-Mile Delivery Solutions

Initially part of Postmates, Serve Robotics has developed autonomous robots aimed at solving the costly last-mile delivery issue. This comes at a time when major delivery platforms, such as DoorDash, are struggling with rising operational costs that increasingly cut into their revenues.

While it may be speculative, the stock’s remarkable 174% increase in the past three months likely triggered Nvidia’s decision to take profits. Nevertheless, I see significant potential in Serve’s market role and its technology.

Research from Ark’s “Big Ideas 2024” report estimates that the robotic and drone delivery market could hit $450 billion by 2030. Serve has shown its effectiveness, achieving over 50,000 deliveries in Los Angeles with an impressive 99.94% reliability, far exceeding human drivers. Additionally, a recent agreement with Uber Eats targets the deployment of 2,000 robots by the end of 2025, setting the stage for substantial revenue growth moving forward.

Several positive factors bolster my investment thesis. For instance, Serve’s Gen3 robot demonstrates significant advancements with a top speed of 11 mph, a 14-hour battery life, and level 4 autonomy, all while maintaining a 50% cost reduction from earlier models, establishing a strong technological advantage.

Strategic partnerships further enhance the investment potential in this robotics venture. Specifically, Serve has teamed up with Magna International for manufacturing needs and partnered with Wing Aviation to broaden its delivery capabilities via robot-to-drone handoffs.

However, challenges remain. Revenue generation is still in the early phases, with the company experiencing considerable cash burn as it scales operations. Serve must carefully navigate its ambitious expansion while managing production costs amidst growing competition.

Despite Nvidia’s exit and associated risks, this market pullback presents a prime opportunity to invest in a potential leader in autonomous urban delivery. Consequently, I plan to increase my stake in anticipation of upcoming catalysts in 2025.

Should You Invest $1,000 in SoundHound AI Right Now?

Before purchasing SoundHound AI stock, it’s wise to consider the following:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks for 2023, and SoundHound AI is not included. The stocks that made this list could see significant returns in the next few years.

Consider that when Nvidia made this list on April 15, 2005… if you had invested $1,000 at that time, you’d have $829,128!*

Stock Advisor provides investors with easy-to-follow guidance for success, including portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 7, 2025

George Budwell has positions in Nvidia, Serve Robotics, and SoundHound AI. The Motley Fool has positions in and recommends DoorDash, Nvidia, Serve Robotics, and Uber Technologies. The Motley Fool recommends Magna International and Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.