Buffett’s Top Picks: Invest in Chevron and Occidental Petroleum

Warren Buffett’s holding company, Berkshire Hathaway, has achieved impressive results over the years, delivering average annual returns exceeding 20%. A substantial portion of this success comes from its publicly traded portfolio. Thanks to regulatory disclosure requirements, we can examine the filings and see which stocks are Buffet’s favorites.

Currently, more than 10% of this portfolio is allocated to just two stocks. Following the recent market correction, many investors might find it an ideal moment to buy.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this moment. Continue »

Buffett’s Longtime Favorites: Chevron and Occidental Petroleum

Two companies that have long been staples in Buffett’s portfolio are Chevron (NYSE: CVX) and Occidental Petroleum (NYSE: OXY). Together, these companies make up approximately 11% of Berkshire’s public portfolio, valued at around $24 billion.

They rank as the fifth and sixth largest investments for Berkshire, indicating Buffett’s strong confidence in both firms.

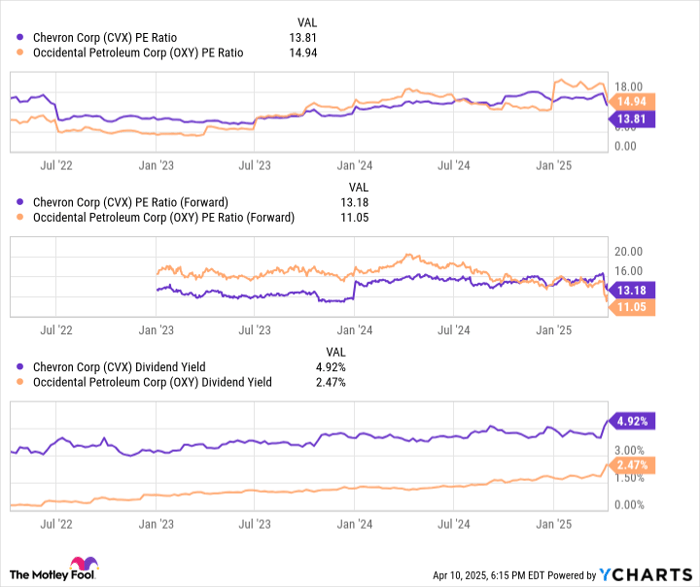

So what attracts Buffett to Chevron and Occidental Petroleum? The S&P 500 trades between 25 and 30 times earnings, while shares in these two companies trade at under 15 times trailing earnings and below 14 times forward earnings. This suggests analysts foresee greater profit potential ahead.

Meanwhile, the dividend yield for the S&P 500 has dropped to just 1.27%. Occidental’s yield is about double that at 2.47%, while Chevron approaches nearly 5%. Both firms have a robust history of executing share buybacks.

In conclusion, these are underappreciated companies with attractive valuations and strong dividend yields, with positive profit growth expected in the upcoming year.

Should investors follow Buffett into these two enduring picks? Before proceeding, it’s crucial to understand one factor.

CVX PE Ratio data by YCharts; PE = price to earnings.

Analyzing Chevron vs. Occidental Petroleum Investments

It’s important to recognize that Chevron and Occidental Petroleum are not the same type of business. Chevron is one of the largest integrated oil and gas companies, meaning it not only extracts raw materials in upstream divisions, but also participates in transporting, refining, and selling the finished products.

On the other hand, Occidental is more focused on upstream production, making it more susceptible to commodity price fluctuations.

During periods of falling oil prices, Chevron can rely on higher refining margins and chemical profits to mitigate losses. Without this diversification, Occidental is far more vulnerable. However, during periods of price increases, Occidental may offer greater upside potential due to its direct exposure to these commodities.

Nonetheless, both companies will require rising oil prices to be profitable long-term investments. Over the last year, oil prices have dropped nearly 30%, settling at approximately $60 per barrel. Investment banks, including Goldman Sachs, project that prices will likely remain low through 2026.

Market conditions can change quickly, however. Purchasing when expectations are low can yield significant returns for contrarian investors.

It’s crucial to hold a positive outlook on long-term oil prices when considering Chevron and Occidental shares. Buffett’s bullish stance suggests optimism, but investors must grasp how vital commodity prices are to these companies’ futures.

Is Now the Right Time to Invest $1,000 in Occidental Petroleum?

Before purchasing Stock in Occidental Petroleum, keep the following in mind:

The Motley Fool Stock Advisor analyst team has determined the 10 best stocks for investors to buy right now… and Occidental Petroleum is not included. The stocks that made the list are poised for substantial returns over the coming years.

For instance, when Netflix was recommended on December 17, 2004… a $1,000 investment would have grown to $526,499!* Similarly, if you had invested $1,000 in Nvidia after its recommendation on April 15, 2005, you’d have $687,684 today!

Notably, i>Stock Advisor boasts a total average return of 818%, outperforming 156% for the S&P 500. Don’t miss out on the latest top 10 list when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 14, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron and Goldman Sachs Group. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.