Buffett Steps Down: Spotlight on Amazon and American Express

With Warren Buffett recently announcing his retirement as CEO of Berkshire Hathaway, investors may want to reassess key stocks in his company’s $286 billion portfolio. Among the many investment opportunities, Amazon (NASDAQ: AMZN) and American Express (NYSE: AXP) emerge as top picks worth considering.

1. Tackling Market Challenges: Amazon

Concerns persist about the retail and e-commerce sectors amid ongoing tariff uncertainties. Amazon is not immune to these challenges. CEO Andy Jassy acknowledged during the company’s first-quarter earnings call, “None of us know exactly where tariffs will settle or when.” However, focusing solely on tariffs may overlook Amazon’s long-term growth potential.

Commanding 40% of the U.S. e-commerce market, Amazon significantly outperforms Walmart, which holds just a 7% share. In the latest quarter, North American sales surged 8%, reaching $93 billion. This growth indicates that Amazon continues to solidify its e-commerce market position.

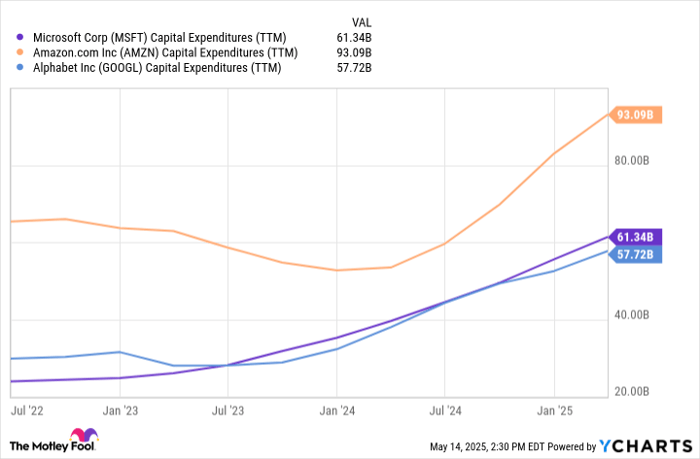

Beyond e-commerce, Amazon’s strength lies in its cloud computing division, Amazon Web Services (AWS), which dominates the market with a 30% share compared to Microsoft‘s Azure, at 21%. AWS contributes approximately 63% of Amazon’s overall operating income, making it a pivotal element of the company’s strategy. As the demand for artificial intelligence (AI) cloud services grows, AWS is poised to capitalize on the expected $2 trillion market expansion over the next five years.

From a valuation perspective, Amazon’s stock appears relatively attractive, with a trailing price-to-earnings (P/E) ratio of 34. This figure is above the S&P 500’s average of 28 but below Walmart’s P/E of 40.

2. American Express: A Long-Time Favorite

American Express has been a staple in Buffett’s investment portfolio since 1991 and is now Berkshire Hathaway’s second-largest holding. Despite concerns about the impact of tariffs on consumer spending, American Express continues to thrive. Revenue grew 7% in the first quarter, reaching approximately $17 billion, while earnings per share (EPS) increased by 9% to $3.64.

Management’s optimism is evident as they forecast revenue growth of 9% for 2025, alongside an EPS projection of $15.25, both at the midpoint. This outlook stands out, especially as many companies have pulled back guidance due to tariff and economic uncertainties.

American Express’s growth is largely attributed to its ability to charge higher fees to members. Management highlighted that the average fee per new account has risen about 40% over the past three years, showcasing robust demand for premium products. The stock is also appealing with a P/E ratio of 21, making it cheaper than the broader market.

Investor Considerations for Amazon and American Express

The stock market has experienced volatility recently, with ongoing concerns about tariffs and the economy. Despite these factors, Amazon and American Express present solid investment opportunities. However, investors should brace for price fluctuations in the near term.

For those beginning to invest, starting with smaller positions in either company may be prudent. A dollar-cost averaging strategy allows investors to purchase shares over time, minimizing upfront capital commitments.

The views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.