Walt Disney and Starbucks Present Strong Long-Term Investment Opportunities

Since President Donald Trump unveiled his tariff strategy, many stocks have significantly declined, including iconic brands. In light of this situation, I have taken advantage of the market disruption to add to my long-term investments. While volatility may persist, now appears to be an exceptional time to purchase shares of industry leaders like Walt Disney (NYSE: DIS) and Starbucks (NASDAQ: SBUX)—which I recently did.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

Walt Disney: A Resilient Brand on the Upswing

Post-pandemic challenges have impacted Walt Disney, notably within its streaming sector and the pricing of theme parks. Returning CEO Bob Iger has shifted the company’s focus towards efficiency and prioritizing investments in its profitable theme parks. Under his leadership, Disney is finding its footing again.

In the latest quarterly results, Disney reported a 5% revenue increase compared to a challenging previous holiday season. Operating income and adjusted earnings per share surged by 31% and 44%, respectively, reflecting management’s efficiency focus. Additionally, the streaming business has reached profitability.

After recent market declines, Disney’s price-to-sales multiple (P/S) is at its lowest since the financial crisis, showing nearly a 30% reduction from its recent peak. Despite potential tariff impacts, this presents a favorable entry point for long-term investors eager to invest in a solid business. For the fiscal year, management expects about $15 billion in operating cash flow and $3 billion in share buybacks. If their strategy to invest $60 billion in parks over the next decade succeeds, significant growth could follow.

Starbucks: A Chance to Reinvest

Starbucks saw a steep rise in its stock price when Brian Niccol was announced as the new CEO in August 2024. However, the stock has since declined by 30%, resulting in its lowest price since before Niccol’s hiring.

Niccol’s turnaround strategy, termed “Back to Starbucks,” has included simplifying the menu, reducing wait times, and enhancing customer experiences in-store. Initial results have shown promise.

The company’s most recent earnings report exceeded analyst estimates, even though comparable sales dipped slightly year-over-year. Notably, key customer metrics improved sequentially. Margins currently face pressure from investments made under Niccol’s leadership, but many initiatives have yet to be reflected in the financial results, indicating that the turnaround is still in its early stages.

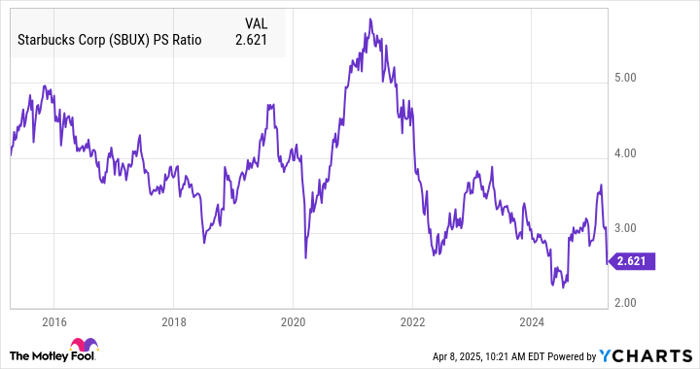

SBUX PS Ratio data by YCharts.

Starbucks now trades at a historically low price-to-sales ratio following the recent decline. Should its turnaround efforts catalyze growth and improve margins, this could be an attractive price point for long-term investors.

Understanding the Tariff Risks

It is essential to acknowledge that both companies face meaningful challenges. Their significant exposure to China makes them vulnerable to escalations in the trade war linked to tariffs. Starbucks, in particular, has approximately 7,600 stores in China, representing around 19% of its total.

Both companies operate cyclical businesses that rely on consumer spending, and if tariffs lead to inflation or a recession, discretionary spending may decrease. Nevertheless, as a long-term investor, I find both companies appealing, planning to hold onto these stocks for many years. Throughout that time, economic cycles will fluctuate, but both businesses are solid and likely to achieve steady growth, potentially rewarding those who buy at current prices.

A Second Chance for Investment Opportunities

Have you ever felt like you missed out on buying top-performing stocks? This is your moment.

Occasionally, our team of analysts puts forth a “Double Down” Stock recommendation for companies poised for substantial gains. If you’re concerned you’ve missed the boat, now is the optimal time to invest before the window closes. Consider the following:

- Nvidia: An investment of $1,000 at our double down in 2009 would be worth $244,570!*

- Apple: A $1,000 investment at our double down in 2008 would have grown to $35,715!*

- Netflix: If you’d invested $1,000 when we doubled down in 2004, it would now be worth $461,558!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and opportunities like this do not present themselves often.

Continue »

*Stock Advisor returns as of April 5, 2025

Matt Frankel holds positions in Starbucks and Walt Disney. The Motley Fool has positions in and recommends Starbucks and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.