The AI Boom Positions Energy Companies for Future Growth

The artificial intelligence revolution necessitates a substantial amount of power, making energy firms prime beneficiaries of the impending AI boom for years to come.

Generative AI platforms such as ChatGPT demand at least ten times the energy of an average Google search. Additionally, large data centers can consume electricity comparable to that of a midsize city.

This AI-driven energy surge coincides with the U.S. and major tech companies like Amazon and Microsoft targeting reduced reliance on coal and other fossil fuels. While they acknowledge the continued role of natural gas as a reliable and inexpensive energy source, the future looks bright for nuclear, natural gas, and renewable energy sectors.

Some energy companies collaborating with AI firms were affected by corrections in the stock market during the first quarter.

This selloff was deemed necessary following a substantial rally after the Trump election, which had capped off an impressive multi-year performance. For long-term investors, this recalibration presents an excellent chance to acquire strong energy stocks at more attractive price points and reasonable valuations.

This article examines two top energy stocks to consider buying in April for long-term growth driven by AI: GE Vernova and Constellation Energy.

Invest in GE Vernova Stock for Potential 25% Growth

The GE spinoff, GE Vernova, GEV, contributes to approximately 25% of global electricity generation through its technologies.

This pure-play energy transition company serves a diverse clientele, leveraging nuclear, natural gas, wind, and more. Since its public debut last April, the stock has surged ahead, outpacing market and sector performance.

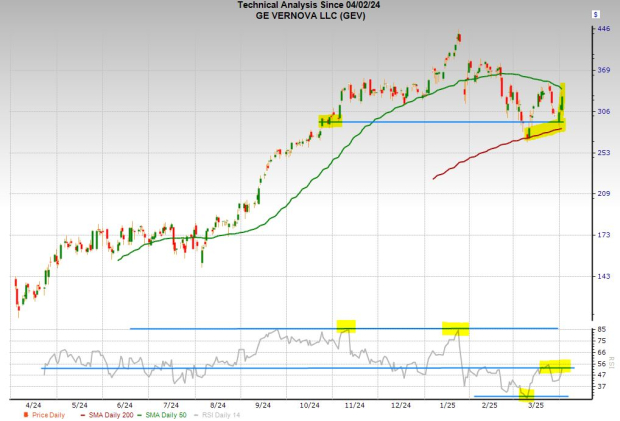

Image Source: Zacks Investment Research

GE Vernova supplies nuclear turbine technology and services for all reactor types and is a leader in next-generation small modular reactor technology.

The company collaborates with the U.S. Department of Energy, fostering a renaissance in the domestic nuclear industry. In addition to nuclear and natural gas, GE Vernova’s growth strategy encompasses electrification software, energy storage solutions, grid advancements, and more.

Analysts forecast GE Vernova’s adjusted earnings will grow by 15% in 2025 and 73% in fiscal year 2026, reaching $11 per share, rebounding from a loss of -$1.60 in FY23 to a profit of +$5.58 in FY24. Revenue is expected to rise by 5% in 2025 and 9% in 2026.

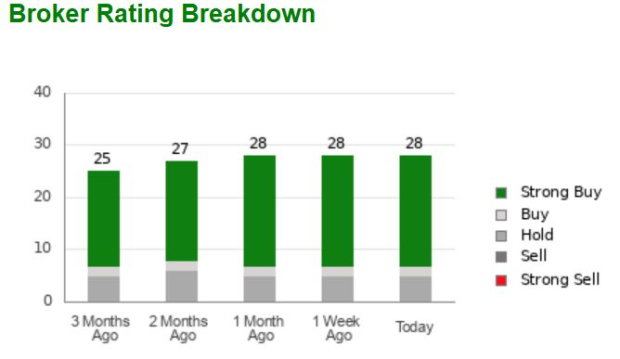

Image Source: Zacks Investment Research

Wall Street recognizes GE Vernova’s leadership in a crucial sector. Recently declaring its inaugural dividend at the end of 2024 and launching a $6 billion stock repurchase plan further showcases its financial strength.

Since its IPO in April, the stock has soared 135%, significantly outperforming the energy sector’s 2% decline and the S&P 500’s 9% rise. Despite a 28% pullback from its January highs, GEV is approaching its 50-day moving average after gaining support near pre-election breakout levels and its 200-day moving average.

Consider This Nuclear and Clean Energy Stock for Long-term Gains

Constellation Energy, the largest nuclear power plant operator in the U.S., announced a major acquisition in January, aiming to become the country’s leading clean energy provider. The firm will purchase natural gas and geothermal powerhouse Calpine in a cash-and-stock deal valued at $26.6 billion, expected to close in the fourth quarter.

This acquisition positions Constellation to enhance its presence in energy-intensive markets like Texas and California while augmenting its nuclear capabilities with natural gas, offering immediate growth potential.

Image Source: Zacks Investment Research

In the realm of AI, Constellation, which operates over 20 nuclear reactors across various sites in the Midwest and Northeast, secured a significant 20-year power purchase agreement with Microsoft MSFT last year, highlighting its long-term value.

Investors appreciate Constellation’s track record for returning cash to shareholders, bolstered by increasing government support for nuclear energy. The company anticipates a 10% increase in dividends per share in 2025, following a 25% hike last year.

Constellation Energy’s Strong Growth Prospects Amid Market Shifts

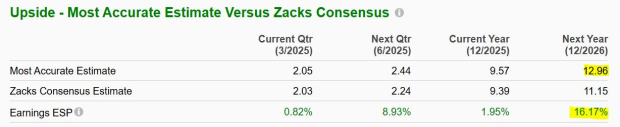

Image Source: Zacks Investment Research

Constellation Energy Corporation (CEG) reports promising long-term growth, projecting double-digit increases in base earnings per share (EPS) driven by the benefits of the Nuclear Production Tax Credit. According to current Zacks estimates, anticipated earnings growth stands at 8% for 2025 and accelerates to 18% in 2026. Remarkably, the company’s Most Accurate Estimate for 2026 is now 16% higher than the consensus, reflecting an upward trend since the release of its fourth-quarter results.

As a frontrunner in the nuclear energy sector, Constellation benefits from the increasing demand for reliable, around-the-clock power essential for the ongoing AI boom. Over the past three years, CEG’s stock price has surged 270%. However, a recent 40% decline from its highs in January has resulted in its performance aligning closely with the S&P 500 over the last 12 months. On Wednesday, the stock rebounded by 3.5%, as it found support near its previous breakout levels related to Microsoft.

Zacks’ Research Chief Highlights Top Stock with Doubling Potential

Our expert team has curated a selection of five stocks that showcase the highest likelihood of doubling in value within the upcoming months. Among these, Director of Research Sheraz Mian has spotlighted one stock projected to achieve the greatest growth.

This standout option comes from a leading financial firm known for innovation. With an expanding customer base exceeding 50 million, the firm offers a variety of state-of-the-art solutions, positioning it for potential significant gains. While not all elite selections guarantee success, this stock has the capacity to surpass previous Zacks’ Stocks Set to Double, like Nano-X Imaging, which rose by 129.6% in under nine months.

For additional insights, feel free to see our top stock and four potential runners-up.

Are you looking for the latest recommendations from Zacks Investment Research? Download our guide featuring the “7 Best Stocks for the Next 30 Days.” Click to access this free report.

Microsoft Corporation (MSFT): Free Stock Analysis report

Constellation Energy Corporation (CEG): Free Stock Analysis report

GE Vernova Inc. (GEV): Free Stock Analysis report

This information was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.