Investors Eye Oversold Energy Stocks as Potential Bargains

The recent downturn in certain energy sector stocks may present investors with a chance to buy undervalued assets.

The Relative Strength Index (RSI) serves as a key momentum indicator, measuring a stock’s performance on days it gains versus days it declines. Typically, a stock is deemed oversold when the RSI falls below 30, according to Benzinga Pro.

Below is the current list of significant oversold stocks in the energy sector, with RSI values at or below 30.

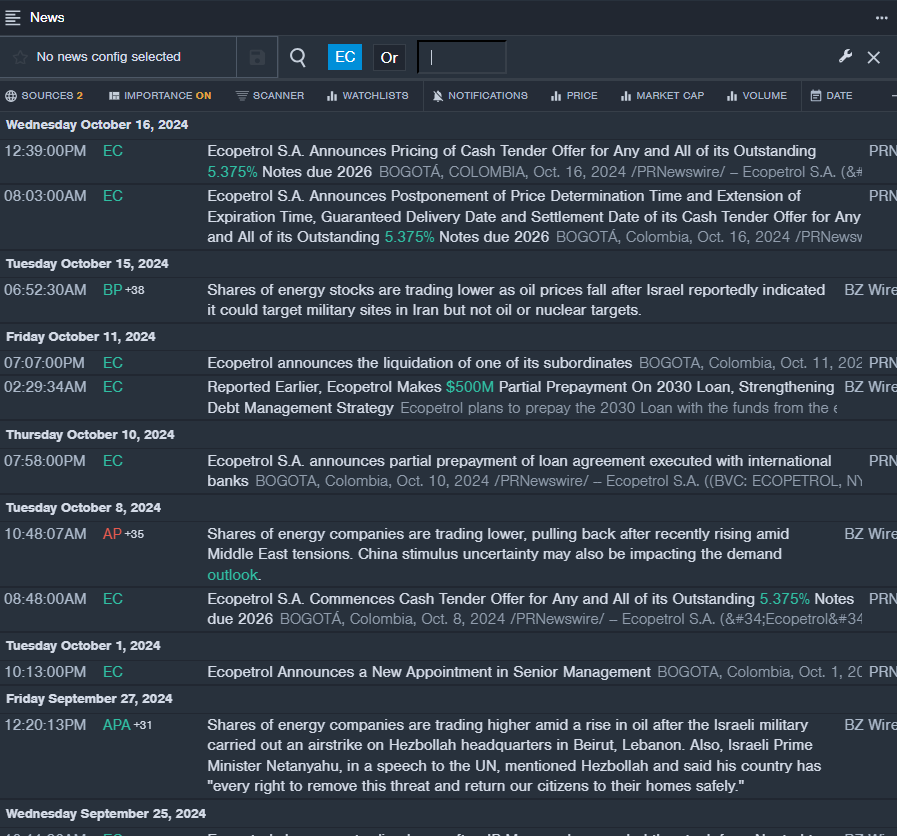

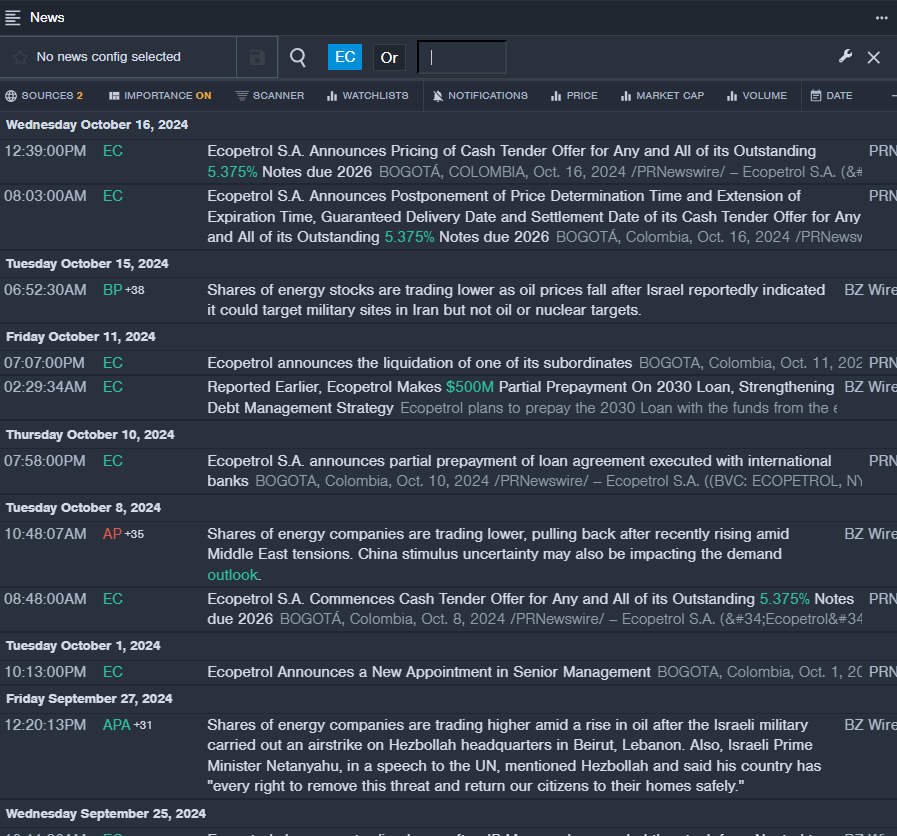

Ecopetrol SA EC

- On October 16, Ecopetrol announced a cash tender offer for all its outstanding 5.375% notes due in 2026. Following this announcement, the stock dropped approximately 11% in the past five days, reaching a 52-week low of $8.13.

- RSI Value: 26.20

- EC Price Action: On Thursday, shares of Ecopetrol declined 1.1%, closing at $8.15.

- Real-time updates from Benzinga Pro highlighted the latest developments for EC.

Torm PLC TRMD

- On July 23, analyst Jonathan Chappell from Evercore ISI Group reaffirmed an Outperform rating for TORM, increasing the price target from $45 to $48. Despite this positive outlook, the stock experienced a decline of about 17% over the past month, reaching a 52-week low of $26.10.

- RSI Value: 27.08

- TRMD Price Action: Shares of Torm fell 0.7% on Thursday, ending the day at $29.90.

- Benzinga Pro’s charting tool provided insights into the trends affecting TRMD stock.

Read More:

Market News and Data brought to you by Benzinga APIs