Market Watch: The $1 Trillion Club Loses Members Amid Sell-Off

The $1 trillion Stock club has gotten smaller during the recent market sell-off. Currently, only eight companies hold a $1 trillion valuation globally. However, two firms are likely to rejoin their ranks if the market stabilizes in the coming months.

Potential Members: Taiwan Semiconductor and Broadcom

Taiwan Semiconductor (NYSE: TSM) and Broadcom (NASDAQ: AVGO) have each reached the $1 trillion valuation threshold but are currently on the outskirts due to market fluctuations. Both companies are expected to maintain robust long-term growth, positioning them for reintegration into the trillion-dollar club either this year or next.

1. Taiwan Semiconductor

Broadcom and TSMC are close to reclaiming their trillion-dollar status, with Broadcom valued at around $800 billion and TSMC at approximately $770 billion. This represents a 25% increase needed for both companies to reach a $1 trillion valuation. Should the market recover quickly, these stocks may present attractive buying opportunities for investors.

As the world’s largest chip foundry, TSMC manufactures chips for clients unable to produce their own, including notable companies like Nvidia (NASDAQ: NVDA) and Apple (NASDAQ: AAPL). Its neutrality in chip production has propelled TSMC to the forefront of the foundry market.

Additionally, TSMC remains committed to technological advancement. Its current leading chip is the 3-nanometer (nm) variety, with plans to introduce 2 nm and 1.6 nm chips in the near future.

Regarding tariffs, Taiwan Semi’s CEO recently commented:

We understand there are uncertainties and risks from the potential impact of tariff policies. However, we have not seen any change in our customers’ behavior so far. Therefore, we continue to expect our full year 2025 revenue to increase by close to mid-20s percent in U.S. dollar terms.

Such bullish statements bolster confidence in TSMC’s potential return to the $1 trillion valuation.

2. Broadcom

Broadcom is diversifying its product offerings, notably with custom AI accelerators known as XPUs, which provide a cost-effective alternative to Nvidia’s GPUs. Many customers prefer Broadcom’s XPUs, as they are designed for specific workloads, enhancing operational efficiency.

The market for XPUs is projected to expand significantly, with Broadcom estimating an addressable market of $60 billion to $90 billion by 2027 from just three clients. As more clients adopt these units, Broadcom’s revenue, currently at $54.5 billion, could see substantial growth.

This creates an enticing entry point for investors, given the recent market sell-off.

Valuation Perspective

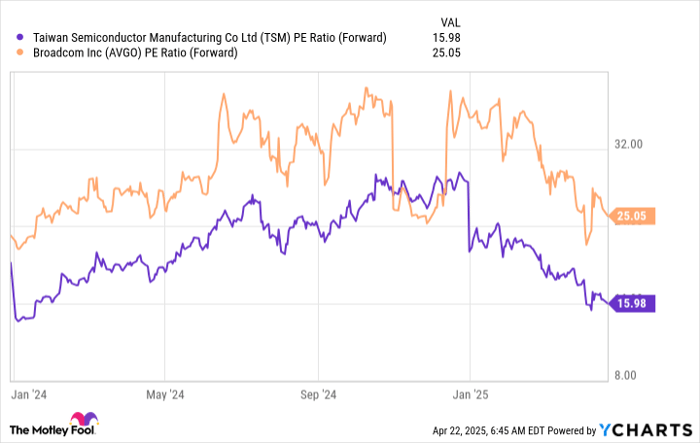

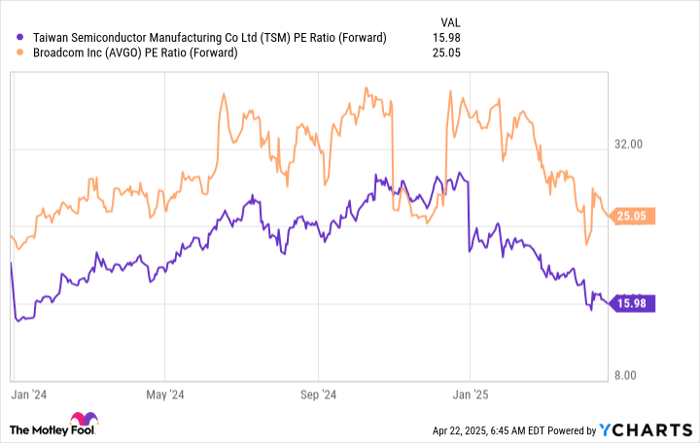

From a forward price-to-earnings (P/E) ratio perspective, both TSMC and Broadcom appear to be relatively undervalued.

TSM PE Ratio (Forward) data by YCharts

While Broadcom has a slightly higher valuation due to stronger investor sentiment, both companies are currently priced more attractively compared to recent months. Patience will be essential as the market navigates ongoing economic uncertainties.

Should You Invest $1,000 in TSMC Now?

Before making an investment in Taiwan Semiconductor Manufacturing, consider the following:

The Motley Fool analyst team has identified their top 10 stocks for current investment opportunities, and Taiwan Semiconductor Manufacturing is not among them. These chosen stocks have the potential to deliver significant returns in the future.

For context, consider when Netflix was recommended on December 17, 2004… an investment of $1,000 would now stand at $566,035! Additionally, Nvidia, recommended on April 15, 2005… would now be worth $629,519!

The Motley Fool Stock Advisor has an average return of 829%, significantly outpacing the 155% return of the S&P 500.

*Stock Advisor returns as of April 21, 2025

Keithen Drury holds positions in Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.