Nvidia and Taiwan Semiconductor: Top Stock Picks Amid Market Fluctuations

Despite recent upward trends in the market, potential announcements from the White House or the Federal Reserve could still trigger declines. Investors should stay prepared with a list of stocks to consider buying during any market downturn.

At the top of my list are Nvidia (NASDAQ: NVDA) and Taiwan Semiconductor Manufacturing (NYSE: TSM). If there’s a significant market drop, these will be my first purchases.

Nvidia: A Leading Force in Graphics Processing

Nvidia designs graphics processing units (GPUs) that power much of today’s artificial intelligence models. With an estimated market share exceeding 90%, Nvidia is a key player. Investing in dominant companies in essential sectors, like Nvidia, is a strategic decision.

Currently, Nvidia is navigating a multi-year buildout cycle with soaring demand for its GPUs. Insights reveal that data center capital expenditures reached $400 billion in 2024 and could climb to $1 trillion by 2028. Market sentiment remains cautious, speculating that spending could dip amid ongoing trade tensions.

However, commentary from Nvidia’s major clients indicates a robust outlook for data center investments, reinforcing the company’s strong position.

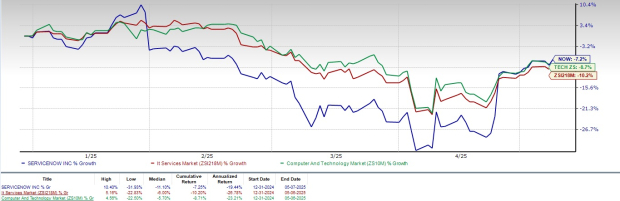

Investors need not wait for a market crash to buy Nvidia shares, as the stock is down about 25% from its peak. Currently, it trades at the lowest forward price-to-earnings ratio seen in over a year, presenting an attractive buying opportunity. At this level, it trades at a slight premium compared to the S&P 500, which is valued around 21.1 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

Although Nvidia is a wise purchase today, I would prioritize it during a market crash.

Taiwan Semiconductor: Riding the Chip Boom

Like Nvidia, Taiwan Semiconductor is well-positioned to benefit from the chip surge driven by AI. As the world’s largest chip manufacturer, TSMC has contracts with major tech firms that cannot produce chips on their own. Many of these companies place orders years ahead, making TSMC’s insights valuable.

Over the next five years, management anticipates AI-related revenue to grow at a compound annual growth rate (CAGR) of 45%. Overall, they project near 20% CAGR for the company, leading to a nearly 148% increase during this period. Recently, TSMC’s CEO, C. C. Wei, reassured investors during the Q1 earnings report:

Despite uncertainties from potential tariff impacts, our customers’ behaviors remain unchanged. We expect our full-year 2025 revenue to increase by close to mid-20s percent in US dollar terms.

This optimistic outlook bodes well for shareholders. However, there are lingering worries about future tariffs on semiconductors. Regardless, TSMC’s chips are essential to virtually all high-tech devices, establishing necessary costs. Due to the current uncertainty, the stock is still relatively undervalued.

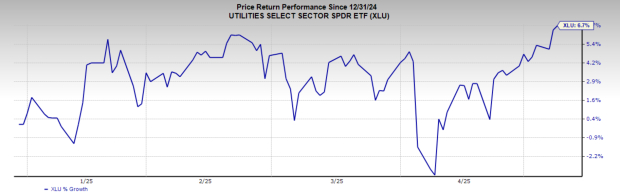

TSM PE Ratio data by YCharts

Trading at under 19 times forward earnings, TSMC remains an excellent buy, and investors should acquire shares while they are still affordable.

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.