The recent economic data highlights a K-shaped economy, characterized by diverging spending patterns between upper- and lower-income consumers. While high-income consumers remain resilient amid inflation, low-income consumers are becoming more price-sensitive, affecting their purchasing decisions.

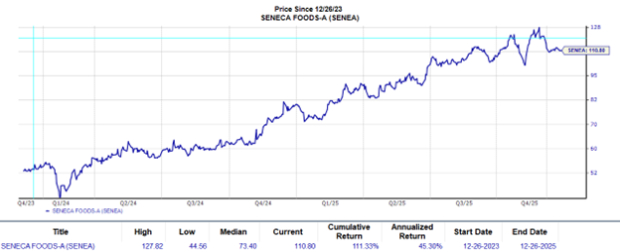

Seneca Foods Corporation (SENEA), which operates 26 facilities across the U.S., reported a 3.7% increase in first-half fiscal 2026 net sales, reaching $757.5 million, driven by a 10.2% volume growth in frozen and canned vegetables. In contrast, Natural Grocers (NGVC) achieved a 4.2% increase in net sales to $336.1 million and a 31% rise in net income to $11.8 million for the latest quarter, targeting a younger demographic willing to pay a premium for organic products.

As of September 30, 2025, Natural Grocers operated 169 stores across 21 states, planning to open 6 to 8 additional locations in FY26. Both companies reflect the ongoing economic disparities in consumer behavior and preferences.