Market Turmoil: Caution Advised for Palantir and Tesla Investors

Amid a significant sell-off on Wall Street, many previously leading stocks are trading well below their highs. Two notable tech stocks that have seen considerable declines are Palantir (NASDAQ: PLTR) and Tesla (NASDAQ: TSLA). As of now, Palantir’s stock price has dropped approximately 37% from its peak, while Tesla shares have been cut by more than half.

Despite these declines, I remain skeptical about investing in either of these stocks at present levels.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Palantir: High Valuation Amid Uncertain Growth

Currently, two main factors create apprehension around Palantir’s stock: its high valuation and the potential impacts of government budget cuts.

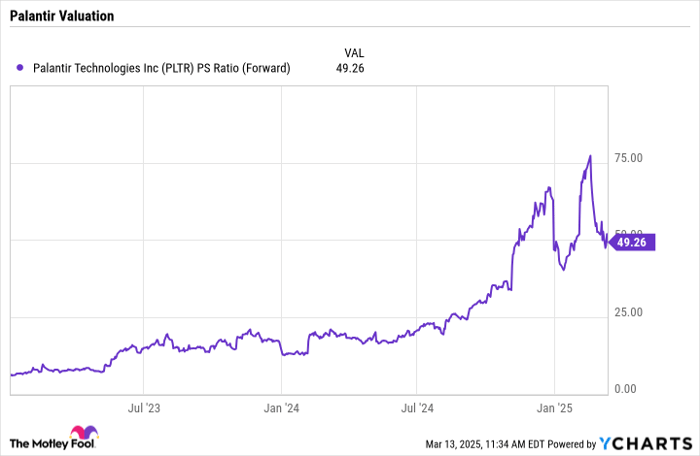

Even after recent price drops, Palantir maintains a steep valuation. The stock is currently trading at a forward price-to-sales (P/S) ratio exceeding 49. This is significantly higher than the historical peak ratios in the software-as-a-service (SaaS) sector, particularly when companies were growing at over 30% annually. To illustrate, Palantir’s revenue grew approximately 36% year-over-year in the last quarter.

PLTR PS Ratio (Forward) data by YCharts.

Palantir’s growth trajectory also faces uncertainty due to the federal government’s current cost-cutting measures. Recently, a directive from President Trump’s Defense Secretary, Pete Hegseth, instructed the Department of Defense to seek an 8% budget reduction over the next five years. Historically, Palantir has relied heavily on government contracts, with approximately 42% of its total revenue generated from U.S. government clients.

While some analysts argue that Palantir’s efficiency-focused solutions could be advantageous in this climate, the uncertainty surrounding Pentagon budgets poses risks for the company, particularly when paired with its elevated valuation.

Given the right price, Palantir could still be an appealing investment. The company has experienced substantial growth in the commercial sector following the launch of the Palantir Artificial Intelligence Platform (AIP). This focus on AI has attracted numerous new clients, presenting significant potential for evolving projects from mere prototypes to full-scale implementations.

Personally, I would consider investing in Palantir if its stock traded in the low $40s, aligning the forward P/S ratio closer to 20 based on analysts’ revenue projections for 2026. While not a bargain, that valuation could be warranted under certain conditions.

Image source: Getty Images.

Tesla: Struggling Core Business and High Hopes

Tesla is another stock I would advise against purchasing, even amidst its recent downturn.

CEO Elon Musk’s political involvement with President Trump and the Department of Government Efficiency (DOGE) has heightened concerns about the company’s image. Tesla’s electric vehicle sales faced challenges even before Musk’s engagement in governmental matters. In 2024, automotive revenue declined by 6%, with an 8% drop in the fourth quarter. Yearly deliveries fell by 1%, though they rebounded 2% in Q4. Competition and an aging vehicle lineup have hindered Tesla’s performance in China, the foremost market for electric vehicles.

Musk’s affiliations with the government might complicate efforts to market Tesla’s EVs. His high-profile role may polarize potential customers in a politically charged environment. Furthermore, while tariffs are projected to exert pressure on competitors, rising production costs affect Tesla as well.

Supporters argue that Tesla’s future lies beyond electric vehicles, extending into autonomous driving, AI, and robotics. While these claims hold merit, Musk’s history of exaggerated timing projections raises skepticism. For instance, Musk predicted in 2015 that Tesla would achieve full autonomy by 2018 and envisioned one million robotaxis operational by the end of 2020. However, as of 2025, Tesla has not realized a fully autonomous system or operational robotaxis for commercial use. In contrast, Alphabet’s Waymo has been successfully offering paid robotaxi rides since late 2022.

With Tesla’s primary operations struggling and lofty expectations baked into its stock price, I would recommend avoiding investment in this company.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Have you ever felt like you missed out on purchasing high-performing stocks? If so, you’ll want to stay tuned.

Our team occasionally publishes “Double Down” stock recommendations for companies they believe are on the verge of significant growth. If you think you’ve lost your investing opportunity, now might be the time to jump back in before it’s too late. The results offer compelling evidence:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $299,728!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $39,754!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $480,061!

We are currently issuing “Double Down” alerts for three exceptional companies, and opportunities like this don’t come often.

Continue »

*Stock Advisor returns as of March 14, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler holds positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Palantir Technologies, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.