Alcoa and Texas Capital Shine with Strong Q3 Earnings Surprises

Aluminum producer Alcoa AA and financial holding company Texas Capital Bancshares TCBI demonstrated impressive performance after exceeding third quarter earnings forecasts on Thursday.

Both companies showcased remarkable growth on their profits compared to the same time last year, making them potential picks for investors.

Highlights from Alcoa’s Q3 Earnings

Zacks Rank #3 (Hold)

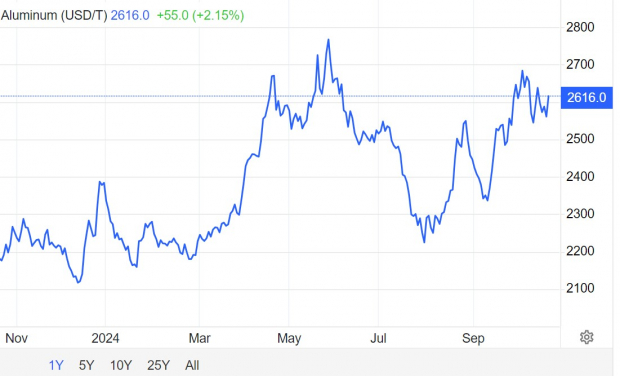

Aluminum prices have surged by +20% this year, now exceeding $2,600 per tonne. This increase, coupled with Alcoa’s ability to manage raw material costs, significantly improved its profit margins. The adjusted net income for Q3 reached $135 million, translating to $0.57 per share, a dramatic turnaround from an adjusted loss of -$1.14 a share a year earlier. This result far exceeded EPS estimates of $0.23 by 148%.

Image Source: Trading Economics

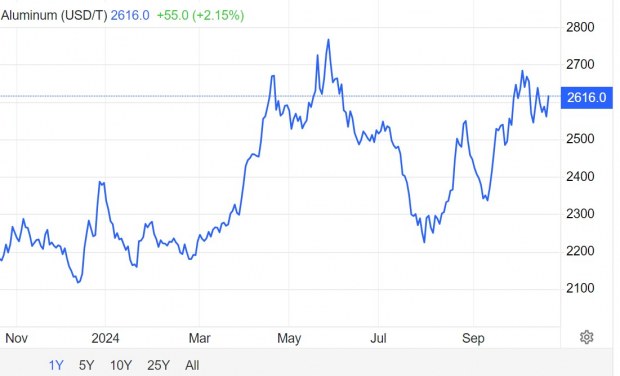

Although Q3 sales were $2.9 billion, slightly below estimates of $2.99 billion (by -3%), it still represented an 11% increase from $2.6 billion in the same quarter last year. Impressively, Alcoa has beaten earnings expectations in three of its last four quarterly reports, reflecting an average EPS surprise of 51.52%. Analysts predict a strong recovery for Alcoa’s bottom line in fiscal years 2024 and 2025.

Image Source: Zacks Investment Research

Texas Capital’s Q3 Performance

Zacks Rank #1 (Strong Buy)

Before its Q3 report, Texas Capital garnered attention due to consistently positive earnings estimate revisions, supporting its strong buy rating. The company focuses primarily on middle-market businesses and high-net-worth individuals across major Texas cities such as Dallas, Houston, and Austin.

Image Source: Zacks Investment Research

Texas Capital achieved a record net fee income in this quarter, rising 38% year over year to $64.8 million. Total net income for Q3 was $74.3 million, or $1.62 per share, marking a 37% increase from $1.18 per share in the previous year and exceeding EPS estimates of $0.97 by 67%. The company’s Q3 sales of $304.91 million topped projections by 9% and increased over 9% from $278.94 million in the same quarter last year.

Though projected earnings may dip by -9% in FY24 due to a more challenging market, forecasts indicate a strong rebound of 39% in FY25, aiming for $4.91 per share.

Image Source: Zacks Investment Research

Conclusion

Given their strong Q3 results, Alcoa and Texas Capital present interesting investment opportunities. Analysts expect upward revisions in earnings estimates in the near future, enhancing their appeal.

7 Best Stocks for the Next 30 Days

Just released: Experts recommend 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They believe these stocks are “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market more than twice, with an average annual gain of +23.7%. Be sure to pay immediate attention to these selected stocks.

Alcoa (AA): Free Stock Analysis Report

Texas Capital Bancshares, Inc. (TCBI): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.