Top Dividend Stocks: Why Apple and Visa Stand Out

Investing in dividend stocks offers a solid strategy for various reasons. Companies that pay dividends typically show resilience compared to those that do not. The regular payouts can mitigate losses, especially during anticipated downturns, a concern for many investors today. This is why purchasing shares in reputable income-generating companies is integral to Warren Buffett’s investment approach—after all, he is widely regarded as the greatest investor of all time. Within Berkshire Hathaway‘s portfolio are many stocks providing consistent dividends. Here, we highlight two stocks worth considering: Apple (NASDAQ: AAPL) and Visa (NYSE: V).

Seeking Investment Guidance? Discover Our Analyst Team’s Picks for the 10 Best Stocks to Buy Today! Learn More »

1. Apple

Apple has become synonymous with Buffett’s investment philosophy. The tech giant has remained the largest holding in his portfolio for several years. In fact, Buffett has praised Apple as the best business globally—a strong endorsement.

Several factors contribute to Apple’s attractiveness, notably its economic moat. Buffett prioritizes this quality in his investments, and Apple’s moat derives from multiple sources, including its powerful brand.

Customer loyalty plays a significant role; for many, switching from Apple to Android would feel like a significant downgrade. Additionally, Apple’s ecosystem creates high switching costs, as customers need to transfer vast amounts of data and risk losing the seamless integration of its devices.

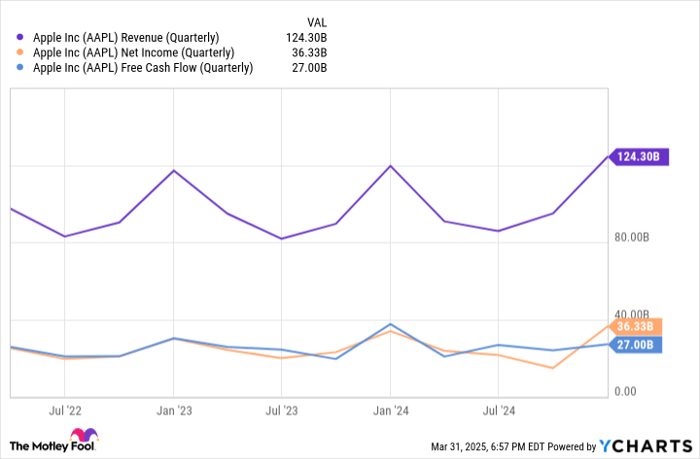

Moreover, Apple consistently generates impressive revenue, profits, and cash flow.

AAPL Revenue (Quarterly) data by YCharts.

Although its top-line growth may not be as striking as in past years, management has multiple avenues for long-term growth. With over 2 billion devices in circulation, Apple has ample opportunities to monetize this customer base further. The company boasts more than a billion paid subscriptions within its ecosystem.

While iPhone sales still dominant its revenue, Apple’s services segment has become its fastest-growing unit—a trend likely to continue. This segment opens up numerous long-term growth avenues.

In line with market innovations, Apple is also actively exploring artificial intelligence (AI) integration. Recent devices have incorporated AI, and the company will continue seeking ways to enhance its ecosystem with this technology.

With a market cap exceeding $3 trillion, Apple remains a strong contender for long-term potential. Its dividend program enhances its appeal, featuring a forward yield of only 0.5% (versus the S&P 500‘s average of 1.3%). However, the company has impressively increased its dividend payouts by 92.3% over the past decade.

Thanks to a conservative cash payout ratio of 14%, Apple is well-positioned to maintain significant dividend increases. The company’s dividends appear secure for long-term reliance.

2. Visa

Visa is recognized as the leading payment network globally, with over 4 billion credit or debit cards featuring its logo. These cards are accepted by more than 150 million businesses worldwide.

It’s vital to note that Visa does not issue cards directly; that responsibility falls to issuing banks. Instead, Visa facilitates the processing of card payments through its network, charging a fee for each of the millions of transactions daily. The company’s moat stems from a robust network effect. As more consumers possess Visa-branded cards, it becomes increasingly advantageous for businesses to accept them, resulting in minimal competition and consistent growth in revenue, profits, and free cash flow.

V Revenue (Quarterly) data by YCharts.

A significant factor in Visa’s success is the shift away from cash and checks toward credit and debit cards. These cards offer convenience, allowing individuals to carry substantial amounts of money digitally. In addition, a lost debit card can be quickly locked, ensuring greater security compared to cash theft.

This trend favoring digital payments presents a long-term tailwind for Visa. Trillions of dollars’ worth of cash and check transactions remain globally, particularly outside the U.S., indicating Visa’s expansive potential for growth.

On the dividend front, Visa has increased its payouts an impressive 391.7% over the past decade. With a forward yield of 0.7% and a cash payout ratio of 22.6%, Visa has considerable leeway for future dividend growth. This stock is a compelling choice for both growth-oriented and income-seeking investors.

Take Advantage of This Unique Investment Opportunity

Have you ever regretted missing out on top-performing stocks? If so, this is a good time to revisit your investment strategy.

Occasionally, our team of analysts identifies substantial investment opportunities, issuing a “Double Down” recommendation for stocks they project will surge in value. If you’re concerned about having missed your chance, now could be the ideal moment to invest, as the data supports this view:

- Nvidia: Investing $1,000 during our double down alert in 2009 would yield $286,347!*

- Apple: An investment of $1,000 from our 2008 recommendation would be worth $42,448!*

- Netflix: If $1,000 was invested from our 2004 double down alert, it would now be $504,518!*

Currently, we have “Double Down” alerts for three incredible companies, and they may not present a comparable opportunity soon.

Continue »

*Stock Advisor returns as of April 1, 2025

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Visa. The Motley Fool has a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.