Smart Long-Term Investments: Two Consumer Giants to Consider

If you’re on the hunt for consumer goods stocks that you can hold onto for years, it’s crucial to choose companies that are established leaders and have a track record of being adaptable. Over time, new challenges and competition will inevitably arise, making adaptability essential for long-term success.

In the consumer goods sector, two companies stand out for their ability to evolve and excel, making them suitable options for long-term investment.

Start Your Mornings Smarter! Get Breakfast news delivered daily to your inbox every market day. Sign Up For Free »

1. Amazon (NASDAQ: AMZN)

One of the most innovative and adaptable companies over the past 25 years has been Amazon. Starting as an online bookstore, the company evolved into a massive online marketplace selling various products.

Today, Amazon’s marketplace not only offers consumer goods but is also a major player in digital advertising, ranking third in the U.S. behind Meta Platforms and Alphabet. Much of this ad revenue comes from sponsored ads on its platform and its Prime Video service.

Simultaneously, the company has developed a sophisticated logistics network and is leveraging artificial intelligence (AI) to improve efficiency in warehouses, customer recommendations, and seller support on its website.

Image source: Getty Images.

Amazon’s most lucrative segment is its cloud computing arm, AWS. Initially born from the need to support partners with data center setups, AWS has now positioned itself as a leader in the AI space, offering foundational models and solutions like Bedrock and SageMaker to clients.

Over the years, Amazon has shown a willingness to invest heavily to enhance its operations. It remains a compelling stock for long-term investors.

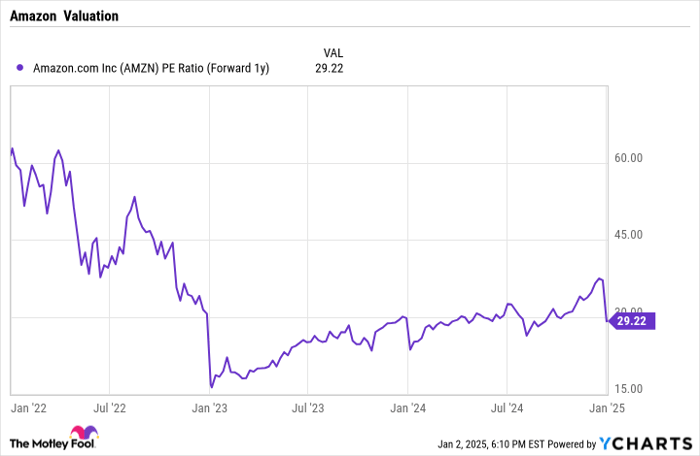

Currently, Amazon’s stock trades at a forward price-to-earnings (P/E) ratio of about 29, based on estimates for 2025—lower than historical averages.

AMZN PE Ratio (Forward 1y) data by YCharts

2. Walmart (NYSE: WMT)

Walmart became the largest retailer in the world through smart adaptations, especially following Amazon’s rise in e-commerce. Instead of simply battling Amazon for general merchandise, Walmart strategically shifted focus towards groceries.

This daring pivot was made even more impressive considering that groceries generally have lower profit margins. Yet, Walmart’s extensive store presence allowed it to become the largest grocery seller in the U.S. Its size and purchasing power provided customers with competitive prices, increasing foot traffic and sales of higher-margin products.

Walmart has also enhanced its logistics to compete directly with Amazon. With stores accessible to 90% of the U.S. population within 10 miles, it has introduced same-day grocery delivery and launched a paid membership program that provides free same-day delivery for groceries, benefiting various product categories.

This convenience strategy has attracted wealthier clientele, and drawing inspiration from Amazon, Walmart has invested in its own advertising capabilities, reaching customers online and in-store. The company is even venturing into same-day pharmacy deliveries to capitalize on current industry pressures.

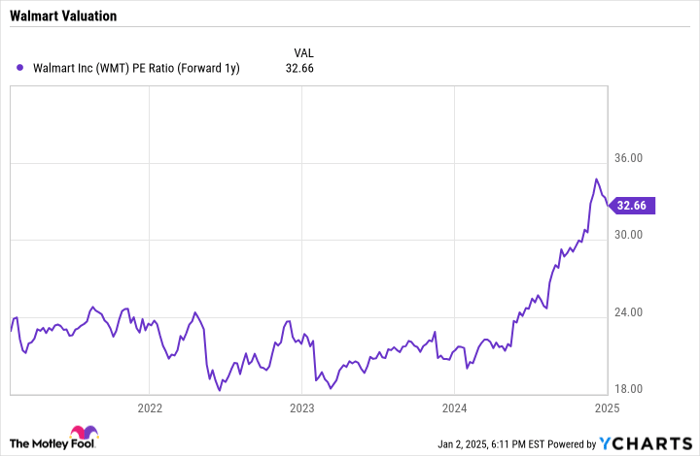

Walmart’s stock now has a forward P/E ratio just under 33, reflecting a rise beyond historical norms.

WMT PE Ratio (Forward 1y) data by YCharts

Despite its valuation, Walmart combines defensive and growth attributes, showcasing a remarkable adaptability that bodes well for its stock over time.

Investment Considerations for Amazon

Before investing in Amazon, consider this:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks for investors to buy right now, and notably, Amazon is not on that list. The selected stocks have strong potential for significant returns in the near future.

For example, when Nvidia was recommended on April 15, 2005, a $1,000 investment at that time would be worth $885,388 today!*

Stock Advisor provides investors with straightforward strategies for success, including portfolio-building guidance, frequent analyst updates, and new stock recommendations each month. This advisory service has more than quadrupled the returns of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Randi Zuckerberg, an ex-director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also a board member. Geoffrey Seiler has positions in Alphabet. The Motley Fool recommends and holds positions in Alphabet, Amazon, Meta Platforms, and Walmart. For more details, please review The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.