Utilities Sector Highlights Opportunities in Oversold Stocks

Identifying the most oversold stocks in the utilities sector reveals potential buying opportunities for investors looking to acquire undervalued companies.

The Relative Strength Index (RSI) serves as an important momentum indicator that compares a stock’s performance on days when its price rises against days when it falls. This comparison helps traders gain valuable insight into how a stock might behave in the short term. According to Benzinga Pro, a stock is considered oversold when its RSI falls below 30.

Here’s an overview of the latest major oversold players in the utilities sector, each with an RSI near or below 30.

Sunnova Energy International Inc NOVA

- On April 11, Sunnova announced the appointment of two independent directors. The company’s stock has dropped approximately 44% over the past month, with a 52-week low of $0.18.

- RSI Value: 22.4

- NOVA Price Action: Shares of Sunnova Energy fell 18.3% to close at $0.19 on Wednesday.

- Edge stock ratings reflect a momentum score of 0.61 and a value score of 87.80.

Pure Cycle Corp PCYO

- On April 9, Pure Cycle reported revenues of $4.0 million for the three months ending February 28, and $9.7 million for the six months. CEO Marc Spezialy stated, “Despite typical winter slowdowns, Pure Cycle maintained positive net income in the quarter, leveraging its robust balance sheet and diversified asset portfolio. Our earnings showcased the strength of our oil and gas royalty portfolio and our water and wastewater infrastructure through tap sales.” The company’s stock has declined about 7% in the past month, reaching a 52-week low of $8.94.

- RSI Value: 19.7

- PCYO Price Action: Shares of Pure Cycle fell 0.1% to close at $10.00 on Wednesday.

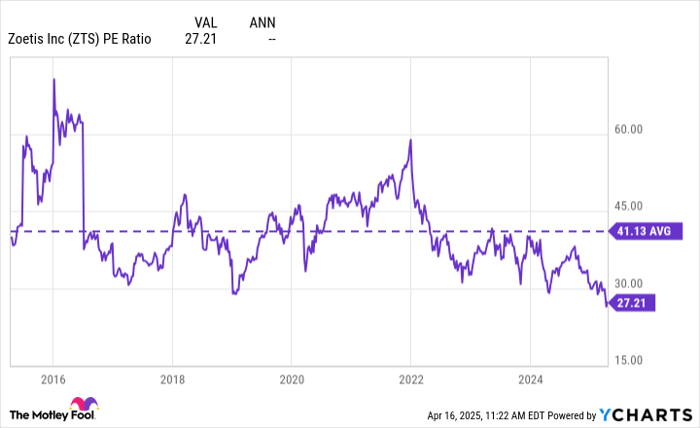

- Benzinga Pro’s charting tool has effectively identified trends in PCYO stock.

For additional information on BZ Edge Rankings, click here to access scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs