In a dramatic financial showdown, Tyler Technologies, Inc. TYL has reported fourth-quarter 2023 non-GAAP earnings of $1.89 per share, surpassing the Zacks Consensus Estimate of $1.86. The bottom line showed visible resilience, climbing above the year-ago quarter’s earnings of $1.66 per share.

The non-GAAP revenues experienced a 6.3% annual increase, amounting to $480.9 million. However, this number fell short of the Zacks Consensus Estimate, which stood at $483.3 million.

The Turning Tide

The top-line growth witnessed a swell, primarily attributed to the rising subscription revenues. Tyler Technologies, Inc. continued its metamorphosis into a software-as-a-service model from its traditional on-premise license-based approach. This change was evident in the fact that software subscription arrangements accounted for approximately 89% of the total new software contract value during the fourth quarter.

Anatomy of Quarterly Details

Tyler’s recurring revenues from maintenance and subscriptions experienced a substantial 7.9% annual growth, reaching $403.6 million and comprising 83.9% of the total quarterly revenues. On a non-GAAP basis, the company reported annualized recurring revenues of $1.61 billion, marking a vigorous 7.9% increase from the previous year.

Segment-wise, the numbers danced to a different beat. Maintenance revenues (accounting for 24.4% of total revenues) slightly crept up to $117.5 million, while subscription revenues (59.5% of total revenues) morphed into $286.1 million, exhibiting an 11.4% annual growth. Software licenses and royalties stagnated at $7.6 million, and professional services revenues experienced a 3.7% decline, amounting to $61.5 million. Hardware and other revenues, on the other hand, boomed, climbing 21.5% from the year-ago quarter to reach $8.2 million.

Operating Resilience

Tyler’s non-GAAP gross profit saw a remarkable 8.4% year-over-year increase, amounting to $229.1 million, while the non-GAAP gross margin mounted by 90 basis points to reach 47.6%. Adjusted EBITDA mirrored this trend, ascending 7.4% to $117.9 million. The non-GAAP operating income for the quarter totaled $107.4 million, marking a robust 9.7% increase from the previous year.

Fortunes in the Financial Minefield

The company’s cash and cash equivalents stood at $165.5 million as of December 31, 2023, in contrast to $131.4 million on September 30, 2023. Significantly, Tyler generated operating cash flow of $147.4 million and free cash flow of $134.4 million in the fourth quarter. The company’s robust free cash flow is channeled into reducing debt, and in the fourth quarter of 2023, Tyler made substantial strides, slashing its term debt by $90 million.

Peering into the Future

Tyler Technologies has initiated annual guidance for 2024, foreseeing revenues in the range of $2.095-$2.135 billion. The company also predicts adjusted earnings guidance within the range of $8.90-$9.10 per share, hinting at a promising year ahead.

Zacks Rank & Stocks to Watch

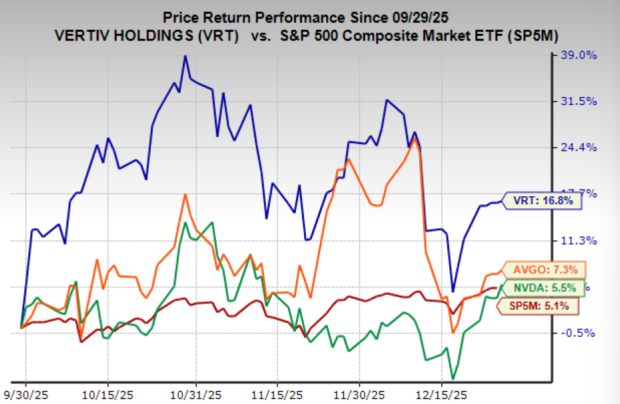

While Tyler Technologies currently carries a Zacks Rank #3 (Hold), its shares have experienced a healthy 34.8% surge over the past year. For investors seeking alternative prospects, top-performing stocks in the broader technology sector include CrowdStrike Holdings CRWD, Amazon.com AMZN, and NVIDIA Corporation NVDA. CrowdStrike and Amazon are currently basking in the Zacks Rank #1 (Strong Buy), while NVIDIA wears the Zacks Rank #2 (Buy).

It’s apparent that the tides of finance are ever-changing. Through the stormy seas, Tyler Technologies has displayed both triumph and tribulation. As investors navigate these financial waters, the company’s Q4 earnings report paints a vivid picture of a company forging ahead in a dynamic market.

Will Tyler Technologies weather the challenges ahead? Can the company build upon its successes and overcome its setbacks? For now, the story of Tyler’s Q4 earnings is an intriguing chapter in the annals of business, one that shimmers with both hope and challenge.