Imagine a horror movie scene: a masked figure with a sharp weapon. Not a comforting sight, right? It’s a bit like the eerie mood pervading the economic landscape today. The U.S. money supply is dwindling at rates unseen since the Great Depression. Should investors brace themselves for an approaching storm?

Image source: Getty Images.

Peering into the Past

Money supply, a key economic indicator, is under the microscope. Economists track M1 and M2, the two primary measures. M1 includes cash and easily accessed funds while M2 encompasses M1 plus short-term deposits. In over 154 years, instances where M2 shrank significantly, like in 1878, 1893, and the grim years of 1931-1933, heralded depressions and soaring unemployment rates. A harbinger of stock market woes.

The Present State of M2 Money Supply

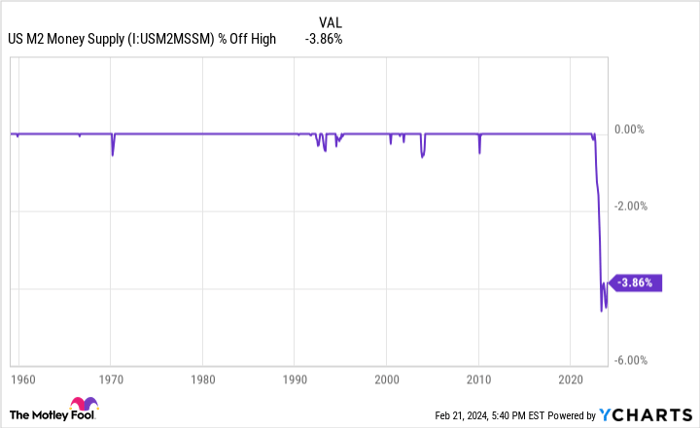

Fast forward to now. M2 money supply is contracting at levels reminiscent of the Great Depression years. While the current drop of nearly 4% pales compared to the 30% nosedive back then, it’s double the decline of 1921. Scarier still, when money is tight, consumer spending and investments plummet, fostering the dreaded specter of deflation.

US M2 Money Supply data by YCharts

On the Bright Side?

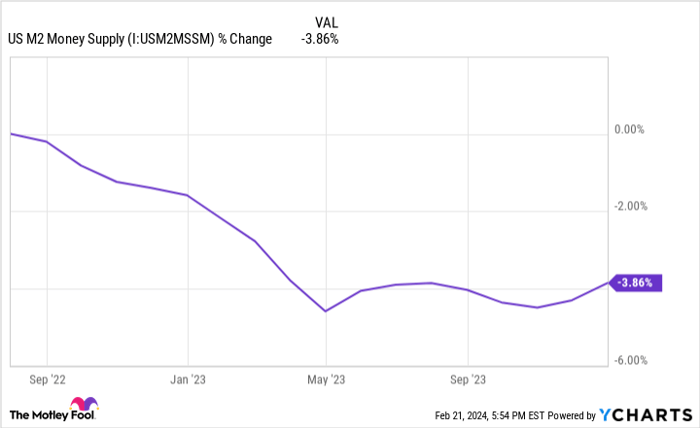

Is an economic doomsday nigh with M2 plunging like it’s 1933? Probably not. Recent months suggest M2 might be stabilizing, hinting at a reprieve from the turmoil of the past following such declines. Why the optimism? Cash is passé; plastic and e-wallets reign. Some believe M2’s crystal ball is murky, with history not a reliable soothsayer.

US M2 Money Supply data by YCharts

Worried? Not quite. According to Goldman Sachs economist Manuel Abecasis, the shrinking M2 might stave off a recession by taming inflation. So, ride out the storm; the silver lining might gleam brighter than anticipated.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the Motley Fool’s Stock Advisor has outshone the market for over a decade.*

They recently unveiled the 10 best stocks ripe for investment right now.

See the 10 stocks

*Stock Advisor returns as of February 20, 2024

Suzanne Frey, an executive at Alphabet, sits on The Motley Fool’s board of directors. Keith Speights holds positions in Alphabet, Apple, and PayPal. The Motley Fool has stakes in Alphabet, Apple, Goldman Sachs Group, and PayPal. The Motley Fool recommends short March 2024 $67.50 calls on PayPal. The Motley Fool adheres to a stringent disclosure policy.

The opinions expressed are solely those of the author and not indicative of Nasdaq, Inc.