The U.S. government has instructed Taiwan Semiconductor Manufacturing Co. (TSMC) to halt the supply of advanced AI chips to China, effective immediately. This directive specifically targets TSMC’s 7-nanometer chips and smaller designs intended for AI accelerators and GPUs (graphics processing units) in China. TSMC has stated that it will comply with all domestic and international export controls.

U.S. Commerce Department Enforces Stricter Export Regulations

The U.S. Department of Commerce issued this order after TSMC discovered that one of its chips had been utilized in a Huawei processor, which appears on the restricted trade list. This type of communication, known as an “informed letter,” allows the administration to impose licensing requirements quickly without lengthy regulations.

Chip manufacturers must acquire special licenses before exporting any technology or AI products to companies like Huawei that are on the restricted list. Following this rule, TSMC also ceased supplying chips to another Chinese chip designer, Sophgo, after identifying the materials as similar to those used in Huawei products.

The Commerce Department is keen on investigating how advanced chips are reaching Huawei, as this could signify a breach of export laws. Previously, chipmakers, including Nvidia (NVDA) and Advanced Micro Devices (AMD), received similar orders from the Department to stop providing advanced technology to China. These measures are part of the U.S. strategy to prevent Chinese military and other entities from utilizing advanced technologies that could enhance their warfare capabilities.

Understanding Market Perspectives on TSMC

TSMC continues to play a critical role in the AI industry as one of the leading chip manufacturers. Despite the rising demand for advanced AI technology, TSMC faces challenges with its export capabilities to one of the world’s largest consumer markets.

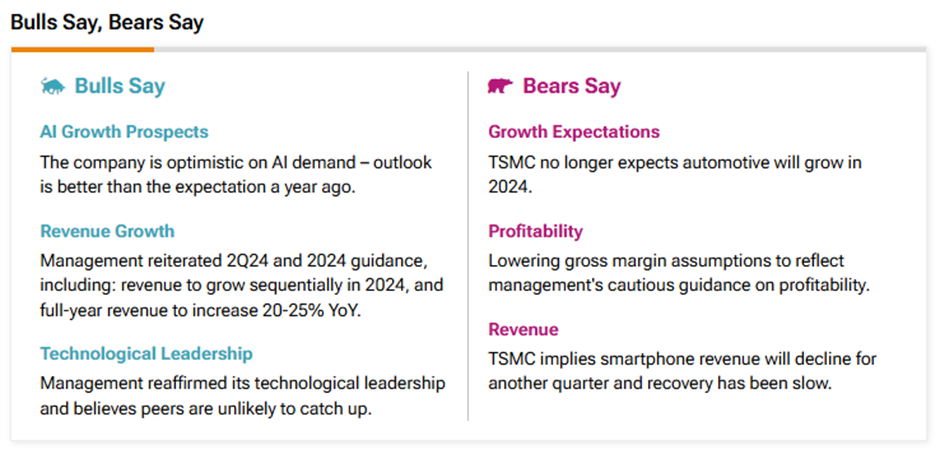

Using TipRanks’ Bulls Say, Bears Say tool, analysts show a divide in perspectives regarding TSMC. Some are optimistic about the demand and the management’s commitment to maintaining its industry leadership.

Conversely, others express concerns over stagnant growth in the automotive sector, declining gross margins, and a sluggish recovery in the smartphone market.

Evaluating TSM Stock: Is it Worth Investing in?

In spite of the current obstacles, TSMC stock has received a unanimous Buy rating from five analysts, resulting in a Strong Buy consensus rating on TipRanks. The average price target for Taiwan Semiconductor Manufacturing Co. is $205, suggesting a 1.9% potential upside from current prices. So far this year, TSM shares have skyrocketed by 95.1%.

See more TSM analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.