Despite a remarkable feat of scaling in both the ridesharing and food delivery realms,Uber Technologies (NYSE:UBER) looks on the brink of achieving an accurate valuation, with the stock having more than doubled over the past year.

Corporate Overview

Uber operates in three core segments: Mobility, Delivery, and Freight. The Mobility arm facilitates passenger transportation through various modes, including ridesharing, carsharing, taxis, public transport, and rentals, across numerous international cities.

On the other hand, the Delivery segment provides same-day delivery services from restaurants, grocery stores, convenience stores, and other retailers via Uber Eats, Postmates, Drizly, and Cornershop. Lastly, the Freight segment connects shippers and carriers through a digital marketplace, primarily in North America and Europe.

Chances & Challenges

Following the resurgence of leisure and corporate travel and the gradual return to office dynamics, Uber’s Mobility business experienced a remarkable upturn in 2023, eventually reverting to pre-pandemic volume and frequency levels, thereby bolstering margins.

Looking forward to 2024, the company envisions several opportunities to sustain growth within its Mobility segment. Expansion into under-penetrated international markets, as well as the introduction of new offerings like Reserve, hailables, Uber for Business, and Shared Rides, are set to be pivotal drivers of growth.

Moreover, Uber is keen on enhancing the driver-side experience through product innovation and operational improvements, having added over 1 million drivers to its platform and witnessed a 32% surge in active Mobility drivers in Q3.

In the Delivery segment, the focus remains on cost reduction and margin improvement, with an emphasis on affordability, variety, and precise deliveries in the food delivery business. The company is also eyeing expansion into grocery, convenience, and alcohol deliveries, while also pushing the Uber One subscription service.

Furthermore, the potential long-term impact of autonomous vehicles cannot be overlooked. Although still in its infancy, the elimination of drivers could significantly enhance margins, given Uber’s modest take rate for Mobility and Delivery in Q3.

However, it is imperative to acknowledge the macroeconomic risks that could thwart Uber’s progress, such as a potential economic downturn affecting leisure and corporate travel. Price competition from rivals and the specter of government regulations also present challenges on the horizon.

The Meteoric Rise and Uncertain Future of UBER

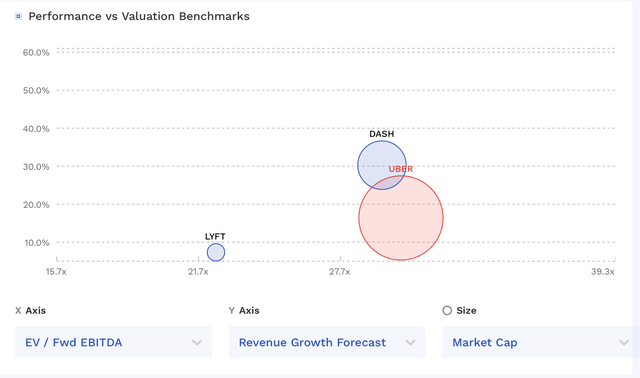

When considering the future of UBER, investors are met with a multitude of factors to analyze. The valuation of the company stands out as a key point of discussion. At a multiple of 21.4x adjusted EBITDA based on 2024 analyst estimates of $5.95 billion, UBER seems to be trading at a relatively high valuation. However, when considering the 2024 consensus of $8.1 billion, the stock trades at a 15.7x multiple, presenting a different perspective on the company’s worth. On a PE basis, the stock trades at 73x the 2024 consensus of $1.97 and x the 2025 consensus of $2.65. With projected revenue growth of 15.5% in 2024 and 15.9% in 2025, the valuation becomes a point of contention among investors.

Comparison with industry peers further complicates the valuation picture. UBER’s trading at a similar valuation to DoorDash (DASH) but at a substantial premium to Lyft (LYFT). Such comparisons create a web of uncertainty around UBER’s true market worth.

In a bold valuation move, considering the growth and scaling of its business, some analysts propose to value UBER between 15-20x multiple on 2025 EBITDA. This valuation presents UBER’s stock between $57-$77, with a midpoint of $67, triggering a wave of speculation and debate within the investor community.

The Road Ahead

UBER has carved out a formidable position in the ridesharing and food delivery markets, harnessing economies of scale that position it as a market leader. As it treads ahead, the company’s margins are anticipated to continue expanding, further fortifying its position. Moreover, UBER is fueled by a plethora of growth initiatives that are projected to propel its trajectory skyward in the coming years, promising a wave of opportunity for investors. With its recent inclusion in the S&P 500, UBER also opens itself up to a new spectrum of investors, underlining its ever-evolving landscape.

While the future seems bright for UBER, the present paints a different picture. The stock appears to be perched at a point of equilibrium in terms of its valuation. Although there exists potential upside towards the high end of the fair value range, the forecast remains modest, particularly in comparison to the midpoint of $67. This tepid outlook compels a “Hold” rating for the stock, with a preference to await a pullback to around $50 before considering a buy-in.