Uber Halts $950 Million Acquisition of Foodpanda Amid Regulatory Issues

Uber Technologies UBER has officially ended its agreement to acquire Delivery Hero’s Foodpanda business in Taiwan, which was valued at $950 million. The termination stemmed from regulatory challenges, as Taiwan’s authorities had previously blocked the deal in December due to anti-competitive concerns.

Taiwan’s Concerns About Market Competition

The Taiwan Fair Trade Commission expressed worries that if Uber, through its Uber Eats division, were to acquire Foodpanda, the joint market share of the two services would skyrocket to 90% on the island. Such dominance could lead to higher prices for consumers. Currently, Foodpanda and Uber Eats hold a duopoly over Taiwan’s food delivery market, commanding significant order volumes.

Financial Implications of Terminating the Deal

Uber has opted not to challenge the ruling from Taiwan’s anti-trust regulator. Consequently, Uber will incur a termination fee of approximately $250 million. This deal was first announced in May of the previous year and included an agreement for Uber to purchase $300 million in new shares from Delivery Hero. However, the cancellation of the acquisition will not impact this share-purchase agreement.

Uber’s Continued Commitment to Taiwan

Despite disappointment regarding the regulatory decision, Uber’s choice to forgo an appeal should not adversely affect its operational strategy. The company remains dedicated to serving its clients, merchants, and delivery partners in Taiwan. Currently, Uber Eats and Foodpanda are poised to continue leading the online food delivery sector, while smaller competitors hold minimal market share. The post-pandemic environment has seen Asian food delivery platforms facing fierce competition and tight profit margins as they offer discounts to attract budget-conscious customers.

Recent Stock Performance and Market Challenges

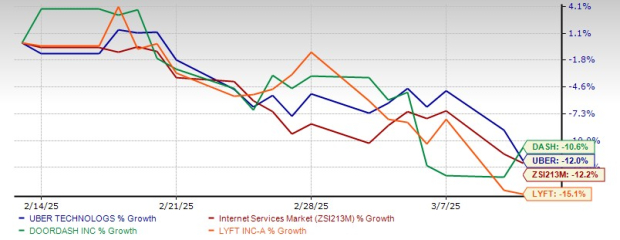

While the decision to abandon the Foodpanda deal is unlikely to harm UBER’s stock, it remains fact that UBER shares have recently faced challenges. The stock has dropped by 12% over the past month, underperforming others in the Zacks Internet—Services sector, including DoorDash DASH. Yet, Uber’s performance remains better than industry averages and its rival, Lyft LYFT.

1-Month Price Comparison of UBER Stock

Image Source: Zacks Investment Research

Impact of Tariffs on UBER Stock

Concerns regarding the ongoing trade tensions, particularly with tariffs imposed by the Trump administration on goods from Canada, Mexico, and China, are adversely affecting UBER shares. The imposition of trade restrictions has heightened fears of a broader economic slowdown, posing further risks for Uber, which operates globally. Recent U.S. market volatility attributed to trade uncertainties and fears of economic deceleration may also impede Uber’s growth, especially as they anticipate currency-related challenges in gross bookings for early 2025.

Estimating UBER’s Future Performance

In recent weeks, UBER’s earnings per share estimates have declined for the first two quarters of 2025 as well as for the full years 2025 and 2026.

Image Source: Zacks Investment Research

Concerns Over UBER’s Debt Levels

Another area of concern is Uber’s substantial debt. Long-term debt surged by 45.6% to $8.3 billion at the end of 2024 compared to figures in 2019.

Image Source: Zacks Investment Research

Evaluating UBER’s Valuation

Currently, UBER shares are considered expensive. A Value Score of C indicates a high valuation at present. The stock trades at a forward price-to-earnings ratio of 25.96, significantly exceeding the industry average of 18.6.

Image Source: Zacks Investment Research

Conclusion

As discussed, UBER is currently facing a variety of challenges. Nonetheless, the company’s underlying fundamentals remain robust. Diversification is vital for large corporations, and UBER has adeptly navigated this by broadening its service offerings through strategic acquisitions and innovations. Sound investments allow Uber to enhance its service quality and reach.

Uber’s Confidence Reinforced by $1.5 Billion Buyback Program

Earlier this year, Uber announced an accelerated $1.5 billion stock buyback program, which reflects its commitment to shareholders and reinforces its confidence in its ongoing business strategy. This bold move highlights Uber’s proactive approach in strengthening its financial standing.

Positioning Against Competitors

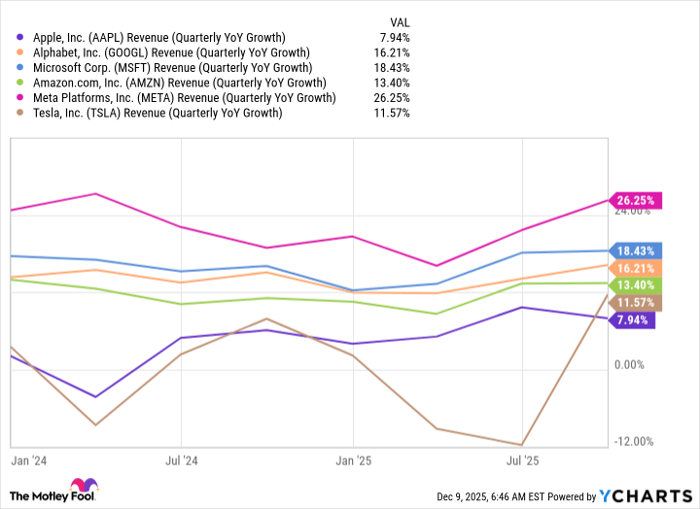

Uber’s recent partnership with NVIDIA (NVDA) has strategically positioned the company as a serious competitor to Tesla (TSLA) in the promising robotaxi market. With its extensive network of drivers and customers, Uber is well-equipped to rapidly scale autonomous services once the necessary technology is fully developed.

Positive Outlook for Investors

Considering these favorable factors, it is reasonable to conclude that Uber, currently holding a Zacks Rank #2 (Buy), represents an excellent addition to investment portfolios. For those interested in monitoring high-potential stocks, a complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be found here.

Five Stocks Primed for Growth

Experts at Zacks have identified five stocks with the potential to double in value. Each stock has been carefully selected as a top choice to achieve gains of +100% or more in 2024. Historical performance of previous recommendations shows increases of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of the stocks in this report are not widely known on Wall Street, creating an excellent opportunity for investors to enter at an early stage.

To learn more about these five promising candidates, see the details today >>

For more investment insights from Zacks Investment Research, you can download the report titled “7 Best Stocks for the Next 30 Days.” Click here to access this free resource.

NVIDIA Corporation (NVDA): Free stock analysis report

Tesla, Inc. (TSLA): Free stock analysis report

Lyft, Inc. (LYFT): Free stock analysis report

Uber Technologies, Inc. (UBER): Free stock analysis report

DoorDash, Inc. (DASH): Free stock analysis report

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.