Uber Technologies has announced its decision to close its Alcohol Delivery Service, Drizly. This move by the ride-hailing company is aimed at refocusing on its core Uber Eats business that brings almost anything within reach through a single app. Cybersecurity concerns may have also influenced Uber’s decision, following a security breach in 2020 that exposed the information of around 2.5 million customers.

Back in 2021, Uber had acquired Drizly for $1.1 billion in cash and stock. Post acquisition, Drizly’s marketplace was integrated with the Uber Eats app, alongside a standalone Drizly app. Drizly currently operates in over 1,400 cities across the United States.

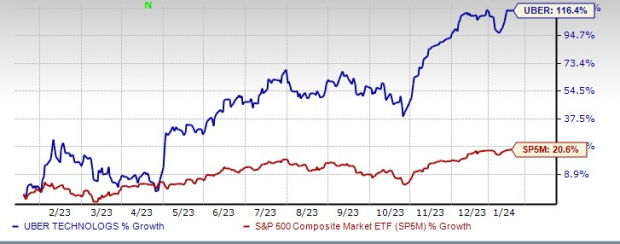

Price Performance

Recently added to the S&P 500 Index, Uber’s shares have surged by 116.4% in the past year, outperforming the S&P 500’s growth of 20.6%.

Image Source: Zacks Investment Research

Diversification is crucial for large companies to mitigate risks, an area in which Uber has excelled. Despite its primary focus on ride-sharing, the company has strategically diversified into food delivery and freight over time.

Zacks Rank

Presently, Uber holds a Zacks Rank #2 (Buy).

Other Key Picks

Investors eyeing the same industry may also consider Lyft and Akamai Technologies, each currently holding a Zacks Rank of 2. You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lyft is benefiting from the growth in the ride-share market, with management anticipating a mid-single-digit quarterly revenue increase in the fourth quarter. The Zacks Consensus Estimate for LYFT’s current-year earnings has improved by 52.8% over the past 60 days.

Akamai is witnessing robust net sales growth, driven by healthy demand in multiple end markets. The Zacks Consensus Estimate for AKAM’s current-year earnings has improved by 0.5% over the past 60 days, with the company exceeding earnings estimates in each of the last four quarters.

Uber’s move to shut down Drizly reflects its strategic initiative to streamline its focus and resources, aiming for a stronger position in its core business. It highlights the company’s adaptive nature, as it prunes areas of non-performance, similar to a skilled gardener pruning dead vines to allow the healthy ones to thrive and blossom.

While Uber’s decision to shut down Drizly may disappoint some investors, it also signals the company’s commitment to optimizing its operations and focusing on high-growth areas. The move aligns with Uber’s endeavor to streamline its business and bolster its position in the fiercely competitive market, akin to a master chess player making deliberate sacrifices to secure a dominant position on the board.

The decision also demonstrates Uber’s resilience and adaptability in responding to cybersecurity challenges and enabling the company to better allocate resources and drive sustainable long-term growth.

As investors adjust their positions in response to Uber’s reorganization, they may find comfort in the company’s ability to pivot strategically, similar to a seasoned sailor adjusting sails to navigate changing winds and retain a strong course.

Uber’s move to shut down Drizly represents a significant strategic shift, signaling the company’s determination to focus on its core business and optimize its operations. This bold move reflects the company’s commitment to sustainability and profitability, embarking on the quest for a leaner and more agile organization, akin to a master sculptor chiseling away excess stone to reveal a refined and elegant masterpiece.

Through this calculated move, Uber aims to concentrate its resources and efforts on high-potential growth areas, similar to a gardener carefully tending to select blossoms to nurture their full potential. By strategically refocusing its business, Uber seeks to solidify its position in the marketplace and drive sustainable value creation, evoking the image of a seasoned general consolidating forces to secure a decisive victory on the battlefield.