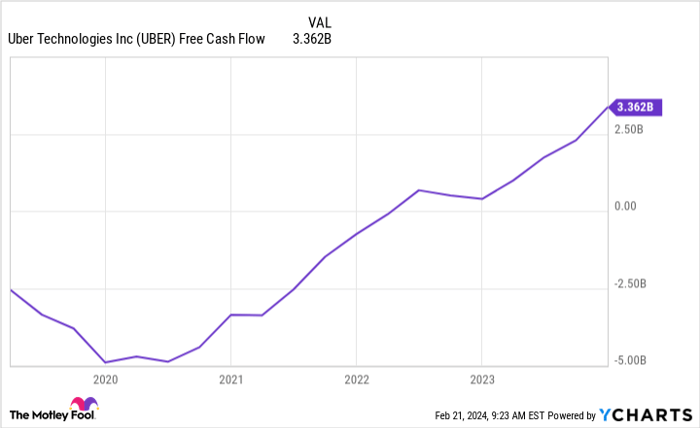

All investments require thorough research, but sometimes conclusions can be misleading. In 2019, the forecast for Uber Technologies (NYSE: UBER) seemed dire, destined to remain a cash-burning venture draining investors. Fast-forward to 2023, Uber flipped the script, generating a staggering $3.4 billion in free cash flow. This financial feat wasn’t just a facade – Uber’s financial health across various metrics proved solid. The journey didn’t stop there as Uber’s 2023 cash flow set a historic record, showcasing consistent growth over the years.

In my skepticism towards Uber, I also dismissed the entire third-party delivery industry, including industry player DoorDash (NASDAQ: DASH). However, Uber’s transformation prompted a reconsideration of DoorDash’s potential to replicate a similar financial evolution.

Let’s delve into Uber’s drastic cash-flow turnaround and how DoorDash is positioned to emulate this success.

Revolutionizing Cash Flow: Uber’s Triumph

Upon its 2019 IPO, Uber’s spending habits were spiraling out of control. For instance, the company allocated a massive $4.8 billion towards research and development, a staggering 70% of its gross profit. These ventures included ambitious projects like an electric flying taxi service, which failed to materialize. Over time, Uber course-corrected by slashing unnecessary expenses, including divesting from unfruitful investments. By mid-2022, this newfound operational discipline paved the way for positive cash flows. The subsequent introduction of digital advertising in 2022 further bolstered Uber’s cash flow, as evidenced by a notable spike in net income.

The key takeaway here is Uber’s shift towards prudent financial management and the identification of high-margin revenue streams that propelled its cash flow to unprecedented levels.

DoorDash’s Path to Prosperity

In 2023, DoorDash demonstrated its potential by generating $1.3 billion in free cash flow, hinting at a promising trajectory akin to Uber’s transformation. A closer look reveals that DoorDash’s management embraced discipline, akin to Uber’s turnaround. The company focused on boosting gross profit faster than revenue growth, a strategy that contributed to its remarkable cash flow figures.

Eyeing 2024, DoorDash’s management emphasizes the need for innovation to introduce new products and services. Following in Uber’s footsteps, DoorDash is exploring the realm of digital advertising within its platform. While DoorDash’s user base is more modest compared to Uber’s, the company’s commitment to operational excellence and the development of high-margin revenue streams positions it as a potential future cash-flow powerhouse. If current trends persist, DoorDash’s record-breaking 2023 cash flow could be a precursor to sustained financial success in the years ahead.

Reflecting on Uber and DoorDash’s transformations underscores the importance of reevaluating investment prospects. As both companies evolve positively, investors stand to benefit from their newfound financial prowess.

Considering an investment in DoorDash?

Before making any decisions, it’s crucial to note that the Motley Fool Stock Advisor team has identified the top 10 stocks for potential monster returns, with DoorDash not featuring on the list. Their robust track record in outperforming S&P 500 returns since 2002 underscores the value of their insights. Investors seeking comprehensive guidance and promising stock picks may find Stock Advisor a valuable resource.

Explore the 10 recommended stocks for potential growth today.

*Stock Advisor returns as of February 20, 2024

Jon Quast holds no position in the stocks mentioned. The Motley Fool has positions in and recommends DoorDash and Uber Technologies. The Motley Fool maintains a disclosure policy.

The views expressed herein belong to the author and do not necessarily align with Nasdaq, Inc.’s views and opinions.