The future looks bright for Uber Technologies (NYSE:UBER) as the new average one-year price target soars to $86.97 per share, marking a significant 27.11% climb from the previous estimate of $68.42 back in January 16, 2024.

The price target, a collective analysis of numerous expert forecasts, now ranges from a low of $65.65 to an impressive high of $105.00 per share. This uptick represents an 11.45% increase from the most recent closing price of $78.03 per share.

Market Sentiment Overview

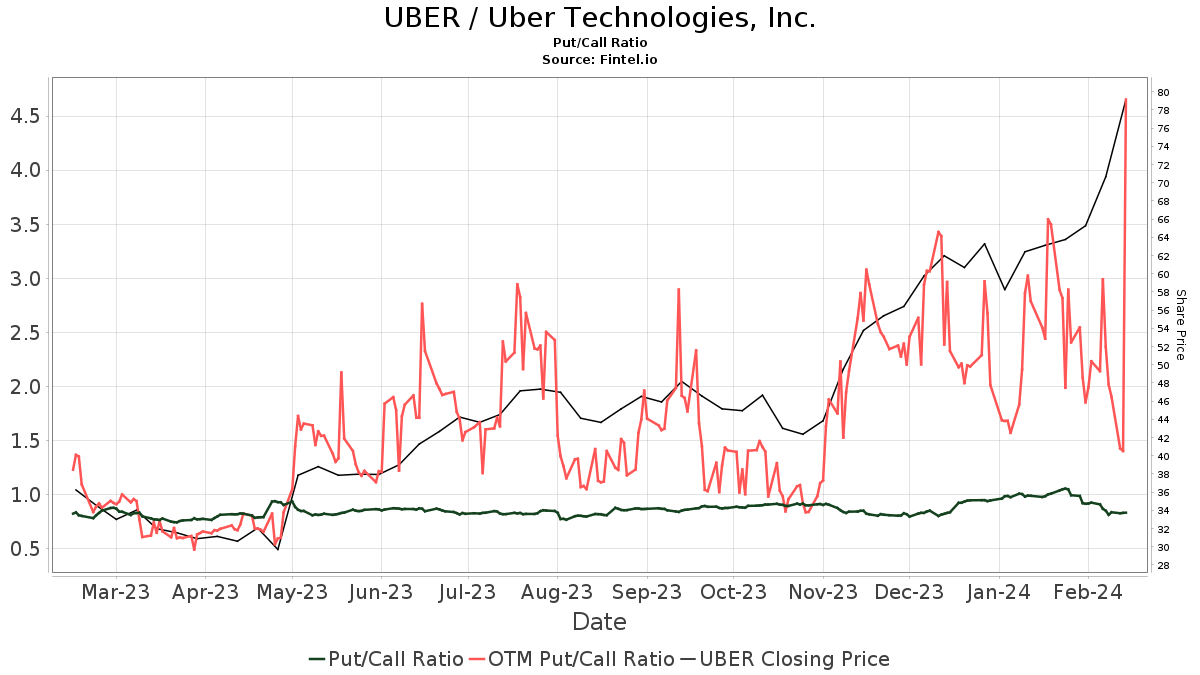

With a noticeable increase of 221 owners or 10.24% in the last quarter, a total of 2,379 funds or institutions are reporting positions in Uber Technologies. The average portfolio weight allocated to UBER by all funds sits at 0.76%, depicting a modest decrease of 8.08%. Moreover, institutional ownership has seen an 8.63% surge in the last three months, totaling 1,997,842K shares.  The current put/call ratio for UBER stands at 0.87, signaling an optimistic market outlook.

The current put/call ratio for UBER stands at 0.87, signaling an optimistic market outlook.

Institutional Holdings Overview

Exciting news from institutions like Jpmorgan Chase, with 86,060K shares constituting 4.14% of ownership. The recent filing showed a decrease from 88,045K shares, reflecting a 2.31% reduction. However, the firm’s portfolio allocation for UBER grew by 13.96% in the previous quarter.

Other noteworthy shareholders include Public Investment Fund, holding 72,841K shares (3.51% ownership) with no changes in the last quarter, and VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, owning 60,433K shares (2.91% ownership). The Vanguard Fund boosted its UBER holding by 0.76%, showcasing an 11.42% increase in portfolio allocation over the previous quarter.

The detailed picture includes Wellington Management Group Llp holding 46,526K shares (2.24% ownership) with an 18.27% decline from the prior filing. On the contrary, AGTHX – GROWTH FUND OF AMERICA, possessing 45,068K shares (2.17% ownership), witnessed a robust 16.24% increase in their UBER holding. This fund raised its portfolio allocation for UBER by an impressive 41.23% in the last quarter.

Insight into Uber Technologies

(Provided by the company itself.)

Since its inception in 2010, Uber’s innovative mission to revolutionize mobility stands out. Commencing with a simple quest to provide convenient ride-hailing services, Uber has now completed over 15 billion trips. With a focus on enhancing urban transportation for people, goods, and services, Uber continues to shape a world of endless possibilities.

Fintel stands out as a top-tier investing research platform catering to various investors, traders, financial advisors, and small hedge funds alike.

Offering a global perspective, Fintel’s inclusive data comprises fundamentals, analyst reports, ownership insights, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Furthermore, the platform presents exclusive stock picks backed by advanced, meticulously tested quantitative models to enhance profit potential.

Curious to delve deeper into this exciting venture? Feel free to explore further.

This insightful update originally featured on Fintel.

The opinions articulated herein belong to the author and do not necessarily align with those of Nasdaq, Inc.