Comparing Uber and Grab: Which is the Better Investment Today?

Uber Technologies (UBER) and Grab (GRAB) both specialize in ride-hailing services, significantly transforming the transportation sector with their unique business models. Despite their similarities, these companies operate in different regions and adopt distinct strategies. Uber has a global presence, while Grab dominates the Southeast Asian market, providing not just ride-hailing, but also delivery and digital financial services across eight countries, including Indonesia, Malaysia, and Singapore. Although Uber focuses primarily on ride-sharing, it has gradually expanded into food delivery and freight services.

Considering these differences, let’s analyze which company currently holds an advantage and which might represent a more prudent investment at this time.

The Case for Uber

Headquartered in San Francisco, CA, Uber continues to see rising popularity in its ride-hailing and delivery platforms. This growing demand, coupled with recent growth initiatives and effective cost management, is positively influencing the company’s financial outcomes.

In its latest earnings report for Q1 2025, Uber maintained its trend of exceeding earnings expectations, showcasing resilience in the face of challenging market conditions.

Uber’s Financial Performance

For the upcoming June quarter, gross bookings are projected to be between $45.75 billion and $47.25 billion, reflecting a 16-20% growth on a constant currency basis compared to actuals from Q2 2024. This guidance incorporates a forecasted 1.5 percentage point impact from unfavorable currency fluctuations, particularly affecting the Mobility segment.

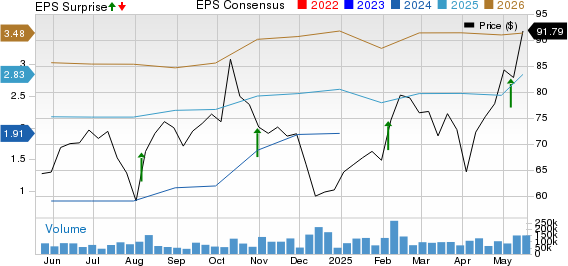

Future Earnings Expectations for Uber

Image Source: Zacks Investment Research

Uber is strategically focusing on the robotaxi market through partnerships, which allows the company to mitigate significant R&D expenses related to autonomous technology development. Additionally, Uber has engaged in various acquisitions and geographic expansion efforts, further diversifying its portfolio. The company’s initiatives in international markets provide it with valuable geographic diversification.

Uber’s buyback strategy is another positive sign. In 2024, the company reported a record $6.9 billion in free cash flow with an adjusted EBITDA of $6.5 billion. The announcement of an accelerated $1.5 billion stock buyback program indicates both a commitment to shareholders and confidence in its ongoing business strategy. This buyback is part of a broader $7 billion program announced previously.

It’s noteworthy that in 2018, Uber divested its Southeast Asia operations to Grab, retaining a substantial stake in the latter.

The Case for Grab

Grab’s success in Southeast Asia can be attributed to its ability to adjust to local market conditions. The company has evolved from a taxi-hailing app to an “everyday everything app” that provides services such as food delivery, e-scooter rentals, and digital payments.

Recently, Grab has benefited from robust growth in its On-Demand Gross Merchandise Value (GMV), expanding its fintech services and boosting user engagement across its platform. In Q1 2025, Grab’s On-Demand GMV surged 16% year-over-year. The company projects revenues between $3.33 billion and $3.40 billion in 2025, signifying a 19-22% increase from the previous year.

Grab’s Financial Position

Grab is solidifying its foothold in Southeast Asia by partnering with Amazon (AMZN) through Amazon Web Services (AWS) to enhance its mobility, delivery, and financial services. In December 2024, Grab named AWS its preferred cloud provider, allowing the company to improve operational efficiency, cut infrastructure costs, and launch new services using AWS’s scalable and secure solutions.

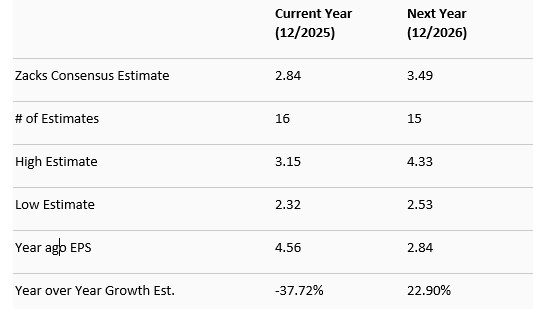

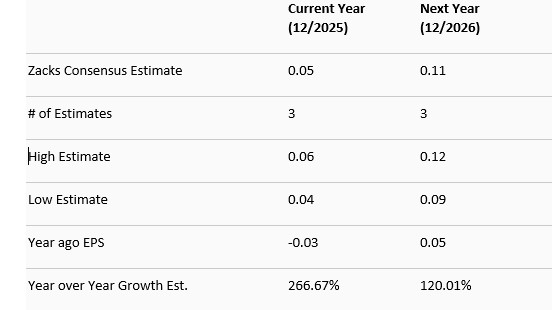

Future Earnings Expectations for Grab

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Valuation Comparison: Grab vs. Uber

Uber is currently trading at a forward sales multiple of 3.58, slightly above its 3-year median of 2.54, and holds a Value Score of D. In comparison, Grab has a Value Score of F, with a forward sales multiple of 5.78, which exceeds its median of 4.85 over the past three years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

Uber’s higher valuation relative to its historical median suggests that investors are inclined to pay a premium for this market leader in ride-hailing. The company’s diversification efforts and shareholder-focused strategies further underline its financial stability. With a market capitalization of $191.95 billion, Uber appears well-prepared to navigate uncertain market conditions.

Conversely, Grab’s limited geographic scope makes it more vulnerable to economic fluctuations affecting Southeast Asia, such as inflation and shifts in consumer behavior. Additionally, intense competition in the delivery space poses challenges for Grab, which has a market capitalization of $20.5 billion and is less generous towards shareholders compared to Uber.

Based on our analysis, Uber presents a more attractive investment opportunity than Grab, even though both companies currently hold a Zacks Rank #3 (Hold).