Uber Faces Fresh Competition from Tesla’s Robotaxi Ambitions

Uber Technologies, Inc. (UBER), a leader in the ridesharing market, is bracing for competition as Tesla (TSLA) prepares to launch its robotaxi service. While Tesla seeks to penetrate this expanding market, Uber’s existing infrastructure positions it well for sustained growth. Nonetheless, at its current valuation, Uber appears to be at a neutral investment standpoint, reflecting its anticipated growth trajectory.

Tesla’s Challenge: A Long Road Ahead

The optimism surrounding Uber’s continued growth is warranted. Given its established presence, Tesla has significant hurdles to overcome before it can pose a real threat to Uber’s operations. Tesla, recognized as the foremost electric vehicle manufacturer in the U.S., has intentions to introduce robotaxis into the ridesharing sector. During an earnings call in April, CEO Elon Musk compared Tesla’s vision to a blend of Airbnb, Inc. (ABNB) and Uber. Musk suggested that Tesla owners might rent their vehicles as robotaxis. However, the recent robotaxi launch event fell short of expectations, lacking concrete details regarding production timelines, leading many to suspect that widespread implementation is still years away.

Responses from Wall Street reflected a similar skepticism surrounding Tesla’s plans. Jefferies analyst John Colantuoni pointed out Tesla’s failure to provide credible evidence supporting its progress toward achieving Level 3 autonomous driving. This poses questions about the company’s readiness to commercialize such technology. Additionally, Colantuoni emphasized Tesla’s obstacles in building a significant fleet of autonomous vehicles, highlighting challenges in technological development, fleet management, pricing, and routing—areas where Uber holds a notable advantage. With partnerships and collaborations, Uber is better positioned to deploy autonomous taxis on a larger scale than Tesla.

Uber has already forged several key partnerships in its pursuit of autonomous vehicles. Notably, the company has collaborated with Waymo to provide autonomous ridesharing in Austin and Atlanta expected by early 2025. It has also teamed up with General Motors Company (GM) to introduce driverless taxis via Cruise. Furthermore, an investment in Wayve will allow Uber to leverage their Embodied AI technology in developing AVs. Recently announced, a new deal with BYD Company Limited (BYDDF) aims to enhance Uber’s electric vehicle fleet by 100,000 units, expanding its capabilities for autonomous rides. These strategic moves place Uber in a competitive position to roll out autonomous ridesharing well in advance of Tesla’s market entry.

Positioned for Success in Autonomous Vehicle Growth

Uber’s early initiatives in autonomous driving, combined with its dominant role in the ridesharing industry, position the company to capitalize on the anticipated growth of autonomous vehicles. Although the stock may not present significant upside at this juncture, Uber’s strategy positions it well for future success.

With its large-scale operations, Uber serves as an attractive platform for autonomous vehicle manufacturers seeking partnerships for driverless services. During its Q2 earnings report, Uber showcased its ability to efficiently connect AV fleets with riders interested in driverless options, facilitating optimal unit economics for automakers. Collaborating with an established ridesharing platform can lower operating expenses for AV developers, allowing them to prioritize advancements in their technology while leveraging Uber’s proven monetization strategies.

As Uber adopts autonomous vehicles, it stands to enhance its operational efficiency significantly. By minimizing or eliminating the need for human drivers in compliant areas, Uber may lower fares, attracting a broader user base. Additionally, AVs could contribute to food, grocery, and package delivery services, enhancing profit margins by decreasing driver-related costs.

A Bright Outlook for Uber’s Growth Potential

Several factors create a favorable environment for Uber that contribute to my optimistic long-term earnings projections, even while maintaining a neutral stock stance. Research from Fortune Business Insights suggests that the global ridesharing market could experience a solid compound annual growth rate (CAGR) of 18.5% through 2032, reaching an estimated value of $480 billion. Continued growth in smartphone usage, growing environmental awareness, and urbanization which has led to crowded roadways are significant contributors to this market expansion. Uber, as the largest player in this domain with varied offerings, is well-equipped to capitalize on these trends and translate them into favorable financial outcomes.

Additionally, Uber’s localized ridesharing options, including motorbike services in Brazil and Southeast Asia, are likely to reinforce its market leadership for the long haul.

Beyond ridesharing, Uber’s ventures into delivery services will further support its growth. Uber Eats, the company’s food delivery service, operates in over 45 countries, and its ongoing efforts to onboard more restaurant partners will enhance its market presence.

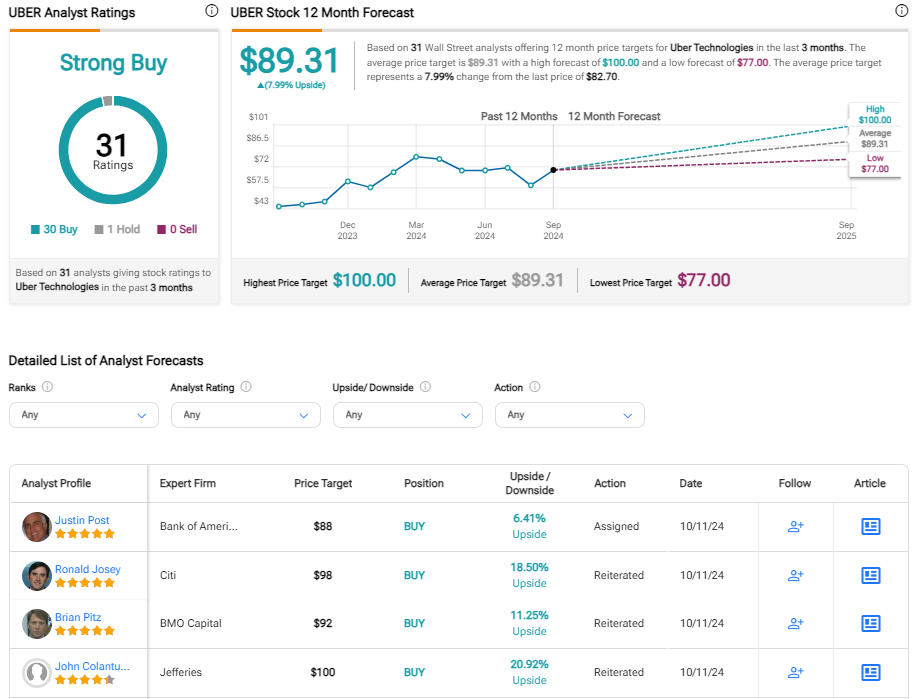

Wall Street Analysts’ Perspectives on Uber

A consensus among Wall Street analysts suggests Uber will reap the benefits of growth in autonomous vehicles. Following Tesla’s recent announcements, Bank of America’s Justin Post remarked that the rapid evolution of AV technology will elevate the value of Uber’s network, as AV companies seek to monetize their innovations. Similarly, Jefferies analyst John Colantuoni remains optimistic about Uber, despite potential challenges from Tesla.

According to TipRanks, the consensus among analysts shows 30 “Buy” ratings and one “Hold” for UBER stock, categorizing it as a Strong Buy. Additionally, the average price target of $89.31 for UBER indicates a possible upside of about 8% from its current trading level.

While the outlook for Uber’s earnings appears positive, I maintain that the stock is currently fairly valued at a forward price-to-earnings ratio of 38x. The modest upside projected by analysts suggests that the stock is priced appropriately at this time. Although there may be room for an expansion in earnings multiples, pursuing that route seems like a high-risk venture at this stage.

Conclusion

Uber demonstrates solid business fundamentals and offers resilient advantages, even as competition from Tesla intensifies. While Tesla has ambitious plans for the ridesharing arena, surpassing Uber will be a formidable challenge. Investors should recognize the competitive strengths held by Uber, which are currently reflected in the market’s perception. Although I believe the company has substantial growth potential moving forward, UBER stock appears suitably valued at present.

Disclosure.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.