UBS Initiates Coverage on Adecoagro: A Neutral Stance with Significant Upside Potential

Price Forecast Indicates 40.92% Growth Opportunity

On October 14, 2024, UBS began coverage of Adecoagro (LSE:0DWL) with a Neutral rating. Based on the analysis from September 25, 2024, the average one-year price target stands at 13.70 GBX per share. Projections vary, with estimates ranging from a low of 10.61 GBX to a high of 17.87 GBX. This average price target suggests a potential increase of 40.92% from the most recent closing price of 9.72 GBX per share.

Projected Revenue Growth Looks Promising

Adecoagro’s projected annual revenue is 1,442 million, marking a 9.00% increase. The expected annual non-GAAP EPS is 0.93.

Insights into Fund Sentiment

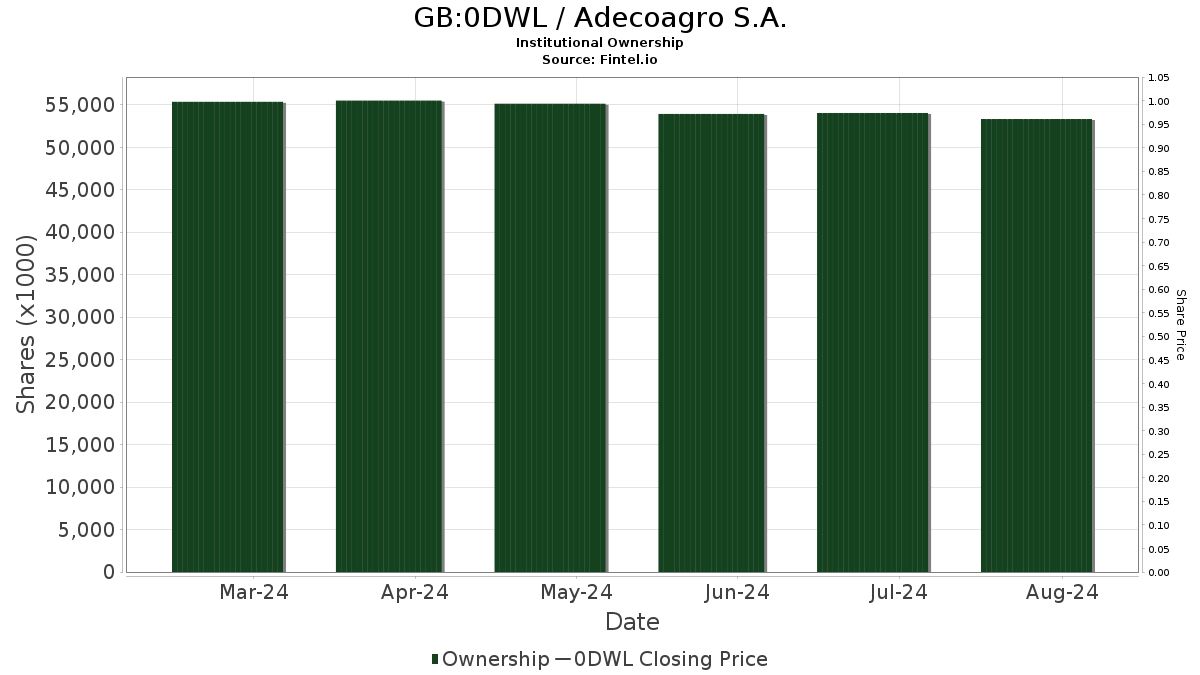

Currently, 156 funds and institutions have reported positions in Adecoagro, reflecting a slight increase of 1 owner (0.65%) over the last quarter. The average allocation of all funds to 0DWL is now 0.23%, which is a rise of 13.86%. Institutional ownership has grown by 1.79% over the past three months, totaling 53,839,000 shares.

Activity Among Other Shareholders

Route One Investment Company remains the largest shareholder, holding 10,076,000 shares or 9.83% of the company. However, this marks a decrease from their previous holding of 11,613,000 shares, a decline of 15.25%, accompanied by a 27.19% reduction in their portfolio allocation to 0DWL over the last quarter.

Jennison Associates has increased its shareholding to 6,254,000 shares (6.10%), up from 5,933,000 shares, signifying a 5.14% rise, although their portfolio allocation to 0DWL has fallen by 52.54% recently.

Additionally, PGGM Investments holds 4,500,000 shares, unchanged from the last quarter. PGIM Jennison Small Company Fund increased its share count to 3,326,000 (3.25%) from 3,212,000, a gain of 3.43%, while reducing their allocation by 4.80%. Herr Investment Group’s holdings rose from 2,033,000 to 2,650,000 shares (2.59%)—an increase of 23.26%, despite a significant 70.68% decrease in their portfolio allocation.

Fintel offers extensive research tools for investors, traders, financial advisors, and small hedge funds. Our data encompasses a broad scope, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, and much more. Advanced, backtested quantitative models drive our exclusive stock picks to enhance potential profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.