UBS Upgrades Terex Outlook Amid Decreasing Institutional Ownership

Fintel reports that on May 16, 2025, UBS upgraded its outlook for Terex (BMV:TEX) from Sell to Neutral.

Current Fund Sentiment

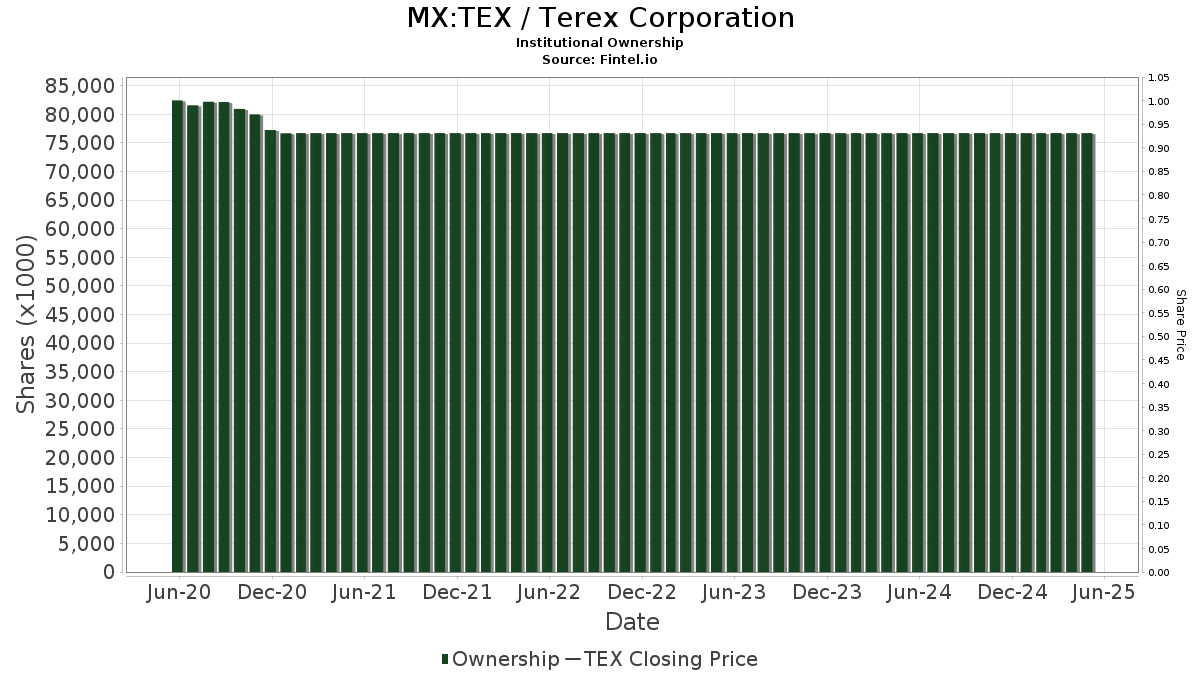

Currently, 527 funds or institutions report positions in Terex, marking a decrease of 42 owners, or 7.38%, from the previous quarter. The average portfolio weight allocated to TEX among all funds is 0.13%, reflecting an increase of 1.08%. However, total institutional shares owned fell by 5.24% over the last three months, totaling 76,688K shares.

Institutional Ownership Trends

Fuller & Thaler Asset Management holds 2,339K shares, accounting for 3.41% ownership of Terex. In its previous filing, the firm reported 2,151K shares, indicating an increase of 8.05%. Nonetheless, its portfolio allocation in TEX decreased by 8.83% last quarter.

IJH – iShares Core S&P Mid-Cap ETF holds 2,167K shares, representing 3.16% ownership. This is up from 2,091K shares previously, showing a 3.49% increase. However, the allocation in TEX decreased by 13.07% over the same period.

Fisher Asset Management owns 2,082K shares, giving it a 3.04% ownership stake. The firm previously held 1,891K shares, which is an increase of 9.21%, but its allocation declined by 2.05% last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 2,003K shares, indicating a 2.92% ownership. This represents a decrease from 2,028K shares, down by 1.28%. Its portfolio allocation in TEX saw a decline of 15.00% last quarter.

UBVLX – Undiscovered Managers Behavioral Value Fund Class L has increased its holdings to 1,878K shares, which is 2.74% of Terex. This is a significant shift from 948K shares previously, reflecting a 49.55% increase. The firm has expanded its portfolio allocation in TEX by 72.04% over the last three months.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.