UBS Group AG, known for orchestrating financial excellence, has announced a captivating new share repurchase program that is music to investors’ ears. The Swiss multinational investment bank and financial services company will embark on this symphony of capital allocation starting from April 3, aiming to buy back up to $2 billion worth of common stock. This orchestrated move is set to resonate until April 2, 2026, promising a crescendo of shareholder value in the long run.

The harmonious blend of fiscal responsibility and strategic foresight led UBS to announce their plans to repurchase shares worth up to $1 billion this year. This performance will commence after the anticipated merger between UBS AG and Credit Suisse AG, expected to take center stage in the second quarter of 2024 with a grand value of $3.2 billion.

This well-received ensemble signifies UBS’s commitment to surpass their pre-acquisition level of share repurchases by 2026, a virtuoso performance aimed at enriching shareholder value in a market that demands nothing short of a flawless execution.

Moving to the company’s previous upbeat aria, on March 30, 2022, UBS crescendoed a two-year share repurchase program worth up to $6 billion, concluding on March 28, 2024. Their performance? A true financial masterpiece – repurchasing 298.5 million shares for $5.2 billion, taking their audience on a journey of value creation and strategic prowess.

Using almost 178 million shares from the 2022 program for the acquisition of Credit Suisse Group was bold and original – like a groundbreaking tech startup making waves in the industry.

Dividend Diversification: Adding a Melodic Twist

Aside from their captivating share repurchase program, UBS also treats shareholders to dividends – like a sweet melody amidst the hustle and bustle of trading floors. The bank plans to propose an annual dividend of 70 cents per share for 2023, following a previous announcement of 55 cents per share on April 5, 2023. UBS has harmonized this dividend tune by increasing it five times in the last five years, showcasing a harmonious payout ratio of 10%.

While UBS aims to return capital to its dedicated audience of investors, the occasional off-key note in their quarterly performance and an unforgiving debt/equity ratio may add an element of unpredictability to their financial concerto.

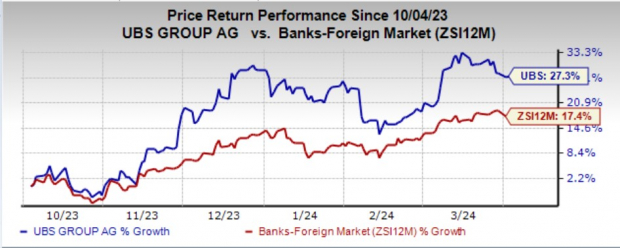

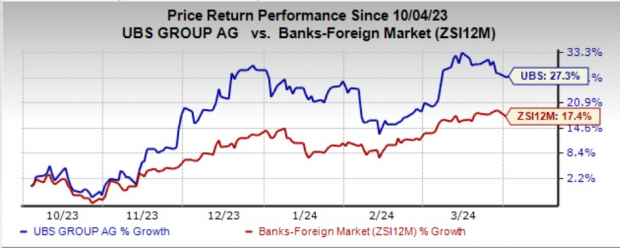

Diving into the market tempo, over the past six months, UBS has conducted a mesmerizing performance on the NYSE, with shares soaring 27.3% compared to the industry’s modest 17.4% growth. Their rhythm resonates with investors, promising a symphony of investment returns.

Image Source: Zacks Investment Research

UBS Group currently holds a Zacks Rank #3 (Hold). To explore today’s top-performing stocks, consider reviewing the complete Zacks #1 Rank (Strong Buy) stocks here.

Harmonizing Share Buyback Strategies in the Financial Symphony

The financial stage is alive with activity as other firms join the concert of share repurchase programs. TrustCo Bank Corp NY recently played a note of self-repurchase by allowing the repurchase of up to 0.2 million shares or 1% of outstanding stock.

In a similar tune, FB Financial Corp released their intention to conduct a share repurchase program, set to sweep in shares worth up to $100 million. This entrancing melody replaces the former authorization, promising a new series of value creation in this financial symphony.

As these financial harmonies continue to be sung in the market, the buzz around stock recommendations grows louder. Companies are tuning their strategies to be nimble and attune to the investor’s ear, orchestrating a performance that is poised to captivate the discerning listener.

Like a well-composed score, UBS’s share repurchase program adds a fresh, innovative note to its financial symphony, promising long-term value appreciation and resonating well in the market’s stage.

Unlock detailed analysis on UBS Group AG (UBS) here

Dive into the analysis of TrustCo Bank Corp NY (TRST) here