The Swiss banking giant, UBS Group AG, has set its sights on a robust growth trajectory in the United States through strategic mergers and acquisitions (M&A). As reported by Reuters, UBS Chairman Colm Kelleher, revealed the firm’s ambition to amplify its wealth management business in the U.S. market over the next three to four years.

Strategic Expansion Drive

UBS Group’s strategic maneuvers underscore a steadfast commitment towards broadening its presence in the U.S. market. The company has diligently fortified its geographic footprint in recent years by fostering strategic partnerships and executing pivotal acquisitions.

One notable event was the successful completion of the acquisition of Credit Suisse in June 2023, a move that is anticipated to fortify UBS Group’s wealth and asset management capabilities. This strategic transaction is poised to propel the company’s capital-light businesses forward, with integration efforts slated for completion by the end of 2026.

Furthermore, UBS Group’s endeavors in the realm of inorganic growth encompassed the establishment of a wealth management joint venture (JV) with Sumitomo Mitsui Trust Holdings in Japan (UBS SuMi TRUST Wealth Management Co.). Additionally, the firm forged an investment banking JV with Banco do Brasil SA, further cementing its strategic outreach into the market.

Driving Ambitious Goals

The cornerstone of UBS Group’s revenue generation lies in its Global Wealth Management segment, with assets under management tallying $3.8 trillion as of December 31, 2023. UBS Group holds a dominant position across various regions including Asia, Latin America, EMEA, and Switzerland in terms of invested assets. Looking ahead, the company has set a lofty target of surpassing $5 trillion in invested assets by 2028, signaling a resolute commitment towards substantial growth and expansion in the years to come.

From a shareholder standpoint, the strategic move into the U.S. market through M&A is expected to fortify UBS Group’s competitive position, potentially paving the way for market leadership in the region.

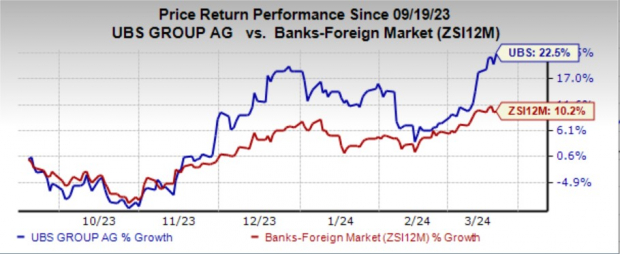

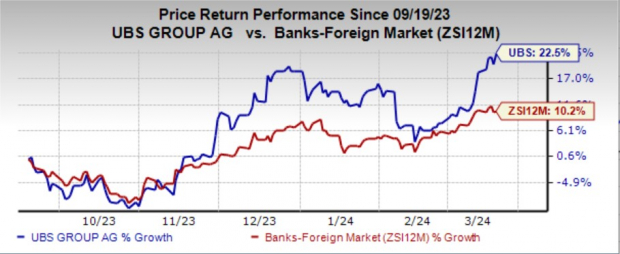

Image Source: Zacks Investment Research

Over the last six months, UBS shares have surged by 22.5% on the NYSE, outperforming the industry’s growth rate of 10.2%.

Expansion Efforts in the Industry

Vinci Partners Investments Ltd. recently announced the acquisition of Compass Group LLC to redefine the investment landscape in Latin America, with the deal expected to be finalized in the third quarter of 2024 pending regulatory approvals.

LPL Financial Holdings also disclosed its intentions to acquire Atria Wealth Solutions Inc. in a bid to enrich its wealth management solutions market offerings, aligning with the company’s mission to provide comprehensive support to independent financial advisors and institutions nationwide.

Infrastructure Stock Boom:

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

For further analysis and insights, refer to the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Find the free stock analysis reports for UBS Group AG (UBS) here, LPL Financial Holdings Inc. (LPLA) here, and Vinci Partners Investments Ltd. (VINP) here.