UBS Downgrades Alcoa’s Outlook Amid Decrease in Institutional Ownership

On May 15, 2025, UBS revised its outlook for Alcoa (BMV:AA1), lowering it from Buy to Neutral.

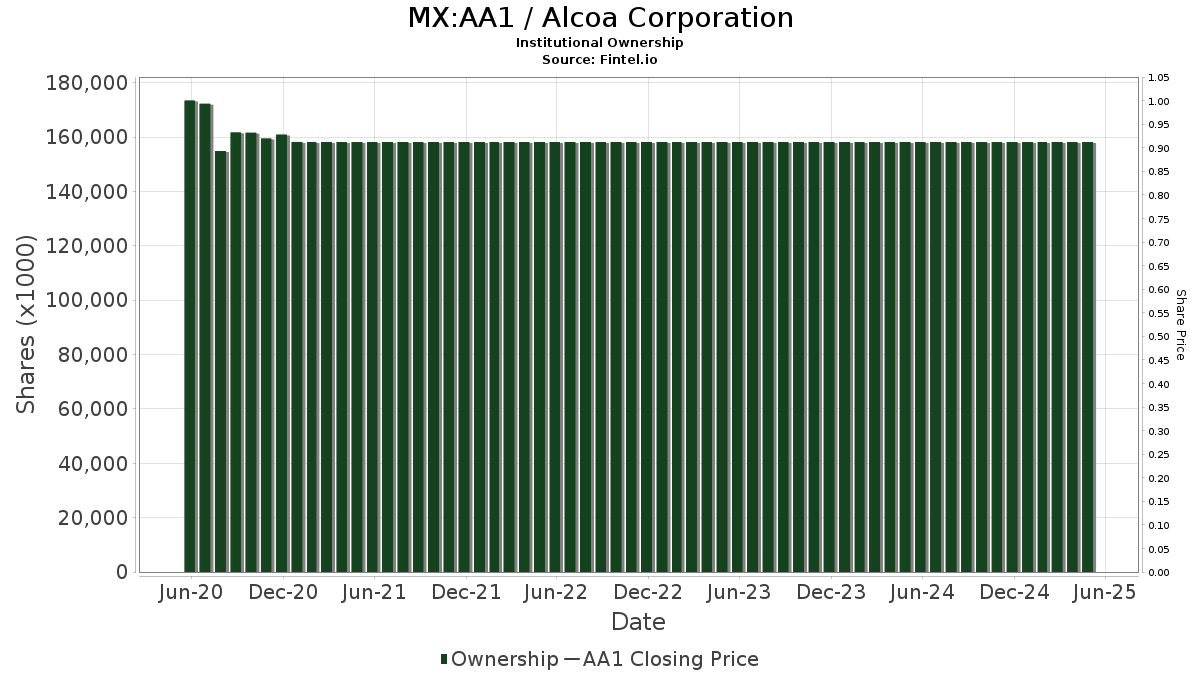

Fund Sentiment Overview

Currently, 569 funds and institutions hold positions in Alcoa, down by 51 owners or 8.23% from the last quarter. The average portfolio weight for these funds dedicated to AA1 is 0.14%, reflecting a 9.83% increase. Additionally, total shares owned by institutions have risen by 0.44% over the past three months, totaling 158,183K shares.

Activity Among Major Shareholders

Eagle Capital Management owns 16,583K shares, equating to 8.92% ownership of Alcoa. This marks a slight increase of 0.66% from their previous holding of 16,474K shares. However, the firm reduced its portfolio allocation in AA1 by 18.70% in the last quarter.

IJH – iShares Core S&P Mid-Cap ETF holds 8,386K shares, representing 4.51% ownership. This reflects a 3.70% increase from the previous quarter’s total of 8,076K shares. Nonetheless, the firm has decreased its portfolio allocation in AA1 by 2.34% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 8,125K shares for a 4.37% stake in Alcoa. This is a decline of 1.24% from a previous ownership of 8,225K shares. Their portfolio allocation in AA1 decreased by 4.68% last quarter.

NAESX – Vanguard Small-Cap Index Fund Investor Shares holds 6,581K shares, which translates to 3.54% ownership. This represents an increase of 1.73% from their prior holding of 6,467K shares. However, this firm also scaled back its portfolio allocation in AA1 by 2.66% over the last quarter.

Geode Capital Management possesses 4,427K shares, accounting for 2.38% ownership. Previously, the firm owned 4,233K shares, showing an increase of 4.38%. Still, it significantly decreased its portfolio allocation in AA1 by 54.67% in the last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.