UBS Downgrades American Water Works Outlook to Neutral

Fintel reports that on April 24, 2025, UBS downgraded their outlook for American Water Works (XTRA:AWC) from Buy to Neutral.

Analyst Price Forecast Indicates Slight Growth

As of April 24, 2025, the average one-year price target for American Water Works stands at 126.03 €/share. Forecasts vary, with a low of 107.28 € and a high of 145.35 €. This average price target suggests a modest increase of 0.42% from its latest closing price of 125.50 € / share.

Projected Financials for American Water Works

The anticipated annual revenue for the company is 4,965MM, reflecting a growth rate of 6.00%. Additionally, the projected annual non-GAAP EPS is 5.65.

Fund Sentiment Overview

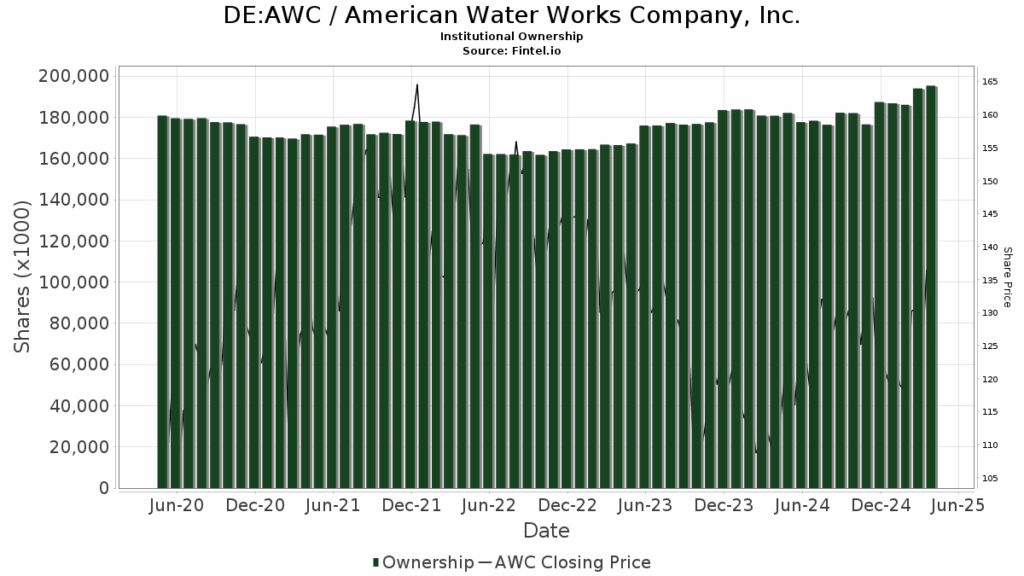

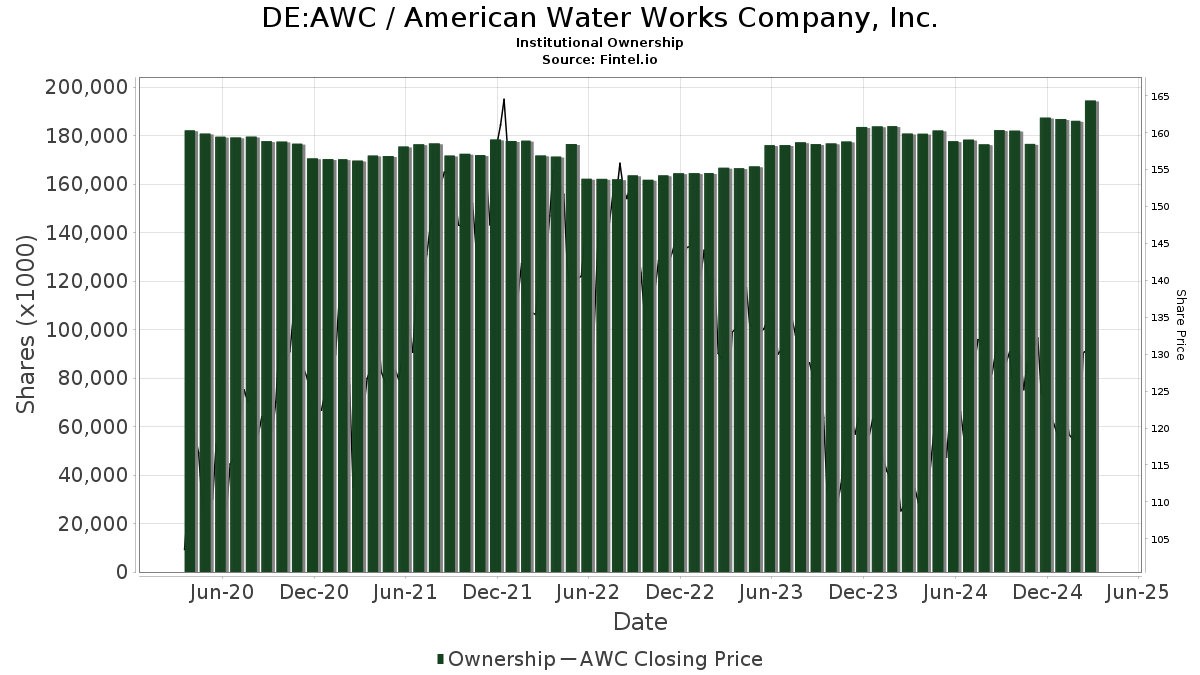

Currently, there are 1,817 funds and institutions reporting positions in American Water Works, a rise of 78 owners or 4.49% in the past quarter. The average portfolio weight of all funds dedicated to AWC is 0.26%, representing a significant increase of 35.66%. In the last three months, total shares owned by institutions grew by 4.67%, reaching 195,391K shares.

Recent Activity Among Shareholders

Aristotle Capital Management holds 6,713K shares, equating to 3.44% ownership of the company. This represents a decrease of 2.30% from the previous quarter, resulting in an 11.94% portfolio allocation drop in AWC.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares possesses 6,099K shares, representing 3.13% ownership, down 1.20% from prior filings, with an overall portfolio allocation reduction of 17.11% in AWC.

VFINX – Vanguard 500 Index Fund Investor Shares owns 5,276K shares or 2.71% of the company. This shows a growth of 3.27% from prior holdings, although their AWC allocation decreased by 16.74% over the last quarter.

Geode Capital Management has 4,671K shares, representing 2.40% ownership. This reflects a slight increase of 2.29% from earlier filings, but their portfolio allocation in AWC dwindled by 56.07% recently.

Lastly, Impax Asset Management Group holds 4,637K shares, or 2.38% ownership. Previously, they held 5,678K shares, marking a notable decrease of 22.47%, with a 20.05% drop in AWC portfolio allocation.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.