Amidst the ever-evolving landscape of investment opportunities, UFP Industries (NasdaqGS:UFPI) finds itself in the favorable position of having its average one-year price target climbing to an impressive 122.40 / share, marking an 8.11% uptick from the prior estimate set on January 16, 2024. This surge in expectations is a clear signal of the growing confidence in the company’s future prospects.

Market analysts, like seasoned meteorologists, have collectively converged on this revised target, with projections spanning from a modest 103.02 to a robust 143.85 / share. Such diversification is reminiscent of a spectrum of hues painting a vivid portrait of the stock’s potential, demonstrating a collective belief in the upward trajectory awaiting UFP Industries.

The Heat Index: Fund Sentiment

Surveying the legions of investors and institutions with stakes in UFP Industries reveals a notable surge in interest, akin to a bustling street alive with activity. A total of 877 funds or institutions have claimed positions in the company, showing an increase of 31 owner(s) or 3.66% in the last quarter alone. While the average portfolio weight of all funds dedicated to UFPI has seen a marginal dip to 0.28%, total shares owned by institutions have decreased by 2.22% to 60,329K shares over the past three months.

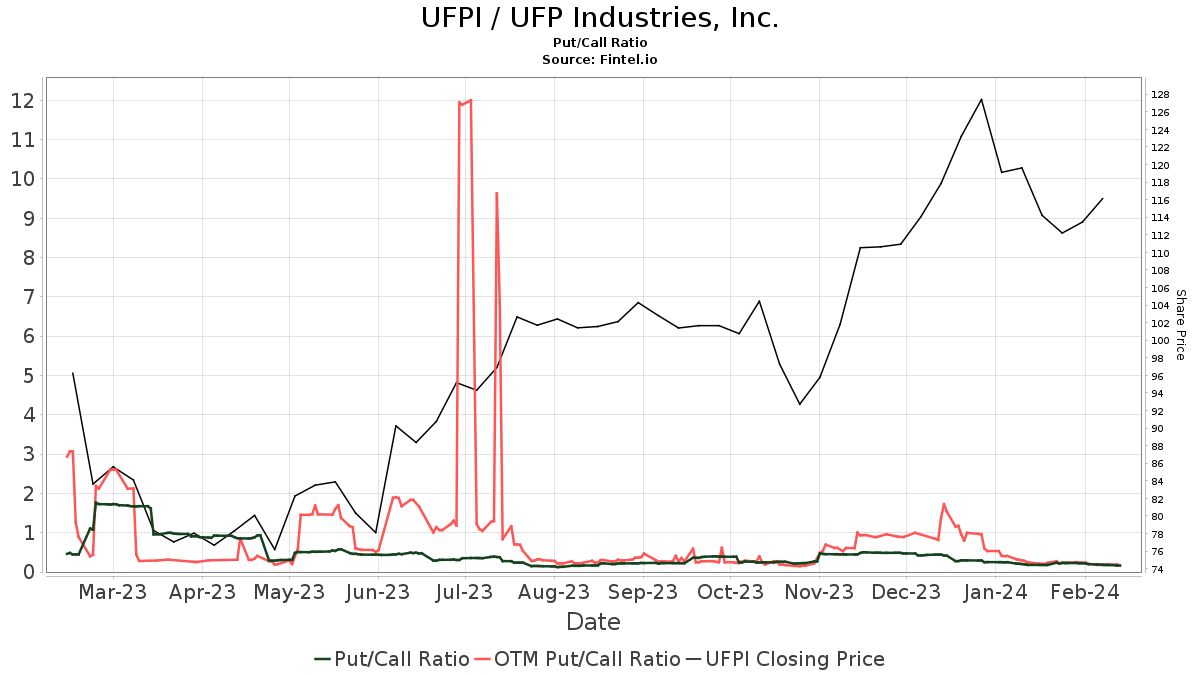

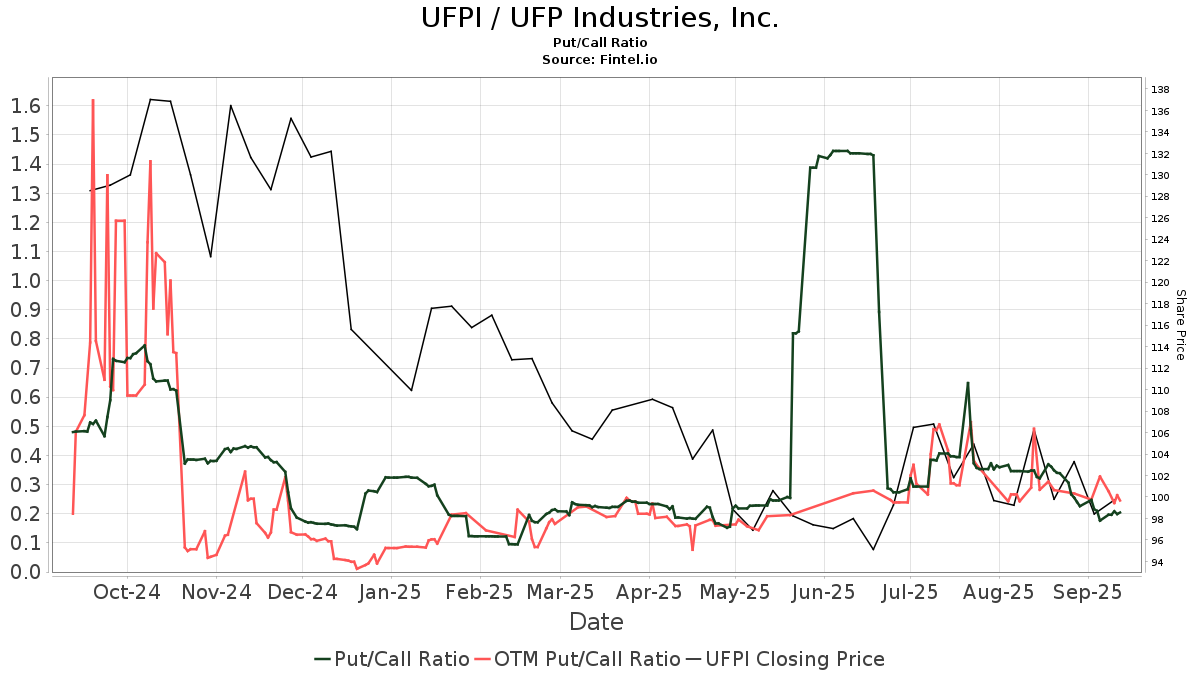

The put/call ratio of UFPI currently stands at a bullish 0.20, hinting at the prevailing optimism in the stock’s future trajectory.

Shareholder Symphony

Among the prominent stakeholders in UFP Industries, Kayne Anderson Rudnick Investment Management leads the charge with a holding of 3,152K shares, constituting 5.10% ownership of the company. Noteworthy is the firm’s substantial increase of 50.46% in shares held, displaying a robust support for the company’s trajectory.

Additionally, IJH – iShares Core S&P Mid-Cap ETF and VTSMX – Vanguard Total Stock Market Index Fund Investor Shares have also bolstered their positions in UFPI, showcasing a marked increase in confidence over the last quarter.

However, amidst this symphony of stakeholder movements, T. Rowe Price Investment Management has taken a different tune, reducing its holdings in UFPI by 33.10% over the last quarter. This nuanced shift highlights the varying sentiments present among investors, adding layers to the stock’s narrative.

UFP Industries: A Legacy Unfolds

Founded in 1955, UFP Industries stands as a paragon of resilience and adaptability in the competitive realm of manufacturing and distribution. With subsidiaries specializing in an array of value-added products for diverse applications, the company has solidified its presence on both local and global fronts, leveraging a rich history as it forges ahead into the future.

Fintel, a beacon of guidance for investors, offers a comprehensive platform replete with a wealth of resources ranging from fundamentals to sentiment analysis. Considered akin to a trusty compass in the turbulent seas of investment, Fintel equips individuals and institutions alike with the tools necessary to navigate the complex yet rewarding world of finance.

Curious to delve deeper into the realm of investing? Uncover insights and opportunities by following the trail that begins at Fintel.

This article was originally published on Fintel, illuminating the path for investors seeking clarity amidst the ever-changing landscape of financial markets.

The thoughts and opinions expressed in this piece are those of the author and do not necessarily mirror the views of Nasdaq, Inc.