UGI Corporation Strengthens Operations Despite Seasonal Challenges

UGI Corporation is enhancing its operations through targeted acquisitions and significant capital investments, aimed at improving performance. The company focuses on modernizing its infrastructure, replacing aging systems to boost overall efficiency.

Despite these initiatives, UGI, which holds a Zacks Rank of #3 (Hold), encounters competition from alternative clean energy sources and faces risks tied to the seasonal nature of its business.

Positive Factors Supporting UGI

UGI is committed to systematic capital investments to tackle various projects. This includes increasing the safety and reliability of its natural gas production and storage facilities while modernizing aging infrastructure.

In the fiscal first quarter, UGI invested $236 million, with 84% directed towards its natural gas sector. Looking ahead, the company plans to allocate between $800 million and $900 million in fiscal 2025, and projects a total investment of $3.7 billion to $4.1 billion by fiscal 2027 to bolster its operations.

To combat inflation and secure capital, UGI prioritizes sustainable cost savings and operational efficiencies. By streamlining processes and leveraging technology, UGI aims to improve its cost control and operational effectiveness.

The company seeks both labor and non-labor cost-saving initiatives. In the first quarter of fiscal 2025, UGI successfully reduced operating and administrative expenses by approximately $33 million and anticipates realizing permanent savings of $70 million to $100 million by fiscal 2025.

Challenges Facing UGI

The seasonal nature of UGI’s business significantly impacts its financial results, particularly in regions affected by winter temperatures. Warmer-than-average winters could lead to reduced demand for energy products and services, potentially diminishing profitability.

The company also contends with competition from various energy sources that may offer lower costs for comparable energy output.

UGI’s Recent Stock Performance

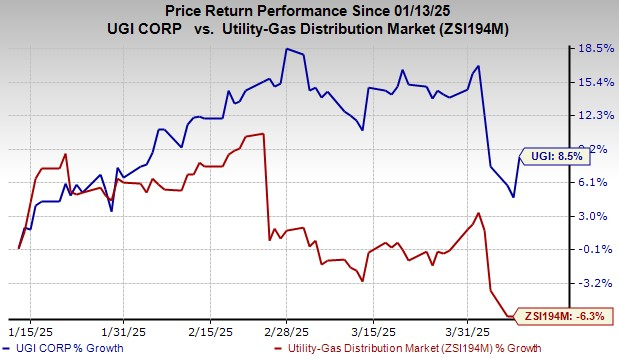

Over the past three months, UGI’s shares have appreciated by 8.5%, contrasting with a 6.3% decline in the broader industry.

Image Source: Zacks Investment Research

Investment Alternatives

Investors may consider other well-ranked stocks in the same sector, like Atmos Energy Corp. (ATO), Chesapeake Utilities (CPK), and Southwest Gas (SWX), each currently rated Zacks Rank #2 (Buy). For a comprehensive view, you can see today’s top Zacks #1 Rank (Strong Buy) stocks.

Atmos Energy projects a long-term earnings growth rate of 7.19%. The Zacks Consensus Estimate for ATO’s fiscal 2025 earnings per share (EPS) reflects a year-over-year increase of 5.1%.

Chesapeake Utilities is expected to see a 16.3% year-over-year increase in its 2025 EPS, with an average earnings surprise of 2.4% over the last four quarters.

In addition, Southwest Gas reports a long-term earnings growth rate of 9.5% and an average earnings surprise of 0.5% across the same period.

Highlighted Stocks for Upcoming Performance

Recently released, experts have identified 7 elite stocks from 220 current Zacks Rank #1 Strong Buys. These stocks are touted for their potential to yield early price increases.

Since 1988, this curated list has consistently outperformed the market, averaging a gain of +23.9% annually. Investors are encouraged to look into these selections.

Southwest Gas Corporation (SWX) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

UGI Corporation (UGI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.