UiPath Inc. Stock Shows Signs of Recovery Amid Industry Challenges

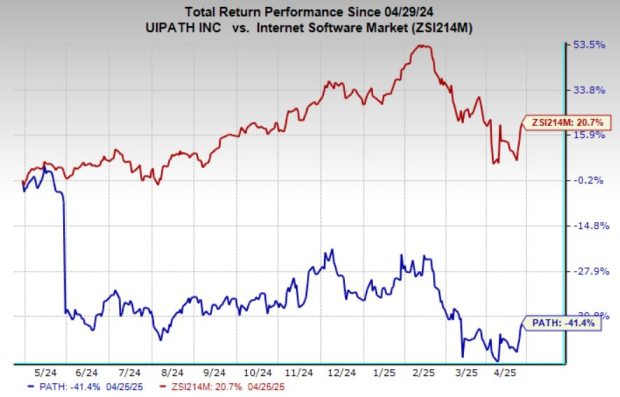

UiPath Inc. (PATH) has experienced a significant decline, with its stock price falling 41% over the past year, while its industry has seen a rally of 21% in the same timeframe. Nonetheless, the stock has recently bounced back with an 8% increase in the last month, indicating a potential recovery after substantial losses.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

This report will analyze PATH’s recent performance to evaluate whether its current valuation presents a solid opportunity for investors.

PATH Capitalizes on Growing Automation Market

UiPath remains a dominant player in the rapidly expanding Robotic Process Automation (RPA) market, which is expected to grow significantly in the coming years. Its comprehensive automation platform positions the company to take advantage of the increasing demand for AI-driven solutions.

A significant factor behind PATH’s success is its strategic partnerships with leading technology companies. Collaborations with Microsoft (MSFT), Amazon (AMZN) AWS, and Salesforce (CRM) enhance UiPath’s credibility and extend its offerings within larger enterprise ecosystems powered by Microsoft Azure, AWS, and Salesforce Cloud.

In the fourth quarter of fiscal 2025, UiPath reported a 5% increase in year-over-year revenue, totaling $424 million. Additionally, its annual recurring revenue rose by 14%, reaching $1.67 billion, highlighting the effectiveness of its subscription model and strong customer loyalty. With innovative partnerships, PATH is well-equipped to thrive in a competitive, evolving automation market.

PATH’s Robust Financial Position

UiPath boasts a strong financial foundation, characterized by a solid balance sheet. By the end of the fiscal fourth quarter, the company held $1.6 billion in cash and equivalents, with no outstanding debt. This lack of debt allows PATH to utilize its cash reserves for growth initiatives and strategic investments, bolstering its financial flexibility.

Furthermore, PATH’s liquidity is impressive. The current ratio stands at 2.93, surpassing the industry average of 2.54. A current ratio above 1 indicates that the company can cover its short-term liabilities. This robust liquidity equips PATH to navigate economic uncertainties and seize emerging opportunities in the competitive RPA landscape.

PATH Trading at a Discount Compared to Peers

The significant stock decline over the past year has led to notably lower valuations. PATH’s stock trades at a forward 12-month price-to-earnings (P/E) ratio of 21.76X, substantially below the industry average of 34.14X. This gap suggests that PATH may be undervalued compared to its peers, offering potential for investors looking for attractive entry points. The reduced P/E ratio reflects market reservations about recent challenges while signaling a buying opportunity for growth-focused investors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Analysts Optimistic About PATH’s Future

Over the past 60 days, analysts have increased seven estimates for fiscal 2026 and two for fiscal 2027, while reducing one estimate for each year. These upward adjustments reflect growing confidence in PATH’s capability to deliver stronger financial results moving forward. This optimism indicates confidence in the company’s strategic direction, operational efficiency, and its ability to leverage growth opportunities—making it an appealing option for investors seeking long-term value in the automation sector.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

PATH Represents a Strong Investment Opportunity

Given UiPath’s strong market presence, solid financial position, and strategic alliances with industry leaders, PATH stands out as a compelling investment opportunity. Currently undervalued, the stock offers an attractive entry point. Analysts have increased their earnings estimates for fiscal 2026 and 2027, reflecting positive sentiment about PATH’s long-term growth prospects in the expanding RPA market.

Additionally, PATH currently holds a Zacks Rank of #1 (Strong Buy), indicating a favorable outlook.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.