UiPath Inc. Shows Signs of Recovery Amid Market Challenges

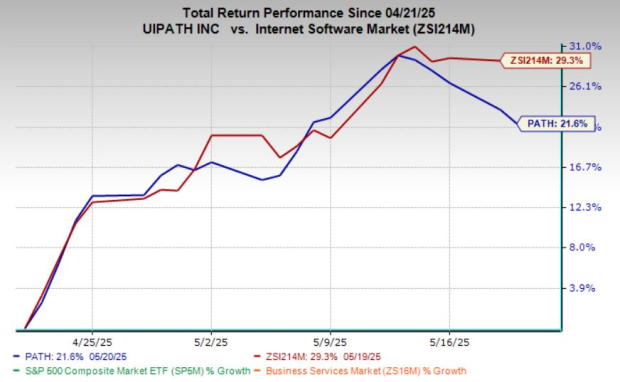

UiPath Inc. (PATH) has had a difficult year, with its stock price declining by 37%. This performance is starkly contrasted with its industry, which has seen a growth of 21%. However, recent trends suggest a reversal; over the past month, PATH has rebounded by 23%, indicating potential for recovery.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

This article will explore UiPath’s recent performance and assess whether current market conditions and price levels create a promising opportunity for long-term investors.

PATH Excels in the Growing Automation Market

UiPath is a significant player in the thriving Robotic Process Automation (RPA) industry, expected to expand considerably in the coming years. The company’s end-to-end automation platform enables it to capitalize on the increasing demand for AI-driven solutions.

A key factor behind PATH’s growth is its partnerships with major tech companies. Collaborations with Microsoft (MSFT), Amazon (AMZN AWS), and Salesforce (CRM) enhance UiPath’s reach and capabilities. These alliances not only enhance PATH’s credibility but also integrate its services into widespread enterprise ecosystems, leveraging Microsoft Azure, AWS, and Salesforce Cloud solutions.

In its fourth quarter of fiscal 2025, UiPath reported a 5% year-over-year revenue increase, totaling $424 million. Its annual recurring revenue increased to $1.67 billion, marking a 14% year-on-year rise, which highlights the strength of its subscription model and customer loyalty. By working alongside industry leaders, PATH is well-positioned to succeed in a competitive and rapidly changing automation landscape.

PATH’s Robust Financial Position

UiPath demonstrates a strong financial foundation, characterized by an impressive balance sheet. As of the fourth quarter, the company had $1.6 billion in cash and equivalents, without any outstanding debt. This absence of debt allows UiPath to utilize its cash reserves for growth initiatives and strategic investments, promoting innovation without financial burden.

The company’s liquidity remains solid as well. At the end of the fiscal fourth quarter, PATH reported a current ratio of 2.93, surpassing the industry average of 2.38. A current ratio over 1 indicates adequate assets to cover short-term obligations. This strong liquidity equips PATH to navigate economic uncertainties and to seize new opportunities in the competitive RPA market.

Image Source: Zacks Investment Research

Mixed Analyst Sentiment Reflects Uncertainty for PATH

Image Source: Zacks Investment Research

Recommendation: Hold for UiPath Stock

PATH shows positive signs of recovery after facing challenges, significantly benefiting from its position in the growing automation market. Partnerships with major tech firms enhance its platform’s reach and relevance. Additionally, strong client loyalty and a robust business model position PATH for long-term success. However, recent downward revisions among analysts suggest concerns about growth and profitability.

Despite a solid financial position that supports innovation, the mixed analyst sentiment indicates uncertainty in the near term. Investors may find it prudent to hold their positions rather than quickly pursuing new investments. Currently, the stock seems to be in a consolidation phase. Waiting for clearer indicators of sustainable growth and market direction may provide better entry or exit opportunities. While PATH has promise, a cautious and observant strategy appears most fitting.

PATH currently holds a Zacks Rank #3 (Hold).

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.