UITB ETF Hits Oversold Mark: What Investors Should Consider

On Wednesday, the UITB ETF (Symbol: UITB) experienced a significant drop in value, with shares trading as low as $46.27 apiece, indicating it has entered oversold territory. This term describes a situation where an asset has been heavily sold, often creating a potential buying opportunity. Analysts use the Relative Strength Index (RSI) to determine this, rating momentum from 0 to 100. An RSI below 30 suggests oversold conditions.

Currently, UITB holds an RSI of 27.5, notably lower than the S&P 500’s RSI of 62.6. For those with a bullish outlook, this low reading may signal that selling pressure is diminishing, prompting them to think about entry points for purchases.

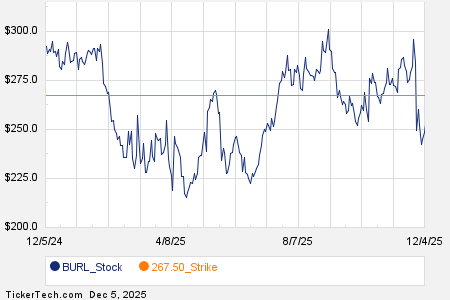

Evaluating UITB’s performance over the past year reveals its lowest share price at $44.165 and a peak of $48.31. The most recent trading price is $46.35, a decline of approximately 0.9% for the day. The chart below illustrates this one-year performance.

![]() Learn about 9 other oversold dividend stocks worth noting »

Learn about 9 other oversold dividend stocks worth noting »

Additional Resources:

- ENFN Options Chain

- Institutional Holders of SMMF

- ETFs Holding TV

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.