Ulta Beauty Reports Strong Q1 Fiscal 2025 Earnings, Raises Outlook

Ulta Beauty, Inc. (ULTA) announced robust first-quarter fiscal 2025 results, surpassing both earnings and revenue estimates while showing annual growth. Consequently, management increased its full-year guidance.

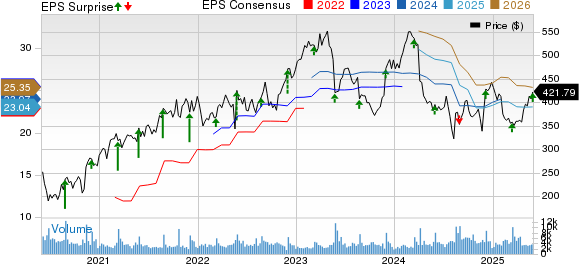

The company’s earnings per share (EPS) for Q1 reached $6.70, exceeding the Zacks Consensus Estimate of $5.77 and up from $6.47 in the previous year.

Financial Performance: Key Highlights

Ulta’s net sales rose 4.5% year over year to $2,848.4 million, surpassing the Zacks Consensus Estimate of $2,789 million. This sales increase was driven by higher comparable sales and contributions from new store openings, offset by a decline in other revenues.

Comparable sales, which include transactions from stores open for at least 14 months and e-commerce, increased 2.9%. This growth stemmed from a 2.3% rise in average ticket size and a 0.6% increase in transaction volume, despite an expected decline of 0.2%.

Detailed Metrics and Insights

Gross profit stood at $1,114.2 million, up 4.2% from $1,069.8 million, but contracted as a percentage of sales to 39.1% from 39.2%. This decline resulted from fixed cost deleverage in stores and the supply chain, balanced by reduced inventory shrinkage.

Selling, general and administrative (SG&A) expenses increased 6.7% to $710.6 million from $665.9 million last year, rising as a percentage of net sales to 24.9% from 24.4%. The increase was due to higher store payroll and benefits costs.

Operating income was $401.8 million, compared to $400.9 million in the prior year, with an operating margin decreasing to 14.1% from 14.7%. The anticipated operating margin was 12.4%.

Financial Health and Store Developments

At the end of the quarter, Ulta held cash and cash equivalents of $454.6 million. The company reported net merchandise inventories of $2.1 billion and stockholders’ equity of $2,430.3 million. Net cash from operating activities was $220 million for the 13 weeks ended May 3, 2025.

During the quarter, Ulta repurchased 986,733 shares for $358.7 million. As of May 3, 2025, $2.3 billion remains in its $3 billion share buyback program announced in October 2024. For fiscal 2025, management anticipates share buybacks of nearly $900 million, with capital expenditures projected between $425 million and $500 million.

Ulta opened six new stores, remodeled four, and relocated two, ending the fiscal first quarter with 1,451 stores totaling 15.2 million square feet. The company aims for approximately 60 net new stores and 40-45 remodeling projects in fiscal 2025.

Updated Expectations for Fiscal 2025

Ulta now anticipates net sales for fiscal 2025 to be between $11.5 billion and $11.7 billion, up from a prior range of $11.5 billion to $11.6 billion. The previous fiscal year saw net sales of $11.3 billion. Comparable sales are projected to be flat to increase by 1.5% year over year, revised from an earlier estimate of up 1%.

An operating margin of 11.7% to 11.8% is still expected for fiscal 2025. EPS guidance has increased to a range of $22.65-$23.20, up from $22.50-$22.90. In fiscal 2024, Ulta reported EPS of $25.34.

Over the past three months, Ulta’s stock rose 15.1%, outperforming the industry growth of 2.9%.

Key Comparisons

Other notable companies include Urban Outfitters, Inc. (URBN), which is rated Zacks Rank #1 (Strong Buy) and projects fiscal-year earnings growth of 20.9%. Genesco Inc. (GCO) also shows promise with a trailing four-quarter average earnings surprise of 37.2%, while Canada Goose Holdings Inc. (GOOS) maintains a Zacks Rank of 2 with trailing averages indicating strong performance.

This article focuses exclusively on Ulta Beauty’s financial results and does not promote any other firms.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.