Analysts See Upside Potential for iShares U.S. Consumer Staples ETF

In our analysis of the ETFs within our coverage at ETF Channel, we assessed the trading prices of each holding against average analyst 12-month forward target prices. From this, we calculated the weighted average implied analyst target price for the iShares U.S. Consumer Staples ETF (Symbol: IYK), which comes in at $74.60 per unit.

Currently, IYK is trading around $67.96 per unit. This pricing reflects an estimated 9.78% upside potential as viewed by analysts, considering the average targets for its underlying holdings. Notable stocks contributing to this potential include CVS Health Corporation (Symbol: CVS), Tyson Foods Inc (Symbol: TSN), and Kenvue Inc (Symbol: KVUE).

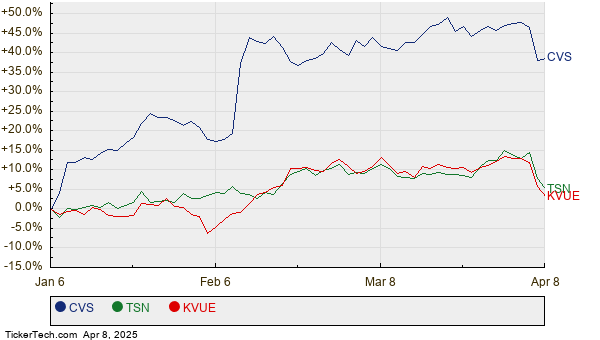

For CVS, trading at $63.78 per share, the average analyst target sits at $72.32, indicating a 13.39% upside. Tyson Foods currently trades at $58.16, demonstrating an 11.75% upside potential with a target price of $65.00. Meanwhile, Kenvue shares are priced at $21.73, with analysts projecting a price target of $23.93, suggesting a 10.14% upside. A twelve-month price history chart illustrating the performance of CVS, TSN, and KVUE is shown below:

Combined, CVS, TSN, and KVUE account for 6.25% of the iShares U.S. Consumer Staples ETF. Below is a summary table detailing the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Consumer Staples ETF | IYK | $67.96 | $74.60 | 9.78% |

| CVS Health Corporation | CVS | $63.78 | $72.32 | 13.39% |

| Tyson Foods Inc | TSN | $58.16 | $65.00 | 11.75% |

| Kenvue Inc | KVUE | $21.73 | $23.93 | 10.14% |

Are the analysts’ targets justified, or are they overly optimistic regarding these stocks’ future trading prices? A substantial price target relative to a stock’s current price often signals optimism but may lead to downgrades if it reflects outdated expectations. Investors should conduct further research to navigate these insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• BMS market cap history

• Institutional Holders of QFLR

• DALI YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.