Why Traditional Investing May Not Be Enough in Today’s Market

Editor’s Note: Recently, I shared insights about my colleague Luke Lango and his innovative system called Auspex, designed to help investors outperform the market.

Luke and his team dedicated nearly a year to develop Auspex, and the results are noteworthy. A comprehensive backtest demonstrated its capability to surpass market returns by over 10X in various 5-, 10-, 15-, and 20-year periods.

Today, I’ve invited Luke to discuss why traditional buy-and-hold strategies may not lead to significant gains anymore and how Auspex offers a valuable alternative.

Don’t miss his upcoming Auspex Anomaly Event on Wednesday, December 11 at 1 p.m. ET. Click here to sign up now.

Now, let’s hear from Luke…

The stock market recently enjoyed its strongest performance of the year, with the S&P 500 increasing almost 6% in November.

Several factors are contributing to this rally. President-Elect Donald Trump has proposed pro-growth policies, such as deregulation and tax reform, which are igniting investor enthusiasm. This, in turn, is pushing the market higher.

Since Election Day, results include:

- The S&P 500 has increased approximately 6.2%, frequently breaking past records of 6,000.

- The Russell 2000, representing small-cap stocks, has jumped around 9.7%.

- The tech-heavy Nasdaq-100 has risen by about 7.2%.

- Bitcoin (BTC-USD) saw a surge of roughly 32%, climbing from $70,000 to an all-time high exceeding $100,000 this past Wednesday.

With such impressive gains, many are curious if this rally will persist until Trump’s inauguration and beyond.

While it is possible, there are valid concerns that the rally could lose momentum before Trump completes his term, or potentially sooner.

It’s crucial to remember that no rally lasts indefinitely. Smart investors must constantly assess market conditions instead of adopting a “set and forget” approach.

This highlights the need for strategies that can succeed in both rising and falling markets.

On December 11, I plan to reveal a new strategy to the public for the first time. Reserve your spot for this event now.

I have been using this approach with a select group of subscribers for five months, and it has consistently outperformed the market each month—November included.

Let’s take a moment to understand why it is essential to reconsider long-term investing as we explore the story of the Trump boom. I’ll also detail the effectiveness of my new strategy, which requires only a few minutes of setup time each month, enabling you to avoid constant monitoring of target prices or stop-losses.

Why Buy-and-Hold Isn’t Always Effective

The investment landscape has significantly evolved over the past several decades. Yet, many investors continue to favor the buy-and-hold philosophy.

They may overlook how dramatically market dynamics can fluctuate.

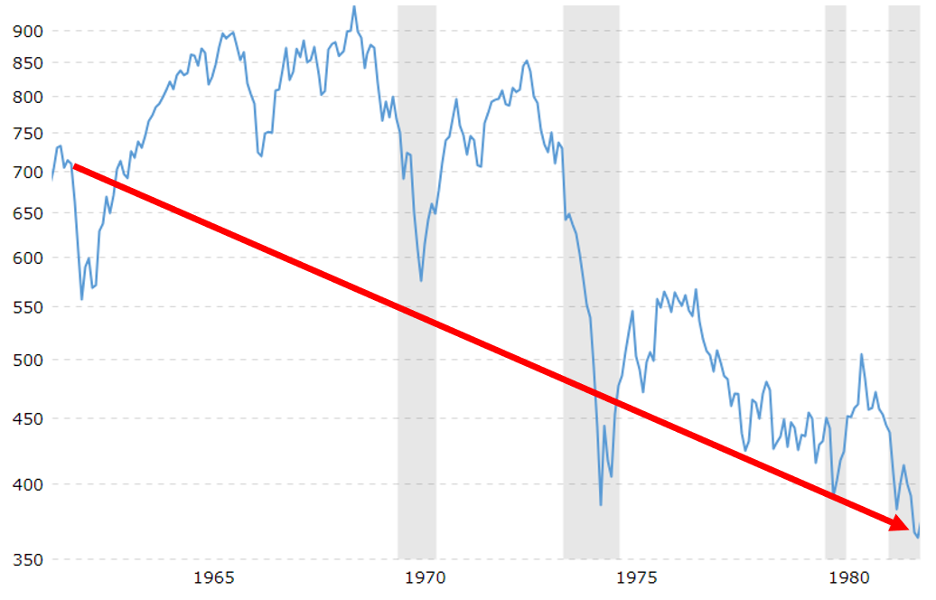

For example, between 1962 and 1982, the S&P 500 index suffered a major decline, dropping from 713 to 363—almost a 50% fall. In such an environment, a buy-and-hold strategy is ineffective.

Source: Macrotrends.net

During this period, substantial wealth accumulation stories were rare, as evidenced by BusinessWeek’s iconic “The Death of Equities” cover released in 1979.

Investing in individual stocks throughout the 1960s and ’70s posed significant challenges, even for seasoned investors. Many once-reliable companies underperformed severely.

Take IBM Corp. (IBM) as an example: from early 1962 to late 1981—spanning 19 years—IBM delivered an average annual return of just 2.62%, even including reinvested dividends.

Understanding Market Dynamics: Trends and Strategies for Success

Investment Insights Amid Market Fluctuations

Source: DQYDJ.com

A $10,000 investment at an annual yield of 2.62% over 19 years leads to a return of only $16,346. This amount may fall short for those seeking a comfortable retirement.

We experienced a similar challenging market period in the 2000s after the dot-com bubble burst and the subsequent financial crisis.

I’m not predicting an identical scenario today.

Currently, there is a possibility of a 25-basis-point interest rate cut from the Federal Reserve later this month, which may support stock prices moving forward.

Ultimately, every rally will come to an end. Euphoria after elections will eventually wane, resulting in investors seeking short-term profits.

While we haven’t reached that turning point yet, I suspect it might occur around the time of the presidential inauguration.

The global landscape remains unpredictable, further complicated by the unique influence of Donald Trump.

In the near future, we may witness global conflicts, rising inflation, and increasing interest rates – all factors that could negatively impact the stock market. This situation might not mirror the extended downturns of the 1960s and 1970s, but it could still create a challenging environment.

Nevertheless, my new strategy aims to help investors surpass market performance and achieve significant gains, regardless of potential downturns.

Navigating Today’s Investment Landscape

Despite the challenges, the “buy-and-hold” strategy remains valid.

I encourage my members to invest in industries like artificial intelligence, precision medicine, quantum computing, and nuclear energy. These sectors, among others, continue to show promise for long-term growth.

This method remains one of the best for building a multimillion-dollar portfolio and fostering a life of financial stability over many years.

However, the market can be volatile, and investors face obstacles when aiming for short-term gains.

It’s crucial to adapt and diversify investment strategies beyond simple buy-and-hold approaches.

To that end, I also advocate for utilizing more active trading techniques to take advantage of market fluctuations.

This led to the development of my new strategy, Auspex, which aims to replace uncertainty with stability.

On December 11 at 1 p.m. Eastern, I will be presenting more about The Auspex Anomaly Event.

Auspex serves as an advanced stock-screening tool that identifies “the best stocks at the best time.”

By combining fundamental, technical, and market sentiment analyses, Auspex spots the stocks expected to perform well in the upcoming month.

Each month, Auspex evaluates over 10,000 stocks to find those demonstrating the highest levels of strength and positive market sentiment for upward momentum.

Typically, this process highlights 5 to 20 stocks, which my team then analyzes to form the Auspex Portfolio for that month.

After starting this live process for a select group of members five months ago, we have consistently outperformed the market, demonstrating exceptional success each month.

November proved highly successful for the stock market, with the S&P 500 gaining 5.7%. In contrast, the Auspex portfolio exceeded expectations with an increase of over 8%.

This month marked the fifth consecutive month of returns that outpaced the market.

Furthermore, historical analysis indicates that Auspex consistently outperforms the market by over 10 times across 5-, 10-, 15-, and 20-year spans.

In an April 2024 back-test, Auspex identified Dynagas LNG Partners LP (DLNG) and Zeta Global Holdings Corp. (ZETA) as companies showcasing substantial momentum.

In April, DLNG surged nearly 30%, while ZETA increased by about 15%, revealing a stark contrast to the S&P 500, which fell approximately 4% during the same period.

Auspex Research: Exceptional Gains in a Flat Market

Stock Performance in May

In our back-test analysis for May, Auspex pointed out two standout stocks: DLNG and ZETA. During this month, ZETA experienced a remarkable increase of over 30%, while DLNG rose nearly 10%. For comparison, the S&P 500 saw a modest gain of just 4%.

In summary, Auspex’s two recommended stocks, DLNG and ZETA, achieved impressive increases of approximately 40% and 50%, respectively, while the broader market remained relatively unchanged.

Looking Ahead to 2025

The upcoming year, 2025, is likely to bring further volatility to the stock market. Investors should expect ongoing changes, much like the trends seen in 2024 and previous years.

In this unpredictable landscape, having access to data-driven and flexible investment strategies will be crucial.

This is the motivation behind the development of Auspex.

With Auspex, investors can position themselves effectively to not just survive potential market downturns but to also aim for returns that exceed market averages.

For more information, click here to register for The Auspex Anomaly Event. Don’t forget to schedule your time for Tuesday, December 11, at 1 p.m. Eastern.

Looking forward to seeing you there!

Best regards,

Luke Lango

Senior Analyst, InvestorPlace