Micron Technology Faces Challenges Amid Price Pressures and Tariffs

Micron Technology (NASDAQ: MU) is experiencing a challenging April. Shares of the memory giant have plummeted by 20% this month, significantly impacted by concerns surrounding tariffs. Some reports indicate Micron may consider raising the prices of its memory products due to the ongoing tariff disputes. This is particularly relevant as Micron operates globally, with manufacturing facilities in the U.S., Japan, Taiwan, and China.

It’s important to note that semiconductors currently remain exempt from tariffs imposed by both the U.S. and China. Moreover, the Trump administration has implemented a 90-day suspension of reciprocal tariffs on numerous trading partners who otherwise would face increased rates. Additionally, imports of memory chips and hard drives from China have also been exempted.

Given these circumstances, Micron might not need to raise product prices, as such an action could diminish demand from customers already facing increased costs. Furthermore, demand for Micron’s memory products is so strong that the company struggles to keep pace with production. This trend was underscored by the company’s robust performance in the previous quarter, along with a positive outlook for the current reporting period.

In light of these factors, let’s explore why purchasing Micron stocks after this recent decline could be a wise decision.

Why Micron’s Valuation is Compelling Right Now

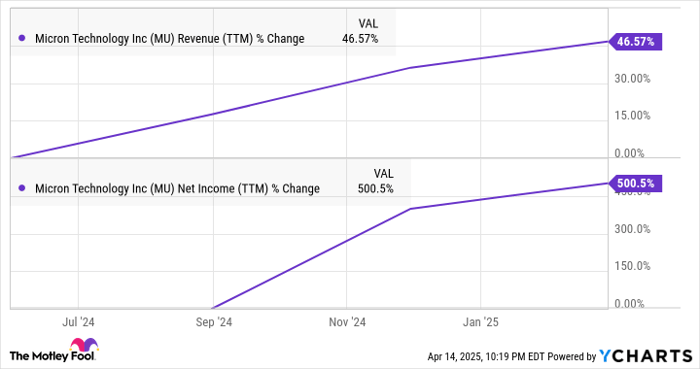

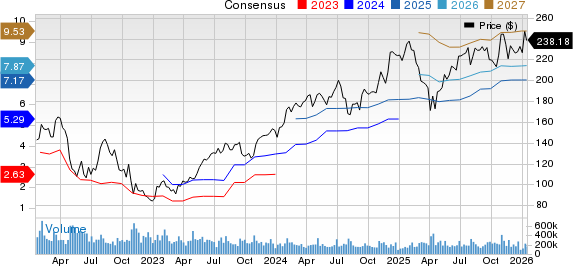

Micron has demonstrated a remarkable 38% year-over-year increase in revenue in its last quarter, along with a dramatic 3.7x rise in earnings. Given this growth, its current valuation suggests it is an attractive buy. Presently, the company’s shares are trading at under 17 times trailing earnings, and its forward earnings multiple is even lower at 10.

For comparison, the tech-heavy Nasdaq-100 index has a trailing price-to-earnings ratio of 27, and a forward earnings multiple of 23. In this context, Micron’s shares are much cheaper, especially considering the impressive growth it has exhibited recently.

MU Revenue (TTM) data by YCharts

Moreover, Micron’s attractiveness in terms of valuation further enhances when accounting for its potential earnings growth. The stock has a price/earnings-to-growth (PEG) ratio of only 0.15, based on projected earnings growth over the next five years, as reported by Yahoo! Finance. A PEG ratio under 1 generally indicates that a stock is undervalued, highlighting Micron’s significant upside potential as it capitalizes on AI developments.

AI Growth Promises Increased Demand for Memory Products

Micron stands to benefit from the surging demand for high-bandwidth memory (HBM) chips that are essential for running artificial intelligence (AI) workloads in data centers. The company’s data center revenue has tripled year-over-year, with HBM sales alone generating a record $1 billion this past quarter.

Micron confirms that its HBM shipments have surpassed expectations. Remarkably, the company has already sold its entire HBM capacity for 2025 and is focused on expanding this capacity further to meet growing demands through 2026. In addition, Micron has raised its total addressable market (TAM) estimate for HBM to $35 billion for 2025.

This figure could continue to rise, as one industry estimate projects the HBM market to reach approximately $86 billion by 2030. Thus, Micron’s data center segment has significant growth prospects, driven by the high demand for HBM solutions.

Beyond data centers, Micron’s memory products are crucial for smartphones and personal computers (PCs). As AI technology improves, the demand for memory in these devices is climbing. Micron notes that the dynamic random access memory (DRAM) used in AI-capable PCs is now one-third higher than last year’s average. Additionally, premium AI smartphones are utilizing 50% more DRAM than the 8 gigabytes (GB) found in 2024 models.

Looking ahead, shipments of AI-enabled smartphones and PCs are expected to grow at an annual rate of nearly 35% through 2029. This trend is likely to facilitate stronger increases in Micron’s memory shipments, complementing its data center business growth.

Overall, Micron Technology shows great potential. The current valuation of its semiconductor stock offers an enticing opportunity for investors, particularly since the company’s robust growth could help it rebound from recent challenges.

Is Now the Right Time to Invest in Micron Technology?

Before deciding to purchase stocks in Micron Technology, consider the following:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy right now, and Micron Technology did not make the list. The selected stocks have the potential to yield substantial returns in the upcoming years.

For example, consider when Netflix was recommended on December 17, 2004. An investment of $1,000 then would now be worth $524,747*! Similarly, Nvidia was recommended on April 15, 2005, and a $1,000 investment would now stand at $622,041*!

It’s noteworthy that Stock Advisor reports an impressive average return of 792 % compared to the S&P 500’s 153 % over the same period. Don’t miss out on the latest top 10 stocks list available when you join Stock Advisor.

*Stock Advisor returns as of April 14, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.