In early April 2025, Wall Street experienced significant volatility, marked by the S&P 500 achieving a record closing high and the Dow and S&P entering correction territory, while the Nasdaq entered a bear market for the first time in three years. This volatility peaked during a week from April 2 to 9, when the S&P 500 recorded its fifth-largest two-day percentage decline in 75 years and subsequently its largest single-day nominal point increase on April 9. During this period, the CBOE Volatility Index (VIX) surged above 50, a level not seen frequently since 1990.

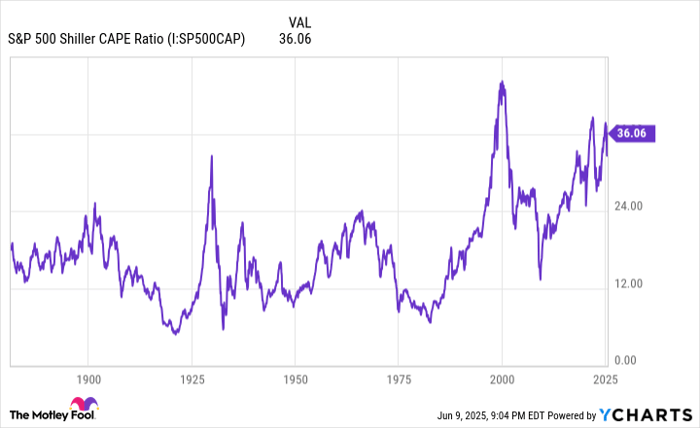

Driving the volatility were President Trump’s announcements of a global 10% tariff and reciprocal tariffs, which created uncertainties affecting trade relations and inflation. The S&P 500’s Shiller price-to-earnings ratio reached 39 in December 2024, highlighting an overpriced market historically linked to future declines. Historically, spikes in the VIX have correlated with future market gains, and prior instances of a significant decline in the VIX indicated potential outsized returns for the S&P 500 in subsequent years, averaging a total return of 102.14% over five years following such events.