“`html

In a recent presentation, trader Jonathan Rose highlighted a current “Trade of the Decade,” focusing on a rare divergence between gold and silver. Rose’s divergence trading strategy has previously earned him $4 million during the 2008 market crash and boasts impressive subscriber gains, including returns of up to 967% in just 52 days.

Rose’s career spans nearly three decades, starting as a floor trader in 1997 and managing risk for a prop trading firm during the 2008 financial crisis. He recalls the firm’s capital dropping from $32 million to $18 million due to a bad trade, an experience that shaped his risk management approach. He emphasizes that traders must prioritize survival over profit, particularly in volatile market conditions.

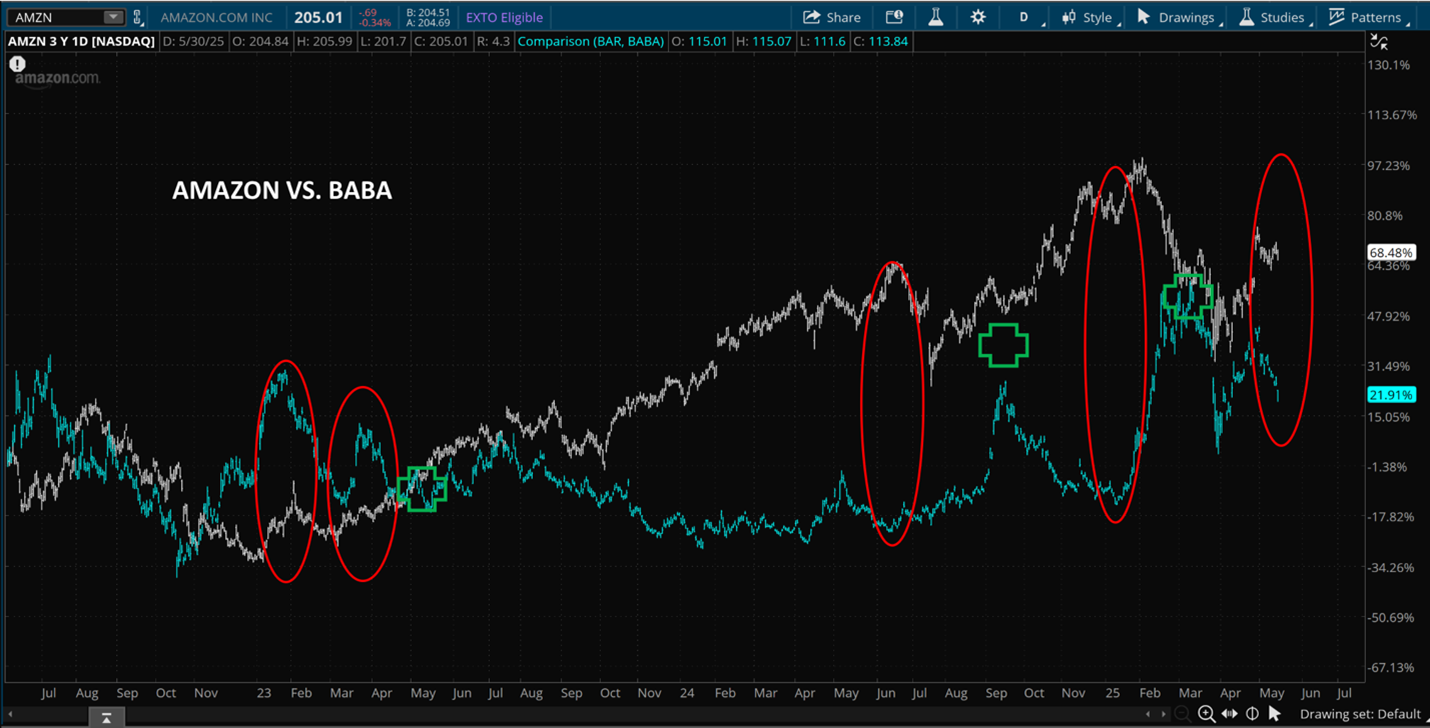

This year, the S&P 500 experienced a 19% drop before rebounding. Rose advocates for using divergence trading to navigate such choppy markets, focusing on relationships between stocks rather than making binary bets on price direction.

“`