Amazon’s Quantum Leap: A New Frontier in Technology Investment

Editor’s Note: Despite current market turbulence, innovation continues to flourish. InvestorPlace Senior Analyst Louis Navellier expresses confidence following Amazon’s recent introduction of Ocelot, its first quantum computing chip. This development places Amazon in direct competition with Microsoft and Google in a rapidly evolving technological landscape, presenting significant investing opportunities.

However, quantum computing’s complexity can pose challenges for investors trying to grasp its market implications. Hence, Louis Navellier is hosting an urgent briefing on Thursday, March 13, at 1 p.m. ET, just one week ahead of Nvidia’s anticipated “Quantum Day” announcements. Click here to secure your spot for this free event.

In today’s article, Louis shares insights on how a past failure led him to develop a system designed to identify market winners—an approach that could benefit you as well.

The current market situation isn’t pleasant. Trade tariffs imposed on Canada, Mexico, and China have pushed the market lower throughout March. Although President Trump has deferred some tariffs on Canada and Mexico until April, the damage has already been done for many investors.

The S&P 500, Dow, and NASDAQ have all given up their gains since the election. Remarkably, during the first six trading days of March, each of these indices dropped over 4%.

Market volatility stems from rapidly changing news as well. For instance, markets dipped yesterday after President Trump proposed increased tariffs on Canadian aluminum and steel. However, they rebounded later as reports emerged of a U.S.-negotiated 30-day ceasefire agreement in Ukraine, contingent on Russian acceptance of the plan.

Amidst this uncertainty, a potential billionaire is making strategic moves today.

As George Washington emphasized, when a community embraces a “spirit of Commerce,” great achievements become possible.

Consider the journey of Jeff Bezos. He left a stable Wall Street career at 30 to sell books online, a bold move in an era when few used the internet. Today, Amazon.com, Inc. (Stock-ticker”>AMZN) leads global commerce with Bezos amassing a net worth of $215 billion.

Similarly, Bill Gates dropped out of Harvard to create software at a time when personal computers were rare. His venture became Microsoft Corporation (Stock-ticker”>MSFT), worth $3 trillion today, and Gates himself is valued at around $108 billion.

Figures like Mark Zuckerberg and Elon Musk exemplify this theme of innovation and success. They demonstrate that billionaire status isn’t a mere stroke of luck but results from talent, hard work, and seizing opportunities as they arise.

I might not be on the same level as Gates or Bezos, but I resonate with the idea of achieving the American dream.

My journey began without privilege; I grew up as the son of a stone mason and was the first in my family to attend college. Today, I enjoy a comfortable lifestyle, thanks to a market-beating system I crafted over forty years ago.

Surprisingly, I developed this system by chance when I didn’t excel in a particular assignment at Cal State Hayward in the late ’70s.

In today’s Market 360, I’ll recount how that assignment failure set me on a path to creating a system that has recognized some of the market’s biggest winners for decades.

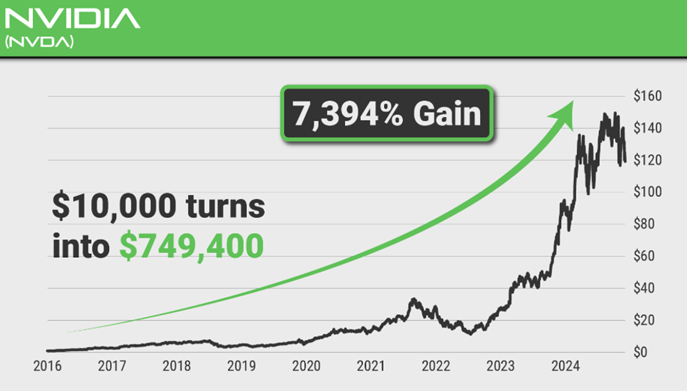

For example, my system led me to discover NVIDIA Corporation (Stock-ticker”>NVDA) when its stock was just $1 (adjusted for splits) in 2016. That investment subsequently surged over 7,000% at its peak.

Finally, I’ll introduce a compelling profit opportunity that my system has detected today, along with details on how you can learn more.

The “Failed” Assignment

While studying at Cal State Hayward in the late ’70s, the prevailing belief was that beating the market required excessive risk. Many would say, “Sure, some traders get lucky for a while, but consistently beating the market is impossible.”

Lucky for me, a progressive professor granted me a once-in-a-lifetime chance: access to Wells Fargo’s mainframe computers to create my own Stock selection models. This occurred during an era when computers occupied entire rooms and were unaffordable for most, making it a significant opportunity.

I invested countless hours poring over market data to develop a model reflecting the performance of the S&P 500. However, the results surpassed my expectations. When I finally ran the model, I discovered my returns significantly outperformed the S&P 500.

It was astounding; I had “failed” my assignment in a way I had not anticipated.

Curious about my unexpected success, I re-evaluated the data to understand my findings better.

What I found was that a select group of small, high-growth companies consistently outperformed the S&P 500 in my model. These companies shared key characteristics: rising sales growth, increasing operating margins, robust earnings growth, and other positive financial metrics.

These attributes became the basis of what I term the Eight Fundamental Factors.

This research ultimately led me to establish the system I rely on today: Stock Grader.

Stock Grader serves as my semiconductor for growth stock evaluation, analyzing over 6,000 stocks regularly and processing extensive financial data each week. The foundation stems from a market-beating formula I developed over 30 years ago.

Throughout the years, I have refined the formula, adjusting the importance of specific variables as necessary. However, the core variables that contribute to outperforming the market have remained consistent.

While my system has evolved in sophistication over time, it remains the cornerstone of my personal investment strategy and my lengthy career in asset management.

Unlocking Profits: A Deep Dive into Stock Grader’s Ratings System

Providing tailored analysis and recommendations to individual investors is at the core of my approach. Let’s break down how my system operates.

Understanding My Ratings System

My analysis framework is built around Eight Fundamental Factors, which include:

- Increasing Sales Growth

- Expanding Operating Margins

- Earnings Growth

- Positive Earnings Momentum

- Positive Earnings Surprises

- Positive Earnings Revisions

- Free Cash Flow

- Return on Equity

These factors work together to form a stock’s Fundamental Grade. To complement this, I also assess institutional buying pressure, referred to as the Quantitative Grade. Essentially, this is about “following the money” — if more capital flows into a stock, it typically indicates gaining momentum, while a lack of investment suggests the opposite.

Combining both the Fundamental and Quantitative Grades results in a Total Grade ranging from A to F, paralleling traditional school grading systems.

A stock that excels in growth and business quality would receive an “A,” whereas one with dismal ratings would earn an “F.”

A Potential 50X Profit Opportunity Awaits

Through the Stock Grader, I’ve pinpointed some of my career’s most significant gains by identifying stocks before they surge.

Last year alone, the system highlighted notable winners such as:

- A staggering 593% gain from a partial sell of Super Micro Computer, Inc. (Stock-ticker”>SMCI).

- A 159% return from a partial sell of Rambus, Inc. (Stock-ticker”>RMBS) in just 16 months.

- A 152% profit in CECO Environmental Corp. (Stock-ticker”>CECO).

- A 46% return on Gatos Silver, Inc. (Stock-ticker”>GATO) in merely one month.

Yet, the standout recommendation came when I advised on NVIDIA when it was trading at $1 (split-price adjusted) back in 2016.

Now, my system has signaled another stock that might replicate NVIDIA’s success, potentially offering up to 50 times profits. This small-cap company, fortified by 102 patents and having ties to NVIDIA, is one to watch.

Here’s why the timing is crucial…

I sense a significant shift is on the horizon. Recently, NVIDIA’s CEO, Jensen Huang, played down the prospects of quantum computing, indicating it was decades away. However, the company is hosting a dedicated Quantum Day, or “Q Day,” on March 20.

This event could mark NVIDIA’s ambitious entry into the quantum computing arena, and upon this announcement, my top stock pick could see substantial growth.

In anticipation, I’m hosting an event on March 13 at 1 p.m. Eastern to discuss the implications of Q Day, including insights into my leading stock pick poised for growth in response to NVIDIA’s announcements.

Despite the market challenges we currently face, NVIDIA’s Q Day could ignite much-needed momentum. Stocks that score well in my Stock Grader, particularly the one linked to this event, are likely to rebound significantly.

Reserve your spot here for the upcoming event.

I look forward to sharing this critical information with you on Thursday.

The Editor discloses ownership of the following securities mentioned in this commentary as of the date of this email:

CECO Environmental Corp. (CECO), NVIDIA Corporation (NVDA), and Super Micro Computer, Inc. (SMCI)