Analyst Insights: iShares ESG Aware MSCI USA Small-Cap ETF Holds Promise with 12% Upside

In a detailed analysis from ETF Channel, the trading prices of underlying holdings in the iShares ESG Aware MSCI USA Small-Cap ETF (Symbol: ESML) have been examined against projected 12-month target prices from analysts. The findings indicate that the ETF has an implied target price of $50.14 per unit based on these holdings.

Current Performance Versus Analyst Projections

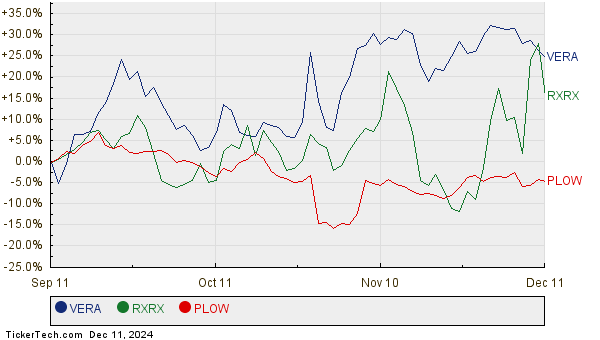

Trading recently at approximately $44.70 per unit, ESML presents analysts with a perceived upside of 12.18%. This means there is room for growth based on what analysts predict for the ETF’s underlying assets. Among these assets, three stand out for their strong expected gains: Vera Therapeutics Inc (Symbol: VERA), Recursion Pharmaceuticals Inc (Symbol: RXRX), and Douglas Dynamics, Inc. (Symbol: PLOW). VERA has a current trading price of $46.92 per share, but analysts project a target of $64.09, indicating a significant 36.59% upside. Meanwhile, RXRX trades at $7.46, with an analyst target of $9.86, reflecting a potential rise of 32.13%. Similarly, analysts forecast that PLOW will reach $32.33 per share, marking a 26.10% increase from its recent price of $25.64.

Below is a chart displaying the 12-month price history and relative performance of VERA, RXRX, and PLOW:

Summary of Analyst Target Prices

The table below summarizes the current analyst target prices for the ETF and its key holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG Aware MSCI USA Small-Cap ETF | ESML | $44.70 | $50.14 | 12.18% |

| Vera Therapeutics Inc | VERA | $46.92 | $64.09 | 36.59% |

| Recursion Pharmaceuticals Inc | RXRX | $7.46 | $9.86 | 32.13% |

| Douglas Dynamics, Inc. | PLOW | $25.64 | $32.33 | 26.10% |

Evaluating Analyst Optimism

As these projections emerge, investors may wonder if analysts are justified in their outlook or if they are being too optimistic about these stocks’ potential over the next year. Skepticism arises when a high target price stands in stark contrast to a stock’s current trading price; it could signal unrealistic expectations or outdated assessments of company and industry trends. Thus, careful investor research remains essential for understanding these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Cheapest Stocks Right Now

• HSEB Videos

• GYRO market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.