“`html

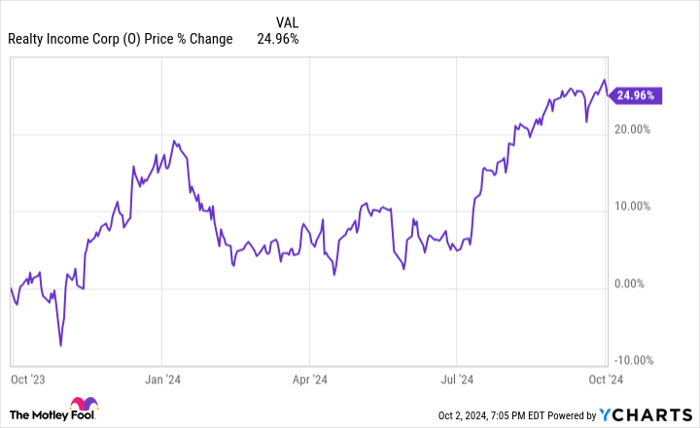

The Vanguard Real Estate ETF (VNQ) has an implied analyst target price of $102.82 per unit, indicating an 11.44% upside from its recent trading price of $92.27. This analysis is based on the ETF’s underlying holdings.

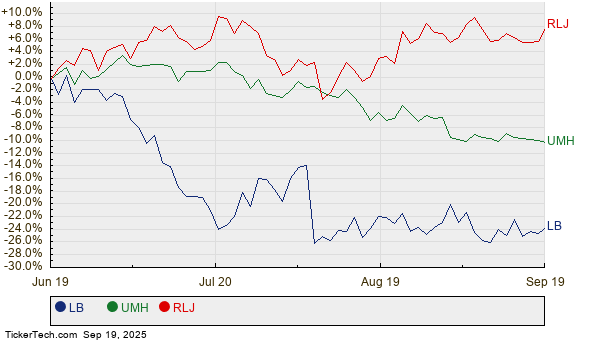

Notably, three underlying holdings show significant upside: Landbridge Co LLC (LB) at 42.99% upside with a target price of $75.14 from a recent price of $52.55, UMH Properties Inc (UMH) at 34.96% upside with a target price of $20.29 from a recent price of $15.03, and RLJ Lodging Trust (RLJ) at 15.85% upside with a target price of $9.03 from a recent price of $7.79.

Current analyst projections may reflect optimism, but they prompt questions regarding future stock performance and market conditions.

“`