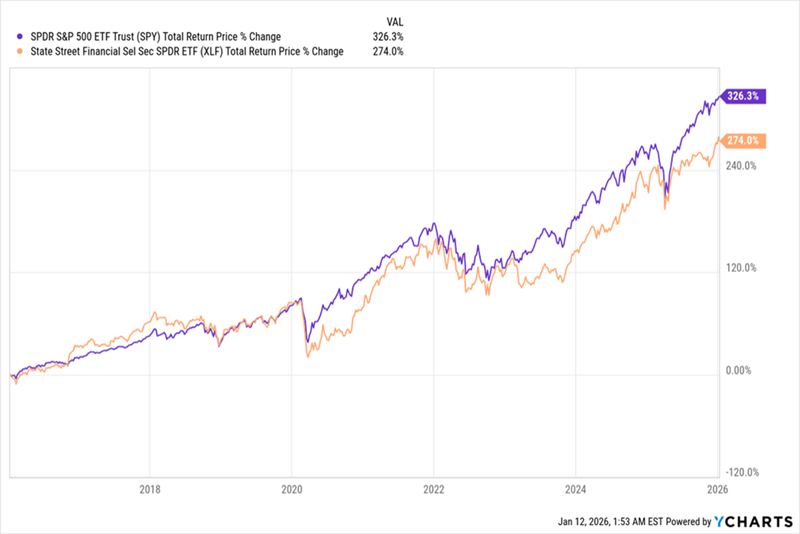

The financial sector posted a strong return of 15% in 2025, as evidenced by the Financial Select Sector SPDR Fund (XLF), making it the fourth-best performer among sectors, behind technology and industrials. Despite this growth, the sector lagged behind the S&P 500, which returned 17.7% last year, indicating a potential for further upside.

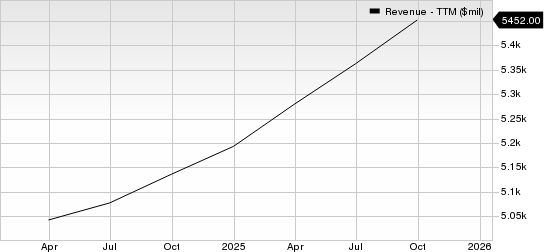

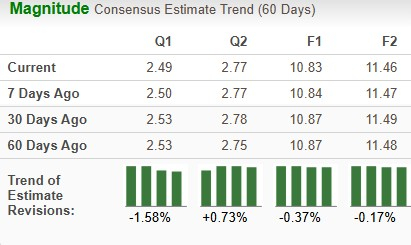

Looking ahead, industry analysts predict financial institutions could invest over $182 billion in 2026, supported by robust pipelines of capital. Investors are encouraged to consider the John Hancock Financial Opportunities Fund (BTO), which offers a dividend yield of 7.2% and has raised its payout by 75.6% over the last decade, outperforming both the XLF and the S&P 500.

As of now, BTO is trading at a discount to its net asset value, making it an attractive entry point for those looking to benefit from the sector’s anticipated growth and dividend income.