Investing in Alphabet: Analyzing Value Amid AI Challenges

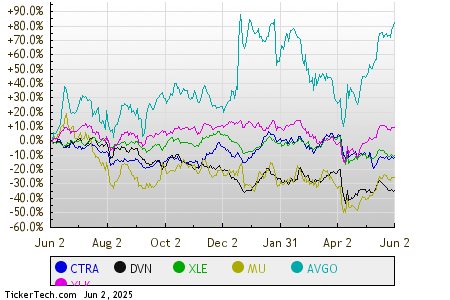

Current Market Context for AI Stocks

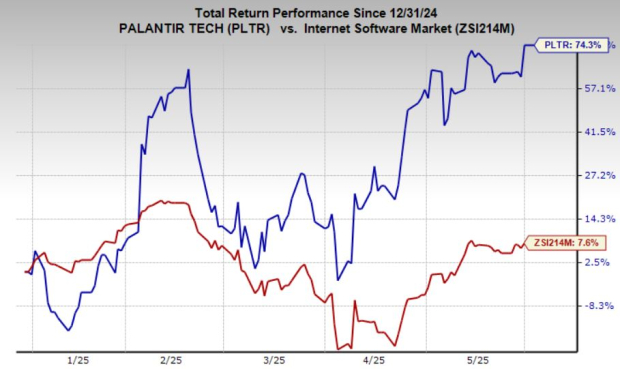

Recent gains in stocks like Nvidia and Palantir highlight the potential of artificial intelligence (AI). However, not all AI stocks have premium valuations, creating compelling opportunities in certain sectors.

Alphabet’s Position and Challenges

Alphabet (NASDAQ: GOOGL, NASDAQ: GOOG) surprises as a potential value play in the AI space. The company has integrated AI into its platforms since 2001, once seen as a top AI stock before the rise of ChatGPT.

Currently, Alphabet’s P/E ratio stands at about 19, making it the least expensive stock among the “Magnificent Seven.” Investors now view it as a value stock due to market uncertainties.

The emergence of ChatGPT surprised Alphabet, which quickly responded with Google Gemini but appears to lag behind in competition. ChatGPT also challenges Google Search’s advertising revenue model by directing users to results rather than websites.

According to Oberlo, Google Search’s market share now drops below 90% for the first time in years. With 74% of Alphabet’s revenue coming from advertising in Q1 2025, this trend could adversely affect the company’s long-term prospects.

Evaluating Alphabet’s Attributes

Despite challenges, several factors might indicate that Alphabet is oversold at the current P/E ratio. The company has made strides to reduce its reliance on advertising revenue, which decreased to 77% from the previous year, even as ad revenue grew by 8%.

Google Cloud now constitutes nearly 14% of Alphabet’s total revenue. Additionally, Alphabet holds businesses like Verily Life Sciences, Google DeepMind, and Fitbit, expanding its revenue streams.

Waymo, Alphabet’s autonomous driving venture, recently attained a valuation of $45 billion, suggesting significant future revenue potential for the company.

In 2025, Alphabet plans to invest $75 billion in capital expenditures, backed by $95 billion in liquidity. It also generated $75 billion in free cash flow over the last year, enabling heavy reinvestment into its AI technologies and competitive areas.

Investment Outlook for Alphabet

Given Alphabet’s low P/E ratio alongside its substantial resources, adding shares at current levels seems prudent. While ChatGPT poses threats to its ad business, Alphabet’s heavy investment might strengthen its AI capabilities.

Investors should remain hopeful about Alphabet’s future, particularly if it improves its AI and diversifies revenue sources such as Waymo. This may result in favorable outcomes for those who invest while the stock remains undervalued.

Considerations Before Investing in Alphabet

Before making an investment, note that Alphabet is not included in the Motley Fool Stock Advisor team’s recent list of the top 10 recommended stocks. Investors should weigh this alongside the strong historical performance of stocks like Netflix and Nvidia.

Historical returns signaled strong growth: A $1,000 investment in Netflix in December 2004 would now be worth $651,049.

Similarly, a $1,000 investment in Nvidia in April 2005 would now amount to $828,224.

Both examples emphasize the potential value of being attentive to broad stock trends despite immediate market valuations.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.