Shopify’s Stock Soars: A Look at Impressive Growth and Future Potential

Shopify‘s (NYSE: SHOP) business is thriving, reminiscent of its strong performance during the pandemic lockdowns. This surge has caught the attention of Wall Street, with the company’s stock climbing 48% through November 2024, nearly double the year-to-date gains of the S&P 500.

As data continues to roll in regarding transaction volumes for the holiday season, there’s potential for the gap in 2024 performance to widen. From a long-term perspective, Shopify’s stock appears to be a solid addition to your portfolio this December.

Gaining Ground in E-Commerce

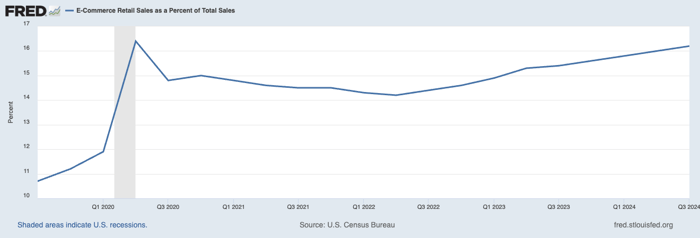

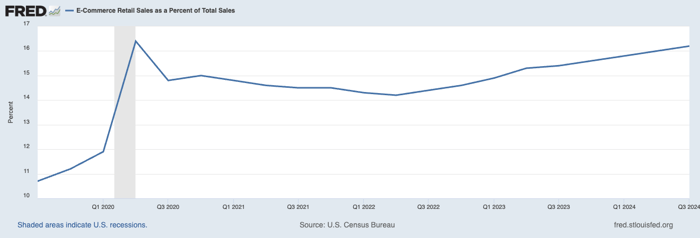

Shopify has been increasing its market share in the global e-commerce space, a vast area with significant expansion possibilities. The platform recently achieved a 16% share of the total retail industry, recovering its pandemic high after almost two years of decline.

E-commerce as a percentage of all retail. Data source: Federal Reserve.

Capitalizing on the demand rebound in 2024, Shopify has seen sales volumes grow by over 20% year-over-year for the last five quarters. Last quarter, overall revenue increased by 26%, bolstered by rising transaction and subscription fees. Subscription charges are particularly appealing because they foster customer loyalty and increase profit margins. “Q3 was outstanding, further establishing Shopify as a leader in powering commerce anywhere, anytime,” stated CEO Harley Finkelstein in a mid-November press release.

Strong Financial Performance

Shopify is mirroring the success of other technology giants like Apple (NASDAQ: AAPL), which has ventured into services that offer stable, recurring revenue and higher margins than hardware sales.

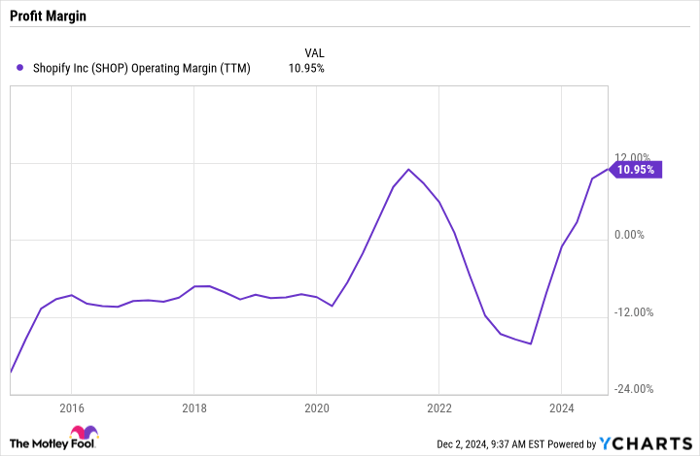

SHOP Operating Margin (TTM) data by YCharts

Shopify’s growth in its services segment has significantly improved key financial metrics. Management noted that monthly recurring revenue, which closely reflects the long-term value of merchant relationships, increased by 28% in Q3. As a result, both cash flow and profit margin rates have risen, and Shopify returned to its all-time high operating profit margin established during the initial pandemic phase.

Wise Use of Excess Capital

Shopify has plenty of opportunities to utilize its excess cash effectively in the coming years. Potential areas of investment include enhancing payment processing services, improving marketing capabilities, and more deeply integrating artificial intelligence into the platform. Success in these areas should attract more merchants, increase retention, and allow for higher transaction fees over time.

That said, Shopify’s stock is currently trading at its highest price since early 2022, nearing the $150 mark, which represents a record from the pandemic era.

Investors should also be aware of the potential risk of slowing growth, which could diminish recent gains if broader market trends shift. Still, for those comfortable with these risks, Shopify remains a strong long-term investment as we move into 2025 and beyond. The company’s focus on capturing more e-commerce market share and enhancing its transaction handling could lead to impressive stock performance in the upcoming decade, especially with profit margins aiming for nearly 20%.

In early 2025, Shopify will likely provide updates on its holiday season performance after a promising 2023-2024. Investors may not need to wait for these results before considering a position in this promising growth stock.

Don’t Miss Out on a Second Chance for a Profitable Investment

If you’ve ever felt like you’ve missed your opportunity to invest in top-performing stocks, now is the time to take action.

Our expert analysts sometimes issue a “Double Down” stock recommendation for companies they believe are poised for growth. If you think you’ve missed your moment, this may be the perfect time to buy before it’s too late. The past numbers are compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $359,445!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $45,374!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $484,143!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may be fleeting.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

Demitri Kalogeropoulos has positions in Apple and Shopify. The Motley Fool has positions in and recommends Apple and Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.