# The AI Revolution: Understanding Its Impact on Financial Markets

Currently, the Stock market is buzzing with discussions on tariffs, tax bills, interest rates, and inflation. However, a more profound shift is taking place: we are entering the dawn of the AI Revolution.

This isn’t just a passing trend; it represents a transformative wave that will alter industries, redefine our daily lives, and generate trillions in new wealth in the coming years.

Regardless of fluctuations on the trade front, actions by the Federal Reserve, or political maneuvering, this shift toward AI is significant.

For those who missed past technological advancements, such as the rise of the internet or mobile computing, this is a pivotal opportunity.

Thus, it’s crucial to look beyond the distractions of politics and the economy, and embrace the technological revolution that is reshaping our reality.

The Next Major Technological Shift: Implications for AI Stocks

Every couple of decades, technology spurs major changes globally.

The 1980s saw the birth of the personal computer, the 90s ushered in widespread internet adoption, while the 2000s experienced a boom in mobile technology. Most recently, the cloud became a dominant force in the 2010s.

Today, it is AI that steals the spotlight.

Similar to past revolutions, this technology is set to reward early adopters significantly. Already, impressive achievements are noted.

For instance, ChatGPT achieved 100 million users faster than any previous product. Companies are investing hundreds of billions annually to develop new AI data centers and chip fabrication facilities. Additionally, utility companies are expanding energy capacity to support this emerging framework. Industries, ranging from healthcare to finance and retail to entertainment, are rapidly incorporating AI into their operations.

This marks just the beginning of a promising journey.

AI’s ability to scale intelligence distinguishes it from other technologies. This software learns, adapts, and improves, leading to compounding value over time.

As a result, the profits for companies engaged in AI development are also set to increase.

Dispelling Bubble Myths: The AI Boom is in Early Stages

Despite concerns about AI stocks being in a bubble, observations suggest otherwise. Instead, they are entering a breakout mode.

While Nvidia’s Stock has reached new heights and AI dominates news, we are likely still in the initial phases of a long-term trend.

In the early 2000s, Amazon (Stock-ticker”>AMZN) was already well established. Yet, a $10,000 investment back then would be worth $2.8 million today.

Similarly, a $10,000 investment in Nvidia (Stock-ticker”>NVDA) in 2013 would yield over $3.5 million today.

Furthermore, investing $10,000 in Apple (Stock-ticker”>AAPL) in 1985 would result in a portfolio worth over $28.5 million now.

These generational gains can emerge from early investments in the right tech stocks.

AI represents a substantial wealth-building opportunity for the next decade.

However, there is one important consideration.

Numerous companies currently capture attention in this sector.

Some are at the forefront, innovating foundational models or applying AI in transformative ways.

Yet, others may simply be adding “AI” to attract investors—a pattern reminiscent of the dot-com bubble, crypto surges, and the electric vehicle hype.

In reality, most so-called “AI stocks” may not generate significant returns.

To accumulate genuine, lasting wealth from this megatrend, careful selection is critical.

Strategies for Wealth Creation with AI Stocks: Timing and Selection

Investors who enter the market with the right companies—those genuinely advancing and scaling AI—will increase their chances for substantial returns.

Finding these companies, however, can be challenging.

Fortunately, our team has meticulously analyzed the landscape.

We’ve developed three proprietary indices aimed at identifying leading AI stocks to aid investors in navigating this pivotal moment.

Each index focuses on crucial layers of the AI ecosystem.

Index 1: The Foundational 5 – Major Tech Players Shaping AI

This index features five major tech companies that create models, manage computing power, and establish the backbone for the AI ecosystem. These giants possess the necessary data and resources to define the future of this technology.

Our Foundational 5 index has appreciated by over 120% since late 2022 (the start of the AI Boom), outperforming the S&P 500 (+55%) and the Dow Jones (+29%).

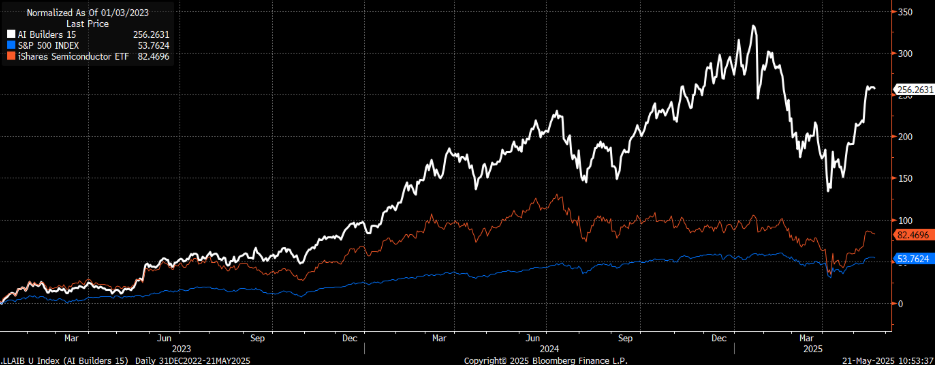

Index 2: The AI Builders 15 – Key Infrastructure Players

This index highlights 15 critical infrastructure companies essential to the AI Boom. These firms build the chips, servers, cooling systems, and networking needed for AI applications.

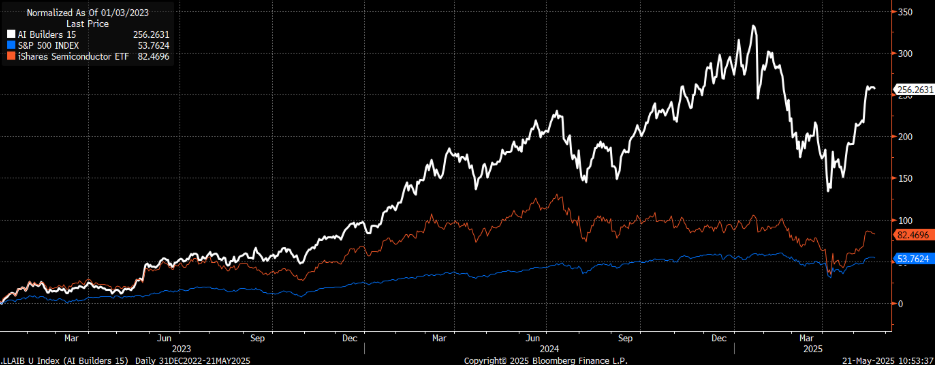

Since late 2022, our AI Builders 15 index has soared by more than 250%, while the S&P has increased less than 60%. The iShares Semiconductor ETF (Stock-ticker”>SOXX) has increased by about 80%.

Index 3: The AI Appliers 15 – Promising AI Application Stocks

This Appliers index includes 15 critical AI application developers that are vital to driving the technology’s integration across various sectors.

# Transformative AI Companies Driving Market Growth

The global economy is being reshaped by innovators leveraging AI-powered applications, from personalized learning to smart cybersecurity and autonomous vehicles. These companies are effectively turning AI into tangible user value.

Consequently, our AI Appliers 15 index has surged over 280% since late 2022, in stark contrast to the iShares Expanded Tech Software ETF (Stock-ticker”>IGV), which has only increased about 100%.

Both of these indices showcase our highest-conviction AI Stock ideas, reflecting companies we believe will spearhead this revolution and yield significant returns in the coming years.

AI Stocks: A Unique Investment Opportunity for Wealth Creation

Investing megatrends often start with skepticism, then gain momentum and ultimately skyrocket.

Currently, AI is on the rise, but the greatest returns are still to come.

This is an opportune moment for investors to establish their positions while wealth is being quietly built.

However, not all AI stocks are created equal. Some could become the next Nvidia, Amazon, or Apple, while others may disappear from the scene.

It’s essential to distinguish future market leaders from those that will fall short.

Thus, we have developed these high-potential indices to guide investors. We believe that the biggest wealth-building opportunities will go to those who invest in the right AI stocks at the right time.

We are confident the moment to invest is now, and this index will lead you to the right stocks.

Access our top-ranked AI stocks here.