Concerns Grow for a.k.a. Brands: Flat Growth and Diminishing Estimates

In the hunt for potential short-selling opportunities or stocks best avoided, apparel stocks frequently top the list. This industry faces intense competition, shifting consumer preferences, and challenges in managing inventory efficiently. Even well-managed companies can encounter significant difficulties.

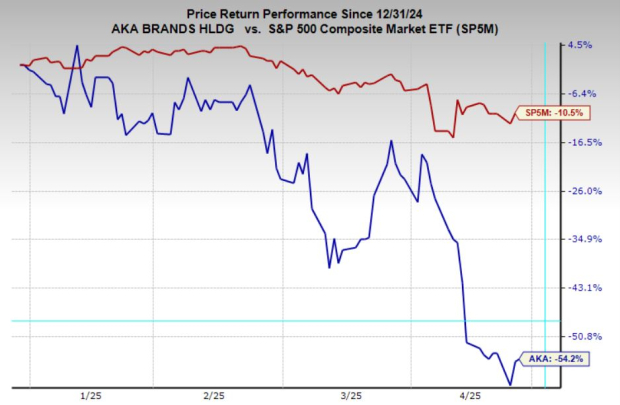

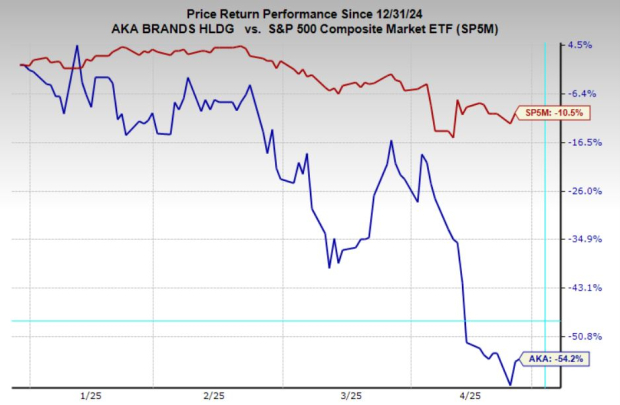

Currently, a.k.a. Brands Holding Corp. (AKA) represents a significant concern. The company contends with stagnant sales growth, ongoing downward revisions to earnings forecasts, and stock performance that markedly lags behind the weak overall market. Until fundamental issues are addressed, AKA appears to be a stock best left on the sidelines.

Image Source: Zacks Investment Research

Flat Sales Growth and Bearish Earnings Outlook

Since its public debut, a.k.a. Brands has struggled to produce substantial top-line growth. The company has experienced flat sales over the past three years, which reflects persistent weak demand. Though management projects moderate revenue increases of 5% for the current year and 3% for the next, these figures barely keep pace with inflation and do little to combat rising costs and margin pressures.

A significant concern lies in the company’s earnings outlook. Over the last two months, analysts have sharply cut estimates across various timeframes. The EPS estimate for the current quarter has declined by an unprecedented 228%. Even more alarming, the full-year earnings estimate—which had almost turned positive—has plummeted by a staggering 2,825%, underscoring growing skepticism regarding the company’s ability to stabilize margins or return to profitability soon.

These drastic revisions reveal deeper issues within the business model and raise serious concerns about management’s capability to navigate a landscape increasingly complicated by supply chain challenges.

Image Source: Zacks Investment Research

Future Prospects for AKA Stock

a.k.a. Brands Holding Corp. (AKA) has seen its shares plummet 93% since the IPO, a dramatic decline indicative of fundamental challenges. The company’s earnings remain deeply negative, with no clear signs of recovery. While several fashion retailers are facing hardships, AKA’s situation is exacerbated by its heavy reliance on Chinese suppliers at a time characterized by tariffs and intensifying geopolitical tensions, which pose additional risks for businesses dependent on low-cost Chinese manufacturing.

Amid declining investor confidence, negative earnings, and a fragile supply chain, forming a bullish view on this stock seems challenging. Without concrete advancements in improving margins, reducing supply chain risks, and restoring sales growth, AKA remains a name to avoid.

The views and opinions expressed herein are those of the author and do not necessarily reflect official positions.